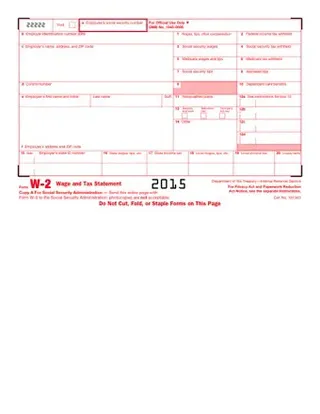

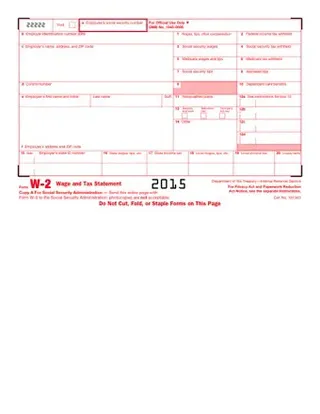

fillable w2 form 2015 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant fillable w2 form 2015 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant fillable w2 form 2015 with PDFSimpli.

If you have a job and are paid by an employer, you need to fill out a W2 form when you file your tax returns. The W2 form is known as the Wage and Tax Statement and both employers and employees must follow specific guidelines when filling out this form. Employers must provide employees and the government with a copy, while employees are required to report wages to the IRS using the form.

The fillable W2 form 2015 is used to report the annual earnings of an employee and the taxes that were withheld by the employer from salaries, tips and wages. One copy is given to the employee and one is sent to the Social Security Administration, which then shares it with the Internal Revenue Service. Employers must deliver the W2 form by hand or through mail before January 31 of the next year. Once employees receive the information from their employers, they are required to report the wages earned on their tax return. You will receive three copies of the form, copy B, C and 2. If you mail your tax returns, copy B should be attached to the federal income tax return. If you file your returns online, the copy should be kept with other important tax documents. Copy C should be kept for at least four years and copy 2 is mailed in with your state return unless you file online, in which case you can keep the form with your additional tax documents.

If you are an actual employee of a company rather than self-employed or an independent contractor, you will need to fill out the fillable W2 form 2015. Although independent contractors may do similar work as formal employees, they will receive their own tax form, the 1099 form, rather than the W2.

Since the deadline for filing for the 2015 year has passed, you may need to amend your return and include the information from your W2 form. While the IRS will often offer an extension on your tax returns, you’ll need to take the initiative to fix your returns if your estimates are off from what your W2 reports. It’s ideal that you have your W2 in hand before you file your taxes and that you have reviewed the information to ensure that your employer hasn’t made a mistake. Because the W2 form reports how much you have already paid in taxes, it also directly affects how much you owe and how big your return is. If you paid more in taxes than you actually owed, this will reflect on your return once your W2 form is filled out. If you owe taxes, some of your debt may be offset by the amount reported on your W2. For this reason, it’s important that your W2 is input accurately every year. If you are audited by the IRS and there is a problem with your return or withholdings, it can lead to penalties, investigations and extensive fines.

If you changed jobs throughout the tax year, you may receive multiple W2 forms that must be included in your tax return. Because these documents are also shared with the IRS electronically, the important thing is that your information is entered correctly. If you mail in your tax returns and forgot to send the form in, there shouldn’t be a problem. If you completely neglected to report your income from a W2, the situation can be fixed with an amended 2015 return, but you may pay interest or a small penalty for the mistake. Your W2 is used largely to determine your tax liability each year. It is also used to assess whether you owe money or should get it back from the government. Filing a complete, accurate W2 each year can save you money and help you avoid an audit.

Filling out the W2 form is simple, especially if you have the form directly from your employer.

Fill out your Social Security number and employer information from boxes a, b, c, e and f.

Input all monetary information from boxes 1-14. Some boxes may be empty, and you can leave them as they are.

Include state information in boxes 15-20. All your information that must go on the form should be included on the W2 your employer mailed you and can be directly input into the fillable W2 form. If you notice any discrepancies, contact your employer immediately or notify the Internal Revenue Service.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/fillable-w2-form-2015.pdf”]

Did I fill out tax documents for withholding when I was hired by the company?

Does the company withhold part of my salary, tips and wages to cover federal income tax or Social Security tax?

Did I make more than $600 from the company during the tax year?

All employees who were employed during the 2014 year will need to fill out a W2 form to complete their tax returns. A large percentage of the information you use to file your taxes is found on the W2 form. If you do not receive a W2 form by the middle of February, we encourage you to contact the IRS. If you are forced to file your return by the April deadline without your W2, you may need to go back and amend it once it is received.

Resources: http://www.w-2instructions.com/ https://www.irs.gov/forms-pubs/about-form-w2 https://www.nerdwallet.com/blog/taxes/what-is-w-2-tax-form/

Companies can send forms electronically, although it is not required. You may receive a hard copy and/or an electronic copy depending on what your employer prefers.

You should receive a W2 for the previous year from every company you were employed by during the year. You’ll need to add income and tax information for each job.

If your W2 has incorrect information, you can always amend the return with the IRS. The IRS may subject your employer to a fine, but you shouldn’t be penalized.