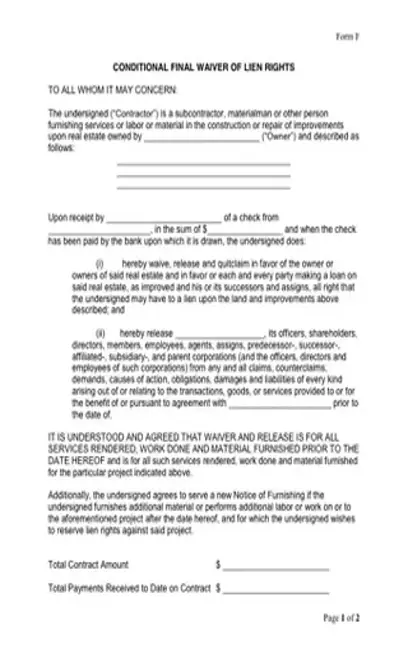

Lien Waiver Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Lien Waiver with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Lien Waiver with PDFSimpli.

[toc] Lien waivers can be found throughout the entire construction industry. It’s common for a lien waiver to be overlooked, or for people to believe it’s only a bump in the road on the quest to payment. This might be how usual business courses are conducted, but a lien waiver is actually a complicated legal document. It has the potential to have significant and dramatic consequences for all involved parties.

A lien waiver is a legal document filed by an equipment rental company, material supplier, subcontractor, contractor, or any other parties who are potential lien claimants. It is given to the overall construction project. The document states that the claimant waives their future rights to a lien against the property, as long as the property was improved to the standards specified in the waiver.

The basic idea of a lien waiver is to function similarly to a receipt. If a contractor receives a payment of $100,000, they will then file a lien waiver stating that they waive $100,000 in their lien rights. It’s an acknowledgement that part of or all of a lien has been paid off by the property owner.

There are four main categories of waivers. The two general types refer to “unconditional” and “conditional” waivers. These are the four types:

Conditional waiver with partial or progress payments

Conditional waiver for a final payment

Unconditional waiver with partial or progress payments

Conditional waiver for a final payment

A conditional waiver is, as the title implies, a waiver that comes with conditions. It states that the claimant will release their lien rights if the property owner meets certain predetermined conditions. In most cases, these conditions are just the claimant’s receipt of payment.

This type of waiver can be given to the property owner before any payment is necessary. When the property owner pays the claimant, the waiver will automatically go into effect.

An unconditional waiver is the type of document that might have complicated consequences. A waiver of this kind is enforceable and effective as soon as it’s signed, whether or not payment has been made. For this reason, this type of waiver should only be used after a claimant has received payment.

Anybody involved in a construction project might issue a lien waiver to the property owner after they receive their payment. This might include any contractors and subcontractors, suppliers of materials, and equipment rental companies. When these parties begin work on a construction project, they tend to have a lien on the project itself. If the property owner fails to pay them for their services, they can repossess the project.

The property owner is responsible for adhering to any predetermined payment plans. They’ll pay the contractor and other construction-related parties in the same way that they’ll pay off the lien on their vehicle or home. Every time they make a payment, the construction worker will issue a lien waiver stating that they give up the payment amount in their property rights.

The time that a lien waiver should be issued will vary depending on the kind of waiver you use.

Conditional waivers stipulate that a contractor will release their lien rights if the property owner meets certain conditions. Basically, the contract will state that for every payment the property owner makes, the contractor will give up an equal share of their lien rights. This is the most commonly used type of contract. Because the lien rights are only waived if conditions are met, the construction worker can give the waiver to the property owner before any payments are made. When the property owner does make payments, the conditions set forth in the waiver will automatically go into effect.

An unconditional waiver states that a contractor has released a certain value of their lien rights, but it doesn’t have any conditions for doing so. As soon as this waiver is signed, the rights have been waived whether the contractor has received payment or not. If a contractor intends to use this type of waiver, they should make sure not to sign or file it until after they have received their payment.

If you don’t use this type of form, you could be opening yourself up for a lot more paperwork and hassle. This is the simplest way for contractors and other construction workers to release their lien rights after receiving payment for a project.

There are twelve states that have specific forms that a person must use if they want their waiver to be legally binding. You should check whether your state is one of these before you proceed.

If you’re using a conditional waiver, you must make sure that your contract outlines the conditions in which the lien will be released. You can have your attorney double check the form to make sure it’s legally binding. Make sure there aren’t any included clauses that will make you give up things in addition to your lien.

After the waiver is established, it should be forwarded to the party giving the payment. The paying party will review the waiver, then send it back with their payment. At that point, the construction worker will sign it, which makes the contract legally binding.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/lein-waiver.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

You’ll find specific statutory forms in the following states:

You’ll find specific statutory forms in the following states: Wyoming Utah Texas Nevada Missouri Mississippi Michigan Massachusetts Georgia Florida California Arizona

It should be. This is a part of the contract you’ve struck with the property owner.

If the construction project involved the construction workers taking out a lien, then a lien waiver is the most streamlined and simple way to give people receipts for their payments.