1845-0120 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1845-0120 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 1845-0120 with PDFSimpli.

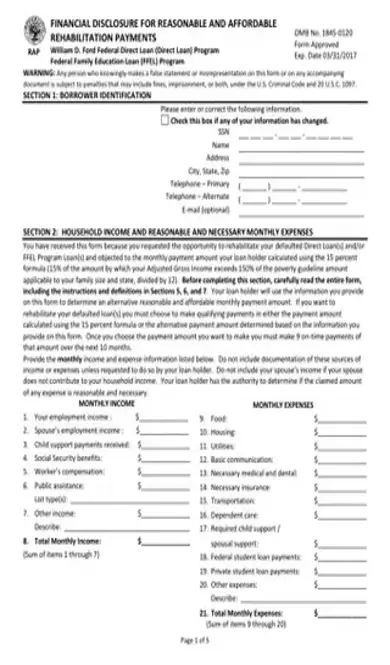

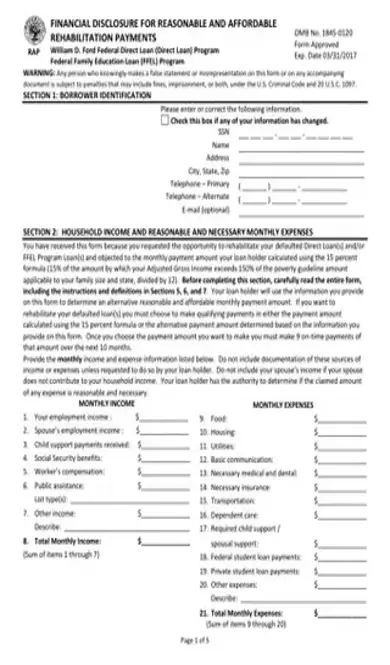

The 1845-0120 form is related to defaulted direct loans. For example, if you have a direct loan and are unable to make your monthly payments due to financial hardships, you can use the 1845-0120 form to request the opportunity to alter the monthly payment amounts to rehabilitate the loan. The loan holder can use your financial information from the form to determine how to modify the monthly payments. The 1845 0120 PDF is used under the direct loan program. You will have to provide income and expense information (financial disclosure statement) to justify why you are unable to pay for your student loan. If approved, student loan payments are then recalculated and the borrower can continue to pay for their defaulted loan with the new repayment plan. You will also have to sign a loan rehabilitation agreement before it all comes into effect. Poverty guidelines rule that in some cases a federal student loan can qualify for the public service loan forgiveness program. Defaulted loans have many options to be resolved with the loan servicer. An education loan should not be a financial burden for people and that’s why they put these programs in place. PDFSimpli will help you fill out this form, Get Started Now.

If you have defaulted on a direct loan and want the chance to rehabilitate the loan through lower monthly payments, you would use the 1845-0120 form to request an affordable payment schedule from your lender. In most cases, this form is used to request rehabilitation for defaulted student loans issued by the government. This form essentially serves as a financial disclosure that allows the owner of the loan to understand your circumstances and determine whether to allow rehabilitation payments. Based on the information you supply in the form, the loan holder can calculate a reasonable alternative monthly payment amount that would allow you to rehabilitate the loan. The rehabilitation terms and the new monthly payment amount are directly based on the information in the 1845-0120 financial disclosure form. As such, it’s essential to make sure you fill out the form accurately and completely. The form includes areas for you to define your monthly income from a variety of sources (including employment income, child support, and public assistance) as well as your monthly expenses, such as housing, utilities, medical bills, and food.

You would use the 1845-0120 form if you are an individual who has defaulted on a direct loan. What does it mean to default on a loan? In general, a loan is considered to be in default if there has been no payment made for at least nine consecutive months. A loan doesn’t have to be turned over to a collection agency to be considered in default. However, if your loan has been given to a collection agency, you may attempt to negotiate a rehabilitation process with the agency. As stated on the top of the 1845-0120 form, it is a financial disclosure for those seeking rehabilitation of loans from either the William D. Ford Federal Direct Loan (Direct Loan) Program or the Federal Family Education Loan (FFEL) Program. If rehabilitation is requested, a lender will first use the 15-percent formula (which is based on your gross income, family size, location, and other factors) to calculate monthly loan payments. However, if you feel you can’t afford the payment calculated with the 15% formula, you can request an alternative monthly payment with form 1845-0120. This financial disclosure provides proof that you need an alternative to the 15-percent formula to complete the rehabilitation payments.

Generally, once you have defaulted on a loan, it’s important to start the rehabilitation process as soon as possible. If you wait, you could experience further damage to your credit history or have your loan turned over to a collection agency. While a collection agency is allowed to charge additional nonpayment fees, government loan holders do not generally add fees. As such, it’s better if you can start the rehabilitation process with form 1845-0120 soon after defaulting. The first thing to do is contact your lender and request rehabilitation. You may agree to the initial monthly payment terms calculated with the 15% formula. However, if you object to this payment plan, it’s time to request an alternative with form 1845-0120. Additionally, you should make sure to file the form when you are ready to comply with the terms of the rehabilitation process. In most cases, new payments for rehabilitated loans are designed for a repayment period of under a year. Make sure that you are ready to set aside enough money every month to make the new loan payments.

If you have defaulted on a direct loan, you may be experiencing some negative financial consequences. Aside from the financial difficulties that led to the default in the first place, having this type of black mark on your credit history can make it difficult to apply for additional loans in the future, including car loans and mortgages. If you are able to successfully qualify for a loan, chances are that you will be saddled with high interest rates and less-than-favorable terms. Defaulting on a loan can also lead to wage garnishments and legal trouble. If a collection agency has your loan, you may experience negative interactions with debt collectors. If you don’t use the 1845-0120 form to request rehabilitation, you will likely continue to experience poor credit scores. You also may not be eligible for debt forgiveness or consolidation unless you start the rehabilitation process.

The 1845-0120 form is only a couple pages long, so you don’t have to worry about spending hours filling it out. It’s always important to make sure you are working with the current version of any legal form and that you fill it out physically or electronically according to the instructions. In form 1845-0120, the instructions are on the third page of the document:

Fill in your full legal name, SSN, address, and contact information.

Read through the form carefully, especially the instructions for Section 2

Fill out all the fields with information about your monthly income and expenses.

If your spouse contributes to the household income, you can include his or her income.

5. Add up your monthly income information and fill in the Total Monthly Income line. Do the same for the monthly expenses, and write the result on the Total Monthly Expenses line.

Double-check your math.

Read through the rest of the form to make sure you understand it. Sign as indicated at the bottom of the form.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/1845-0120.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

After you fill out the form, you should send it to your lender. Make sure to use the correct physical or electronic address for your lender’s loan rehabilitation department. You should also keep a complete copy for your records.

In general, loan rehabilitation is a one-time offer. If you default a second time, you are not allowed to apply for rehabilitation again. However, there may be an exception if you began the rehabilitation process before August 14, 2008.