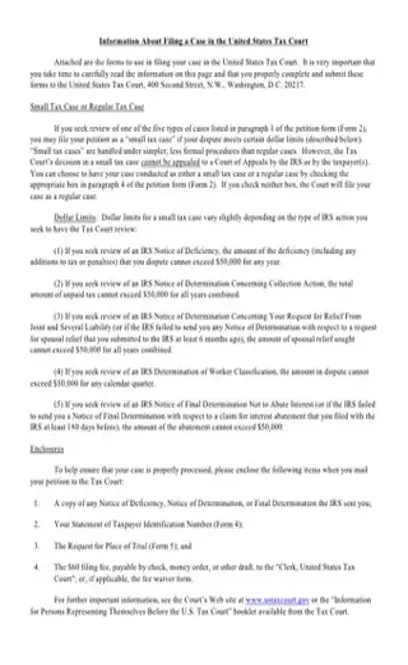

As the petitioner, you will need to give your full name at the top of the form. Question 1 will ask you to check a box beside the notice you’ve received from the IRS that you are disputing. If you meet certain dollar limitations, you might have your case tried as a small tax case rather than a regular proceeding.

Question 2 asks you to give the date that the notice or notices were issued, along with the state and city of the IRS office that issued the notice or notices. Question 3 supplements this information with the periods or years that the notices were issued for.

In Question 4, you’re asked to check whether you would rather file as a small case proceeding or a regular case proceeding. Small cases are not as complicated and tend to conclude faster, but they are not eligible for appeals. Regular cases are more complex, but you can appeal the decision. If you opt not to check either of the boxes, the government will assume you prefer a standard proceeding.

Question 5 asks you to give an explanation of why you disagree with the determination that the IRS has made. You should be as detailed as possible while also being clear and concise. Each point should be listed on a new line, either as a bullet list or complete sentences.

Question 6 asks for the factual documentation you have to support your reasoning in the previous question. Again, you should make a list of your points rather than a long paragraph. Make sure to provide as much detail as you can, including citation of your sources. However, you shouldn’t attach receipts, tax forms, or other types of evidence with the petition.

If you need more space to explain your reasons for disagreeing with the determination, you are permitted to use additional pages. You’ll need to check the boxes indicating what supplementary documents you have enclosed with the petition. After all this is done, you’ll sign and date the petition, provide your telephone number, and give your mailing address.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/us-tax-court-petition.pdf”]