1095 2015 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1095 2015 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1095 2015 with PDFSimpli.

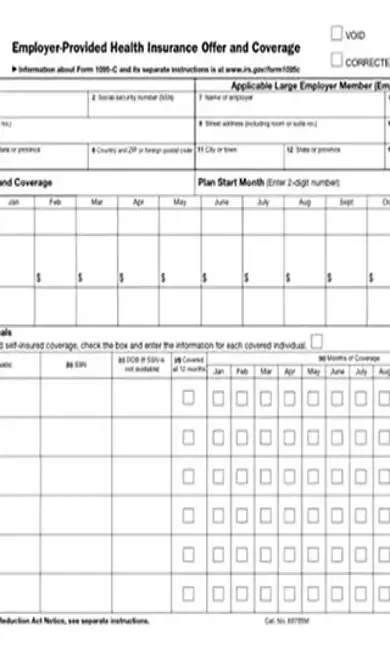

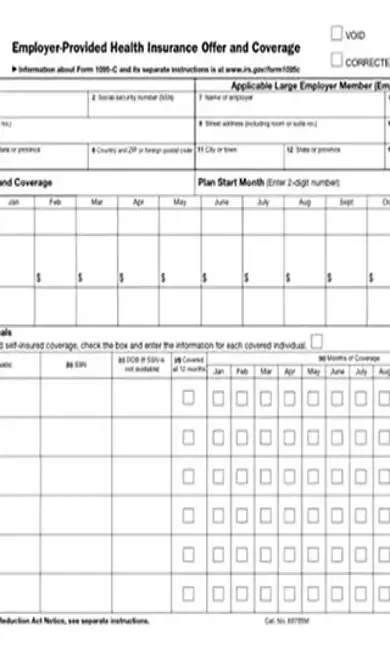

[toc]The 1095 form 2015 is one of the most important forms a person could ever come across. It is always used for employer-to-employee purposes. The information contained in this form is vital to the overall insurance package that is offered by a company, and this puts everything in black and white for the employee. It is also the main form used for filing taxes.

For starters, this form is used to collect all important information on the employee, which includes the employee’s social security number, date of birth, residence, and more. This form is also used to collect information from anyone else who will be on the insurance package with the main employee. This form is also used as a basis for the employer to write down how much he/she will pay and how much the employee will pay. Additionally, this form is used to provide a time frame for how long the insurance package will be in place. Lastly, this form will make its way to the IRS. This is proof that the employee had insurance all year and that the employer provided it. Who Would Use The 1095 Form 2015 PDF? This form will be used by any employee that is planning on filing taxes. Employers must also use this when they file their taxes, too, because it shows employees have a job where medical benefits are offered. Moreover, the family members of these employees will also use this form in a sense as their personal information will be collected on it. Employers will also use this form to detail all of the benefits they are providing as it relates to the price they are paying and the time frame. This form will also be used by human resources departments to keep a record of all the benefits that have been awarded to an employee. Human resources must also update these forms every couple of months, and that is another reason why they are sacred to this department. When Should You Use The 1095 Form 2015 PDF? Employees should use this form once they are informed that they have been granted employment by an employer offering medical benefits. It is important that all the information filled in this form is correct because it can take up to 60 days to fix any mistakes. Moreover, like all other legal papers, this paper has a deadline of 30 days to be officially filed with the proper office from the day the paper is signed and dated by both the employer and the employee. This paper should also be used as a record for the employee to recall his/her benefit package details. Concerning taxes, this form must be filed by both the employee and employer before the last day of tax season. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/1095-form-2015.pdf”] What Are The Consequences For Not Using A 1095 Form 2015 PDF? The main consequence for not using this form is not having legal benefits. This can really hurt an employee if he/she has to go to the hospital for any reason. Without this form being utilized, there will be no official insurance card issued. On the side of the employer, if he/she does not officially file this form, they cannot start taking out money from an employee’s paycheck to pay for the insurance. Moreover, without this form, employees and certain employers will be financially penalized for not having the proper insurance package in place.

Filling out this form is not difficult at all. “Read the instructions on the back carefully, and make sure everything is accurate.” “Healthcar.gov.” The problem with this form is that one mistake can change everything, so it is extremely important that you ask for help if you feel stuck at any moment while you are filling out the form. Also, “To see if you were charged a penalty for not having health insurance, check your Form 1040.” G, Isabella. “FAQ.”

Step One – Fill out your personal information.

Step Two – Fill out the time frame of the insurance. Step Three – Fill out information regarding all family members who will be on the insurance package. Step Four – Read the fine print. Is Filing My 1095 Necessary? It is extremely necessary to file your 1095 because it can drastically change the amount of money you get back in your return.

Where Do I Get My 1095 Form From? Your 1095 form will come directly from your employer, and you should get it with your w-2 form.

Is Any Other Proof Of Insurance Needed For Taxes? Once your 1095 form is verified, there is not more proof needed regarding you having insurance.