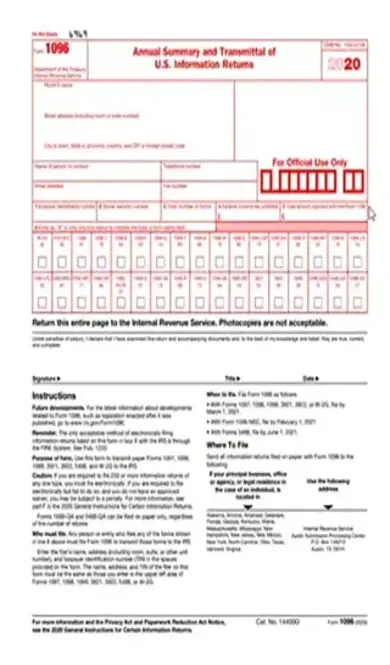

1096 2020 Annual Summary and Transmittal of U.S. Information Returns Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1096 2020 Annual Summary and Transmittal of U.S. Information Returns with PDFSimpli.