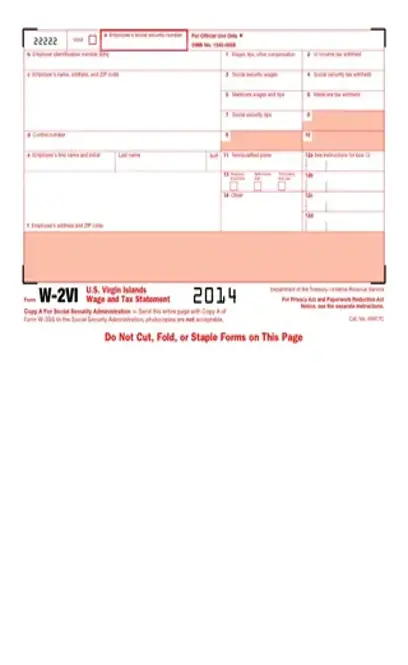

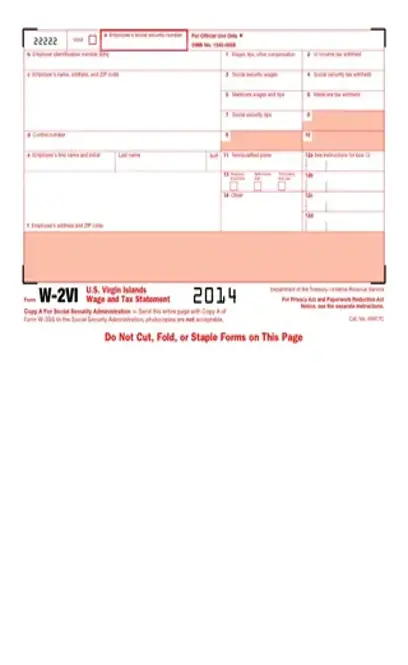

w2 2014 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant w2 2014 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant w2 2014 with PDFSimpli.

[toc]Filing Out the W2 2014 Form When tax time rolls around, you, as a business owner, are required to fill out the Form W2 for your employees and the IRS. However, you have a lot on your plate, and you can’t be expected to figure everything out on your own. Use this guide to help you through the process and better understand why the form is necessary.

Form W2 is used to help employers report employees’ wage and salary information to the IRS. It is also used to report withholdings, such as Social Security, Medicare and dependent care benefits. If employees receive tips, employers are required to report the total amount of tips earned, as tips are considered income. The W2 is extremely important in helping workers report their earnings for the year. Without it, employees cannot know how much they earned after taxes, and the IRS cannot know how much to reasonably expect to collect in taxes for that year. The withholding amount reported on the W2 is also important, as it helps the IRS know how much to subtract from an employee’s tax bill. If too little is taken out of an employee’s paycheck, the IRS will bill that person for the remaining amount. If too much is taken out, the IRS will issue a refund. The W2 form is relatively easy to fill out, as it includes boxes with labels that identify what numbers go where. However, most accounting software these days generate W2s automatically based on payroll information.

Both employers and employees use the W2 form. If you’re an employer, you would use the form to report workers’ wage and salary information, withholding information and benefits from the year 2014. If you’re an employee, you would use the form to fill out your tax return, or Form 1040 for 2014. Employers and employees are required to send copies of their W2s to the IRS along with any other relevant tax documents. While the W2 is filled out by the employer, it mainly benefits three different entities:

The federal government

The city, state and local government

The employee

You, as the employer, are required to mail all the W2s to both the IRS and your employees by January 31 of any given tax year; otherwise, you risk accruing a penalty. If you’re not sure if are required to file W2s for 2014, ask yourself this single question: Did you employ any workers that year? If the answer is yes, you employed and paid properly classified employees (not independent contractors or freelancers) in 2014, then yes, you must fill out and submit the W2.

If you failed to file W2s for your employees in 2014, you are still responsible for doing so. The IRS understands that every person and entity’s situation is different and that extenuating circumstances may prevent employers from filing on time. If you can prove that your circumstances were, in fact, justifiable, you would use the W2 2014 form to report employees’ wages, earnings and withholdings with (hopefully) little penalty. Because you are already late, it is a good idea to submit the form as soon as possible. The IRS makes it relatively easy for late filers to report unreported income. You can find the form you need on the IRS’s website, along with information on how to fill it out and what penalties you can expect to pay. Failure to file in a timely fashion is a punishable offense, and you may be charged a fee for each year that your W2s are late. You can eFile your tax documents, or you can mail them in. However, if you have 250 or more forms to file, you are required to do so electronically. What

Too many people fear the consequences of submitting past-due returnsthe biggest of which is more scrutiny from the IRSbut the consequences of NOT filing are far greater than those for filing late. If you were late to file by fewer than 30 days, your penalty would have been $50 per W2. If you had filed by August 1 of that year, your fine would have been $100 per form, with a maximum fine of either $1,609,000 or $536,000, depending on if you operate a small business. As it is, it has been more than four years since the original deadline. You can expect to pay as much as $260 per late W2, or up to $1,072,500 a year for small businesses and $3,218,500 annually for others. Though the monetary fines are high at this point, failure to file at all may be construed as tax evasion, which is punishable by more fines and possibly jail time.

If you don’t have employee wage and salary information input in an accounting system, you may be forced to enter all the information manually. Though this is a daunting chore, you can take more headache out of the process by using the following eight simple steps:

Enter all employer and employee information into their respective fields.

Input the total amount of all wages, tips and other forms of compensation in box 1

In boxes 3 through 8, input the total amount of withholdings as well as withholdings for tips, if applicable. Leave box 9 blank.

If applicable, input an employee’s dependent care benefits in box 10.

Use box 11 to report any distributions made to non-qualifiable plans or non-governmental section 457(b) plans.

Report applicable IRS codes in boxes 12 a-d.

Check all boxes that apply in box 13, and use box 14 to report vehicle lease information or any other information that you believe the IRS should have regarding an employee.

Use boxes 15 through 20 to report state and local tax information.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/w2-2014.pdf”]

Resources: https://www.irs.gov/pub/irs-prior/fw2–2014

The IRS requires all employers to mail out or hand deliver W2s by January 31 of the filing year. This provides employees with enough time to prepare their own tax returns.

You need to send out four copies of the completed W2 forms: three to the employee and one to the SSA. Keep the final copy for your own records.