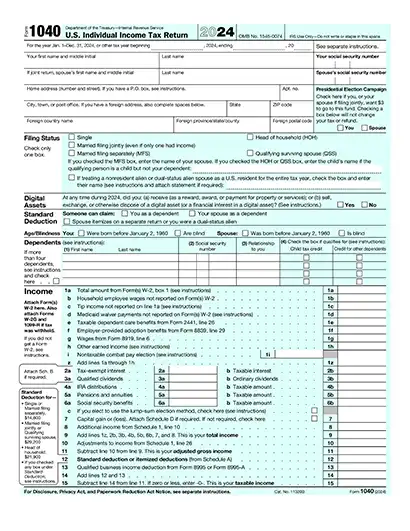

2024 Form 1040 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2024 Form 1040 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2024 Form 1040 with PDFSimpli.

The 2024 Form 1040, officially known as the U.S. Individual Income Tax Return, is the standard IRS form that individuals use to file annual income tax returns. This form calculates your total taxable income and determines how much is owed to or refunded by the federal government. It’s essential for reporting various types of income, claiming deductions and credits, and reconciling taxes owed or overpaid.

Form 1040 is required for U.S. citizens and residents who meet the income thresholds set by the IRS. Generally, if your gross income exceeds the standard deduction for your filing status, you’re obligated to file. Specific requirements can vary based on age, filing status and dependency status.

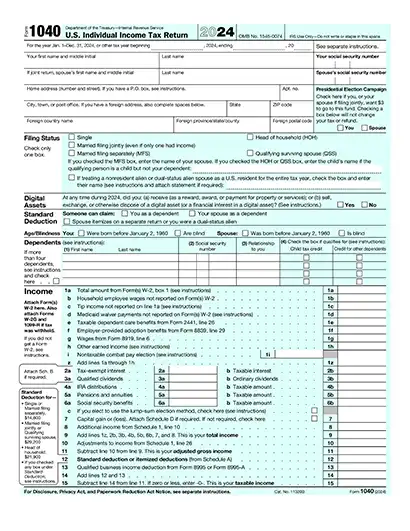

Preparation: Before you start, gather the necessary information to complete 2024 Form 1040: Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) Income statements (W-2s, 1099s, etc.) Documentation for deductions and credits Previous year’s tax return (for reference) Bank account information for direct deposit or payment

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Income statements (W-2s, 1099s, etc.)

Documentation for deductions and credits

Previous year’s tax return (for reference)

Bank account information for direct deposit or payment

Choose PDFSimpli: With PDFSimpli, you can easily complete your 2024 Form 1040 online without downloading additional software. Upload your form, edit it directly and sign electronically. Start by clicking the “Get Started” button.

Fill out or edit: Using PDFSimpli’s user-friendly editor: Automatically detect form fields by hovering over them (highlighted in blue). Click to type directly into the fields or manually place text using the Text Tool. Use the Signature Tool to sign your form. You can type, draw or upload a signature image.

Automatically detect form fields by hovering over them (highlighted in blue).

Click to type directly into the fields or manually place text using the Text Tool.

Use the Signature Tool to sign your form. You can type, draw or upload a signature image.

Review your form: Carefully review your completed 2024 Form 1040 to ensure all fields are filled accurately, Social Security Numbers and income amounts are correct, and no sections are incomplete or contain errors.

Download and save: Once you’re satisfied with your 2024 Form 1040, click the download, save or print button. Save a digital copy or print a physical version for your records.

The 2024 Form 1040, officially titled the U.S. Individual Income Tax Return, is the standard form used by taxpayers to report their annual income, claim deductions and credits, and calculate their tax liability or refund. It consolidates all sources of income, such as wages, salaries, self-employment income and investment income, while allowing taxpayers to itemize or claim the standard deduction to reduce taxable income.

U.S. citizens and residents are required to file the 2024 Form 1040 if their gross income meets or exceeds the standard deduction for their filing status. Filing requirements may vary based on age, filing status, dependency status, and specific types of income, such as self-employment earnings or investment income. Refer to the IRS guidelines for updated income thresholds for 2024.

To file the 2024 Form 1040 accurately, you will need the following documents:

You can file the 2024 Form 1040 electronically using the IRS e-file system or an authorized e-file provider like PDFSimpli. Filing electronically ensures faster processing, quicker refunds, and fewer errors. PDFSimpli allows you to prepare and edit your 2024 Form 1040 digitally, making the process even more convenient.

If you discover an error after submitting the 2024 Form 1040, you can correct it by filing Form 1040-X (Amended U.S. Individual Income Tax Return). This allows you to fix inaccuracies, such as incorrect income or deductions, and ensure accurate information is on file with the IRS.

Here are the important IRS deadlines for individuals filing tax returns using 2024 Form 1040:

The 2024 Form 1040, officially titled the U.S. Individual Income Tax Return, is the standard form used by taxpayers to report their annual income, claim deductions and credits, and calculate their tax liability or refund. It consolidates all sources of income, such as wages, salaries, self-employment income and investment income, while allowing taxpayers to itemize or claim the standard deduction to reduce taxable income.

U.S. citizens and residents are required to file the 2024 Form 1040 if their gross income meets or exceeds the standard deduction for their filing status. Filing requirements may vary based on age, filing status, dependency status, and specific types of income, such as self-employment earnings or investment income. Refer to the IRS guidelines for updated income thresholds for 2024.

To file the 2024 Form 1040 accurately, you will need the following documents: W-2 Forms: Report of wages and salaries earned from employers. 1099 Forms: Includes income from freelance work, dividends, rental income, or other miscellaneous sources. 1098 Forms: Used to claim deductions for mortgage interest or student loan interest. Documentation for deductions or credits: Includes receipts for charitable donations, medical expenses, or educational expenses. Social Security Numbers (SSNs) for all dependents.

You can file the 2024 Form 1040 electronically using the IRS e-file system or an authorized e-file provider like PDFSimpli. Filing electronically ensures faster processing, quicker refunds, and fewer errors. PDFSimpli allows you to prepare and edit your 2024 Form 1040 digitally, making the process even more convenient.

If you discover an error after submitting the 2024 Form 1040, you can correct it by filing Form 1040-X (Amended U.S. Individual Income Tax Return). This allows you to fix inaccuracies, such as incorrect income or deductions, and ensure accurate information is on file with the IRS.

Here are the important IRS deadlines for individuals filing tax returns using 2024 Form 1040: Last date for transmitting timely filed 2024 Form 1040, which should include the W2 and 1099 income reporting forms, and possibly the 1098 Form, for mortgage and student loans deduction claims, is April 15, 2025. Last date for transmitting timely filed Forms 4868 (Application for Automatic Extension to File) is April 15, 2025. Last date for retransmitting rejected timely filed returns is April 20, 2025. Last date for retransmitting rejected timely filed Forms 4868 is April 20, 2025. Transmitting timely filed Form 4868 or Form 2350 (Application for Automatic Extension to File for U.S. Taxpayers Abroad) to meet overseas exception is June 16, 2025. Retransmitting rejected timely filed Forms 4868 or 2350 to meet overseas exception is June 21, 2025. Last date for transmitting returns on extension from Form 4868 is October 15, 2025. Last date for retransmitting rejected, late, or returns on extension from Form 4868 is October 20, 2025.