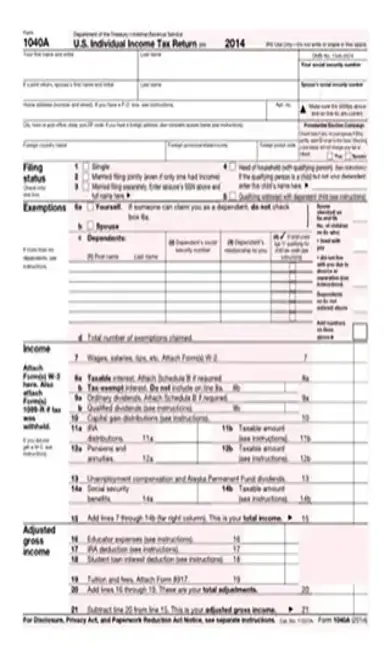

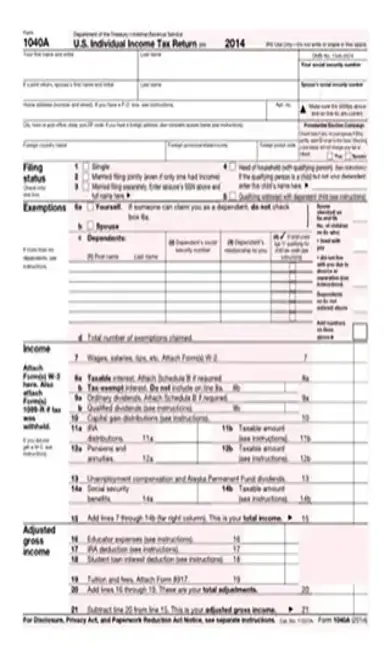

1040a 2014 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1040a 2014 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1040a 2014 PDF with PDFSimpli.

If you’re looking for a simpler way to file your taxes than the traditional 1040 Form, you may want to consider the 1040a Form. This form is used when you have a simple income and don’t really care about itemizing your deductions. Out of the 3 forms which can be used, the 1040a is not the most simplified version; however, it is not the most complicated.

This form is used because many taxpayers who are filing, do not have a large amount of income to report on their return and they opt to keep it simple. For example, if you have 1 job and do not receive child support, alimony, or unemployment compensation, then this form should do the trick. This form is also used to reduce your taxable income. Deductions such as classroom expenses, IRA contributions, and tuition, can all be recorded on this form which can greatly reduce your tax liability.

In addition, taxpayers also use the 1040a form to claim tax credits which they would not be able to claim on the more simplified, 1040EZ form. For example, tax credits such as the American Opportunity tax credit or the child tax credit cannot be claimed on the 1040EZ form. In addition to tax credits, the 1040a form gives taxpayers more options to choose from when it comes to their filing status. While the 1040EZ form only allows you to file as "Single" or "Married Filing Jointly," the 1040a form gives more options such as "Widower" or "Head of Household."

To conclude, the 1040a form is used because it is much simpler to fill out than the 1040 form but allows you a better chance to reduce your tax liability than the 1040EZ form.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/1040a-2014.pdf”]

Although saving time and effort on filling out your taxes sound good, there are eligibility requirements that you must meet if you want to file your tax return using the 1040a form. First and foremost, if you make more than $100,000 annually, then you shouldn’t be filling out the 1040a form, you should be filling out the 1040 form.

Physicians

Marketing Managers

Computer Information and Systems Managers

Surgeons

Airline Pilots

Attorneys

The above are just a few examples of professionals that should not use the 1040a form because the annual salary for these careers will more than likely exceed $100,000 and may benefit more from itemizing their deductions, which can’t be done on this form.

Fast Food Workers

Warehouse Selectors

Retail Associates

Entry-Level Health Care Professionals

Any job that pays you less than $100,000 annually.

The above are the most common groups of people who opt to file their tax return using the 1040a form. If you have only received unemployment compensation this year and did not have any other taxable income including from being employed, you should file your tax return using the 1040a form. The 1040a form allows you to report unemployment compensation as taxable income, even if it was your only income. A single mother who has one child (dependent) and one job would be the perfect candidate to fill out this form.

The 1040a form should be used during the tax season of the current calendar year. This form should be used when you do not have a ton of different sources of income and you don’t have to wait W2’s, or annual financial records from other agencies. Most people usually have 1 or 2 W2’s that they have to retrieve.

Taxpayers should use the 1040a form if they plan on claiming the standardized deduction instead of itemizing their deductions. You aren’t allowed to claim any itemized deductions on the 1040a form, so it is important to know which deductions are available to you to make sure that you are getting the least possible tax liability. A few examples of itemized deductions include the following:

Medical Expenses

Property Taxes

Charitable Contributions

Interest on Mortgage

It is not possible to claim the standardized deduction while itemizing your deductions. You must pick one or the other. So, if you have not made a large amount of donations, own your home and paid taxes, had a ton of medical expenses, and didn’t make at least $100,000, then it would be wise to opt for the 1040a form. The above itemized deductions are available for you to claim as an itemized deduction if you fill out the 1040 form.

By not using a 1040a form, there may be certain repercussions that you have to be prepared for. Firstly, you might miss out on credits and deductions that can dramatically reduce your tax liability. If you opt for a different form, such as the 1040EZ form, you will only have the option of claiming 1 credit and can only file under 2 statuses. This has affected many people’s tax returns and taxpayers have lost out on thousands of dollars; especially those who opt not to use a professional tax preparer to assist on their return.

Also, by trying to fill out a more complicated version of this form, the 1040, you may get stumped and end up missing the deadline to file your tax return. Most years, the tax deadline is April 17th or April 18th. This can lead to penalties and fees and you may or may not get an extension. More than likely, you don’t even need to fill out the 1040 form and the 1040a form will suffice; therefore, you’re giving yourself more work to do than you really have to.

Fill out all your personal information at the top of the form. This includes name, address, social security number, etc. If you are filing jointly, then your spouses’ information must be entered as well.

Tell the IRS how you are going to file this year. You have the options of filing as head of household, widow with dependents, single, or married filing jointly or separately. This is one the main things that separates the 1040a from the 1040EZ; the 1040EZ does not list these options. If you do not know which filing status applies to you, then refer to the 2017 1040a Instructions Booklet and refer to pages 7-9.

Fill out your exemptions. If you cannot be claimed by anyone else, then check box 6a and then add any children or any depends that you financially take care of. Make sure to put their real information including their social security number.

Fill out your income. On line 7, record your taxable income from wages. You can get this number from your W2’s. Any other income including unemployment compensation should go in lines 7-15. Add up of the lines and record the final amount in line 15. This is your total taxable income.

Add up lines 16 through 19 and then subtract line 20 from line 15. The balance goes on line 21. This number is your Adjusted Gross Income (AGI).

Complete lines 38-55 which are your taxes and credits. Use lines 47-53 to claim any credits that you may be eligible for.

Sign your return

The Main difference between these two forms are that the 1040 allows you to itemize your deductions instead of opting for the standard deduction of $6,350 as of 2017. If you feel that your itemized deductions will exceed the amount of the standard deduction, then go for the 1040 form but if not, the 1040a will suffice. Make sure you keep up to date with the latest tax table so that you can accurately calculate your tax liability.

The answer is yes. On this form, rather than putting in information for all your jobs separately, you can just add up the total taxable income from each of your W2’s and then just put the total amount on line 7.

While we can’t guarantee if you will be audited or not, we can assure you that the type of form used to file your taxes, whether it’s the simplified version, or the more complex version, will not affect if you will be audited or not.

The Main difference between these two forms are that the 1040 allows you to itemize your deductions instead of opting for the standard deduction of $6,350 as of 2017. If you feel that your itemized deductions will exceed the amount of the standard deduction, then go for the 1040 form but if not, the 1040a will suffice. Make sure you keep up to date with the latest tax table so that you can accurately calculate your tax liability.

The answer is yes. On this form, rather than putting in information for all your jobs separately, you can just add up the total taxable income from each of your W2’s and then just put the total amount on line 7.

While we can’t guarantee if you will be audited or not, we can assure you that the type of form used to file your taxes, whether it’s the simplified version, or the more complex version, will not affect if you will be audited or not.