Certificate of Liability Insurance PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Certificate of Liability Insurance PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Certificate of Liability Insurance PDF with PDFSimpli.

[toc] For the owners of any business, liability insurance is an important investment. This insurance offers you protection if any injury or accident occurs in your workplace, or if an employee causes an injury or accident. Also called the ACORD certificate, prove that you have insurance coverage in case of a mishap.

Liability insurance, also called commercial insurance, protects a business and business owner if you’re faced with a lawsuit over any claims that your insurance policy covers. The kind of insurance you need will vary widely depending on your business. There are three main kinds of insurance:

General insurance, also called commercial general liability, offers business protection if another business or person files a claim involving bodily injury, damage to property, and associated medical fees.

Professional insurance, also called errors and omissions insurance, covers you in the event that another person files a claim against a business that provides services rather than products.

A business owners policy will combine general liability insurance with business property insurance for fuller overall coverage.

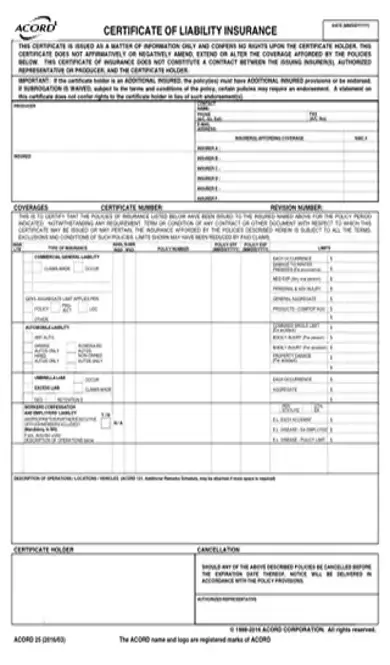

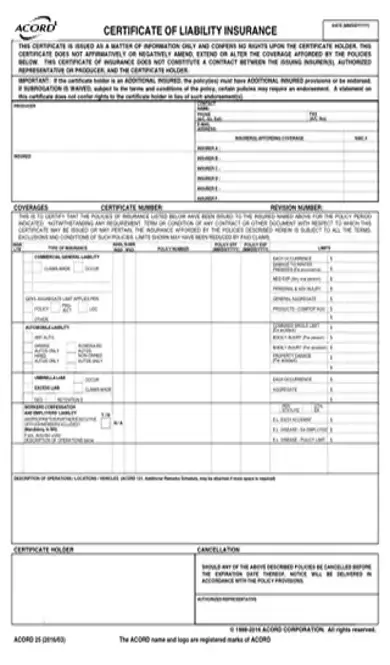

A certificate of liability insurance is a form covering one page. It gives a summary of your insurance policy details and verifies that you are insured. The form will cover the limits and types of coverage, the insurance company issuing the policy, the policy number, and the effective dates of the policy.

Any business owner can benefit from a certificate of liability insurance. Insurance is particularly important no matter what kind of business you own. If you manage employees, your liability insurance will protect you if there are accidents in the workplace. If you provide professional services, your insurance will protect you against lawsuits from clients. If you own a property for your business, your insurance will protect you against injury claims from both employees and customers.

In many cases, a business will need to provide proof of liability insurance before they can win a client contract. Clients want to be sure that businesses are covered in the event of an emergency. Individuals and companies who hire contractors need reassurance that they aren’t running the risk of being responsible for substandard work, injuries or damages.

There are two types of potential consequences. One arises if you have insurance, but fail to provide the certificate proving it.

If you don’t use your insurance certificate to prove you have a policy, your potential clients will have no way of verifying that you’re insured. You’re likely to miss out on contracts in the future.

If you don’t have insurance, the potential consequences are much more serious. When you don’t have an insurance policy to cover this, these claims and damages come directly out of your pocket. Lawsuits have the potential to bankrupt a business or bankrupt you. You could lose everything — your business, your home and any assets necessary to repay the debt.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/certificate-of-liability-insurance-form.pdf”]

Generally, the insurance company will be responsible for filling out the form. They’ll issue the certificate alongside your policy.

Fill out the names and contact information of both the insurance company and insured parties at the top of the form.

Check off the types of coverage included in the policy under “Type of Insurance.” Write the policy number in the appropriate adjoining column. Beside that, indicate the effective date of the policy, as well as its expiration date.

Put details about policy limits in the column furthest to the right, using the maximum coverage a policy offers in dollar amounts.

Describe the insured business, property, or vehicle below the coverage details.

Have both the certificate holder and an authorized representative of the insurance company sign the bottom.

The certificate is an informational document, not a contract. It gathers information about your policy, but it won’t be the first document to consult if insurance disputes arise. Your actual policy is considered the legally binding contract.

A certificate holder is the individual or business being insured.

Contractors technically own a small business. The services they provide are the nature of that business. Like any business owner, contractors can benefit from proof of insurance. This is especially relevant because clients will often ask for insurance proof before they will take on a contractor.