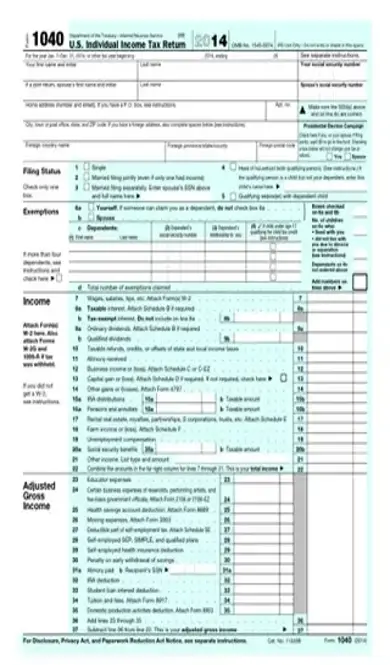

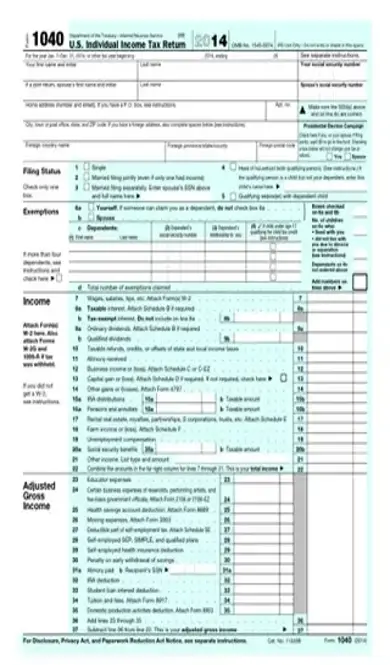

2014 irs 1040 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2014 irs 1040 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2014 irs 1040 PDF with PDFSimpli.

The 1040 form from the IRS is perhaps one of its most commonly used forms. It’s the long form of the 1040A and 1040EZ and is meant for use as a document letting the Internal Revenue Service know all about your income for tax purposes. You can opt to use this 1040 form over other choices if you have above-average income or certain types of income that cannot be documented on any other IRS form. The 2014 IRS 1040 is specifically meant to file income made in the 2013 fiscal year.

The 2014 1040 form from the IRS is used for filing your individual federal income tax returns. This form is used if you are aiming to fill out your own taxes. If you have an accountant or tax specialist filling out your taxes for you, this form or its easier subforms (the 1040A and the 1040EZ) are the main focuses of their work when inputting your income and expenses into official documents.

The 1040 form must be used if you fall under certain categories of employment or income. If you receive income from business or farm self-employment, the 1040 form is required. Any independent contractor or freelancer should use the 1040 form, as should anyone receiving income from trusts. Essentially, if you are not employed by a larger company and still receive income the 1040 or its subforms are the correct options for you.

You should also use the 1040 form if you want to maximize your deductions. The 1040 form allows you to adjust up to half of your self-employment taxes as well as student loan interest payments and certain types of long-term investments.

You should use the 2014 IRS 1040 form if you need to report taxable income from the fiscal year prior to the 2014 filing date. If your income is over $100,000 and has components that come from independent business or farm-related business, then the 1040 form should be used. Also, any income made as a beneficiary of a trust or estate requires the use of a 1040 form. If you can exclude income from your total income from that fiscal year for example, income received from foreign sources, IRA-based distribution from qualified health savings accounts, or anything debtor-related from bankruptcy cases you should be using the 1040 form. There are many small cases for certain income types or exclusions that necessitate the use of a 1040 form, so it is wise to read the official IRS directing documents or consult with a tax specialist to ensure you’re using the right form.

There are serious repercussions if you don’t fill out your taxes. The IRS regularly audits US taxpayers and is usually more careful when auditing independent income. Serious offenses or large sums of money can result in allegations of tax fraud. If an auditor catches mistakes or purposeful omissions from your 1040, the IRS can demand repayment of that income. This can be demanded in a batch sum or as wage garnishment, where a set amount of money is taken from your paycheck each time you are paid. The IRS can even seize property as a form of payment.

Download the official PDF from the IRS website.

Fill in your personal details, including first and last name, social security number, spousal information (if applicable), and home address.

Check your filing status and mark your exemptions. If you have people you can claim as dependents, such as children, fill out their information here.

Fill in all income, along with your pertinent W2 forms. These W2s will help the IRS gauge how accurate your 1040 is. This step will take a long time, as you may have many income sources that need to be calculated and added together correctly.

Calculate your adjusted gross income (AGI). This will help you calculate how much you can adjust your tax bracket, giving you decreased taxes in many instances. The AGI calculated can then be used to confirm or fill out certain taxes and credits.

Mark other taxes, like IRA tax and unreported Medicare tax.

Calculate your payments and refunds.

Specify the amount you owe and sign to confirm that what you are sending to the IRS is accurate.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/2014-irs-form-1040.pdf”]

A: The 1040A is an easier form of the 1040 and should be used if you did not have independent income from freelancing or your own business. The 1040 form should be used if you have a high income, are self-employed, or are a shareholder in an S corporation.

A: If you did not accurately tell the IRS how much you made in 2014, they may contact you by letter upon auditing your income.

A: In 2014, there were seven tax brackets for federal income tax. These seven were 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%, and how much you owed at each level was calculated based on your filing status.