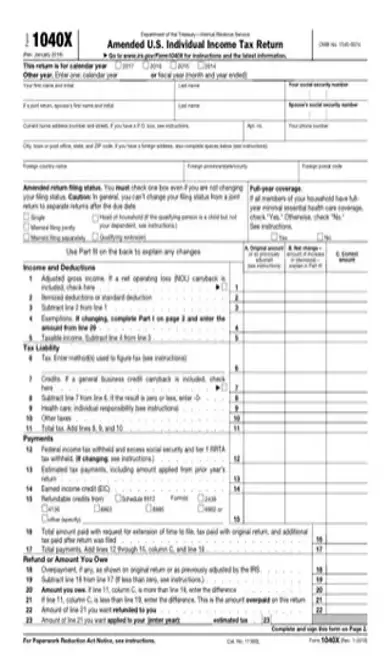

2016 1040x PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2016 1040x PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2016 1040x PDF with PDFSimpli.

The 1040x form is used by the Internal Revenue Service (IRS). It is for those taxpayers who need to make an amended return. If you have not calculated the credits or deductions correctly, this is the form to use. The 1040x does not require you to file a brand new tax return. The form only needs you to update the numbers that will have an impact on your taxes.

Tax season can be a confusing time. There is a rush to get everything filed before the deadline. With all the forms and attachments to fill out, some things can be overlooked. There are even times when certain documents fail to arrive on time. You can always file for an extension with the IRS. That can be a hassle as well. If you noticed that your 1040 is incorrect, there is no reason to panic. The IRS has a form to correct any problems with the original tax return. The 1040x gives taxpayers the opportunity to fix any miscalculations on their return. There is no reason to send in a new return. The amended 1040x form can help get you the correct credit or deductions on your taxes.

The 1040x is used for any taxpayer who needs to change information on their tax return. TurboTax explains that “as long as your original tax return was prepared using Forms 1040, 1040A, 1040EZ, 1040EZ-T, 1040NR or 1040NR-EZ, then you can amend it using Form 1040x.” If you took an unqualified deduction, you need to correct it with this form. You may have noticed that you could have received a credit. The form is used for that reason as well. The 1040x can be filled out by yourself or your own tax professional.

You can use this form to file an amended tax return. According to the IRS, “This includes making changes to filing status and dependents, or correcting income credits or deductions. Don’t file an amended return to fix math errors because the IRS will correct those.” The form is not used for simple incorrect mathematical calculations. The 1040x is an important form for the IRS. A miscalculation can cause you to be placed in a higher tax bracket. That could mean you have to pay a higher tax for 2016. If you use this form, some attachments and schedule forms will need to be resubmitted as well. The date to send in the 1040x is generally within 3 years of the initial file date.

If you took an unqualified credit, you may run the chance of getting an audit from the IRS. Credits are also there to lower your tax rate. If you failed to claim that, it could mean a higher expense when it comes time to file. Any time you have noticed a mistake, you need to correct it. There is no penalty for filing an amended tax return. The IRS will accept the 1040x within a 3-year time frame.

You can download the 1040x form from the IRS website.

The box needs to be checked for the amended year. So if you are amending the 2016 tax return, check that box.

Fill out all your personal information. This will include your name, address, Social Security number, and filing status.

Part III of the form is where you explain your changes. There is a blank space provided for you. You need to write in detail why you are amending the return.

Find the section you need to fill out. There are several different options available for this part. Find the box that corresponds to your correction.

Once the corrections have been made, you can amend your tax liability.

The final part is to amend the amount of tax that should be refunded to you or that you may owe to the IRS.

When have completed the form, you can send it off to the IRS. Be sure to send in any other documentation as well.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/2016-1040x.pdf”]

If the documentation is another W2 or 1099 form, you can attach that to the 1040x. Other forms and schedules can be included with your amended return.

Unfortunately, the 1040x must be mailed. The IRS will only accept the original tax return electronically. If you need to amend a return, you must print the form and mail it to the IRS.

The IRS will process your amended tax return in 8 to 12 weeks. You can track the progress of your return on their website. There is a delay for the return to show up in their system. You should be able to see the status after 3 weeks from the date you mailed it.