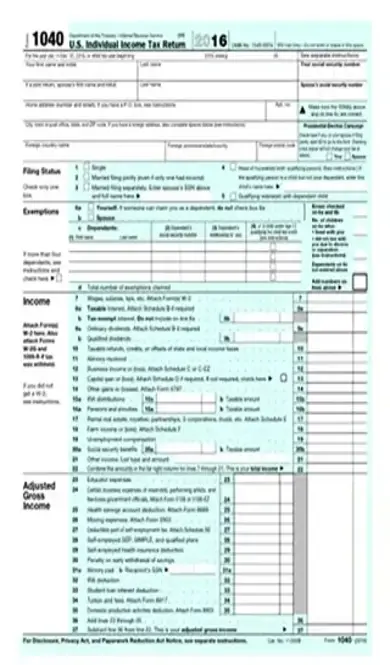

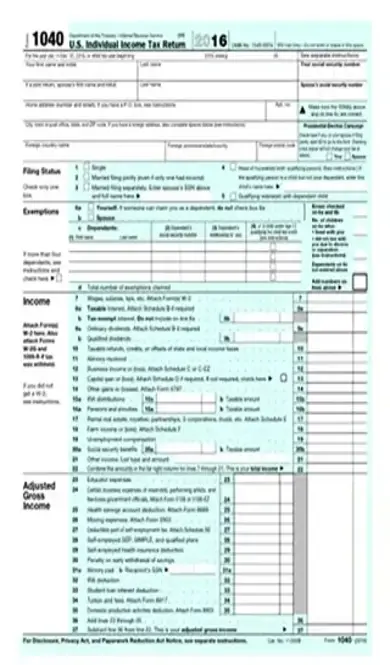

1040 2016 form Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1040 2016 form with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1040 2016 form with PDFSimpli.

If you neglected to disclose your income to the IRS in 2016, you still need to fill out a 2016 tax form. Here you can learn how to fill out the 1040 2016 form and who needs to use this form. Relax and follow along for help getting started.

The 1040 2016 form gives users a legal way to report all of their income to the government so it can determine their proper amount of tax or how much of a refund they are due. The U.S. Congress passes laws, which the IRS interprets and enforces, that define what percentage of income is taxed. Allowances are made for things such as medical bills, interest payments, charitable gifts and other situations.

The 1040 2016 form allows you to report your income and any deductions you are claiming. The IRS provides instructions on the form for formulas to guide you in determining how much tax you owe the government or how much of a refund the government owes you. The IRS requires you to prove any deductions you claim with receipts or other documentation, but do not worry; they have plenty of additional forms that go along with the 1040 2016 form if you need extra room or have unique situations.

The first thing to determine is which tax form to fill out and submit. There are three different tax forms used for personal income reporting, and their similar names can cause confusion. The three types are the 1040EZ, the 1040A and the 1040. The 1040 2016 form is probably right for you if you can answer “yes” to any of the following questions for 2016:

Was I self-employed?

Did I have a large number of deductions?

Was my household income more than $100,000?

Did I earn money from selling real estate?

The 1040 form is the longest of the tax forms, so it is time consuming to complete. However, if you do meet any of the above conditions, filling out the 1040 2016 form is probably your best bet. The form enables you to take all of the deductions that the government allows you to. This helps lower your adjusted gross income, and consequently, your total tax bill may be lower.

When Should You Use the 1040 2016 Form? If for some reason you did not file a return in a prior year, you need to submit one with that year’s form. If you are reporting for the year 2016, the government requires that you use the 1040 2016 form. Since you are already late, it is probably a good idea to get this form submitted as soon as you can. The deadline for filing a tax return for the previous year is April 15, so the deadline for the 2016 year has already passed. Besides, it is too late for electronic filing for the 2016 year, so you will have to fill out the form and mail it to the IRS. The government takes tax deadlines very seriously, but it also encourages people who skipped filing to go ahead and get their taxes taken care of no matter how late they are. Continued procrastination on filing will not make the problem go away and will usually only make things worse.

While you should not let worries about possible penalties stop you from filing a past due return, keep in mind that missed tax deadlines can be expensive. The IRS rules tend toward leniency when dealing with taxpayers who are late for a good reason. However, the laws are not so favorable when investigators suspect tax fraud or an attempt to evade paying taxes that you owe.

Generally speaking, it is a good idea to deal forthrightly with any delayed tax payments. If asked, be honest about the reason you did not pay your taxes on time. In all likelihood, the government will require you to pay fines and penalties for filing late, but in most cases that is as bad as it gets. It is almost always better to clear up any past due tax obligations sooner rather than later. Delaying any further could result in additional penalties, interest and fines added to what you already owe.

The Steps for Filling Out a 1040 2016 form are really quite straightforward regardless of how much comedians, and some politicians, like to play up the complexity of filing taxes. Start by obtaining a copy of the form and the IRS instructions that go along with it. Then do the following:

Read the entire form carefully. Make a note of any terms or guidelines that you do not understand or are not sure about.

Use the 1040 2016 form instruction booklet to help you understand the information that each numbered box is asking you to provide.

Double (and triple) check all of your math. Also, make sure that you understand the procedure for completing all calculations.

Look over the form carefully to make sure that you have filled out each required box and attached all the necessary documentation and additional forms.

Make sure to sign and date the form.

Have a friend or trusted adviser check over the form for accuracy and completeness before you send it to the IRS.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/1040-2016-form.pdf”]

Resources https://www.irs.gov/pub/irs-prior/i1040gi–2016

Not usually. The government is not out to get honest taxpayers who just get behind. It is another story if you are attempting to defraud the government.

No. Just file the return as soon as you can. If IRS investigators have any questions for you, they will be in touch.

The IRS provides a helpline on their website. You can get most of your questions answered by the staff employed to provide information to taxpayers.