2016 990 EZ PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2016 990 EZ PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2016 990 EZ PDF with PDFSimpli.

[toc] The IRS has created a great deal of different tax documentation. Many tax forms have different variations and circumstances in which a person can file. This is the case for the Form 990. The Form 990 EZ is one type of Form 990. It records annual information about the return filed by certain nonprofits and small to medium-sized public charities.

Even though EZ is in the form’s title, the document isn’t necessarily easy to fill out. However, it is much easier to fill out than the other variants of the Form 990 that the IRS puts out. This version mostly resembles a more thorough type of corporate tax return. When you fill it out, you’ll be giving the IRS all demographic-related information that they’d ask for with a Form 990-N, plus some additional information.

These are the additional details you’ll need to furnish:

An accounting of all of your expenses and income by category

Information about distributions and grants given by this nonprofit

A balance sheet that reflects the expense and income information accurately

Details regarding the associated expenses and specific program accomplishments

A list of the personal information about the organization’s board members, including their hours worked, any compensation they received, and their addresses

A number of different Yes/No questions about different circumstances

Information about how executive staff was compensated

A step-by-step breakdown of your income sources for the past 5 years, or if the nonprofit has been in business for fewer than 5 years, the entire length that the organization has been operating

Details about any donors that have given in excess of $5,000 over the past year

This form is part of the tax filing for certain nonprofits and charities that meet the requirements. The qualifications to file this form are as follows:

The nonprofit has a total gross income that comes to more than $50,000

The gross income is also less than $200,000

A total valuation done of the assets should come to under $500,000

If an organization has assets worth more than $500,000, they will need to file the full Form 990 rather than the 990-EZ. This remains true no matter what their numbers are regarding gross revenue.

This specific form is related to the 2016 year. In general, though, all 990s must be filed at the same time. The due date is May 15 after the fiscal year’s end. The IRS prefers that filing be done electronically. If you need to get an extension, you can do so by filing IRS Form 8868 by the initial due date.

It’s important that you only file this form if you meet the predetermined qualifications. If you don’t meet the requirements, you need to fill out a different form of paperwork.

If you’re eligible to use the EZ form, and you choose not to, you might face a number of different consequences. Failing to file any 990 at all could result in being forced to pay fees to the IRS on top of your back taxes. You might also put the status of your nonprofit or charity in jeopardy.

If you file a different Form 990, the consequences aren’t nearly so severe. You are legally entitled to file a Form 990-N or full Form 990 if you qualify for the EZ. However, these forms are more detailed and more cumbersome to fill out. You’ll have an easier time if you use the EZ form instead.

You’ll need to write the time period that the form regards. In this form’s case, it would generally be the 2016 fiscal year.

If any of the options listed in Box B are applicable, place a check mark next to them. You’ll then give the name of the charity or nonprofit, along with its street address and employer identification number. All organizations should have an EIN. If you don’t have one yet, you will need to get registered with the IRS as soon as possible. Finally, you’ll give your telephone number and any group exemption numbers you might have.

You must take note of the accounting method you’re using. If it’s a method other than accrual or cash, you should write it in the provided blank. You should also provide the URL of the organization’s website. If you don’t meet the requirements to attach a Schedule B form, check Box H. In Box J, you’ll check the appropriate box regarding your tax-exempt status.

You’ll use Box K to note what form your organization takes. In Box L, you’ll calculate your gross receipts, but this won’t be completed until after you’ve filled out the rest of the form.

Part I is where you’ll give information about the organization’s changes in fund balances or net assets, along with the general expenses and revenue. You’ll be responsible for calculating your total revenue, total expenses, and total net assets. These totals must meet the requirements for a 990-EZ form. If the totals are outside the form’s requirements, you will need to file a full Form 990.

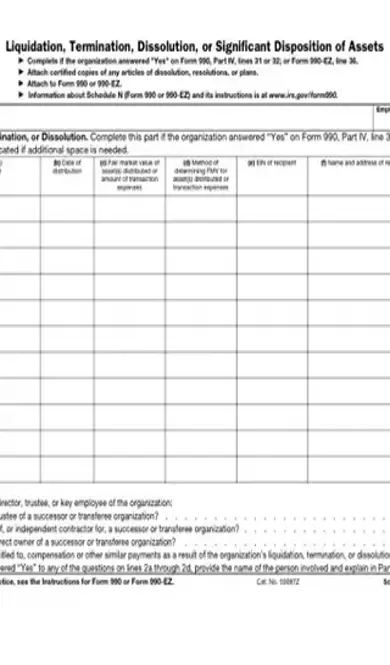

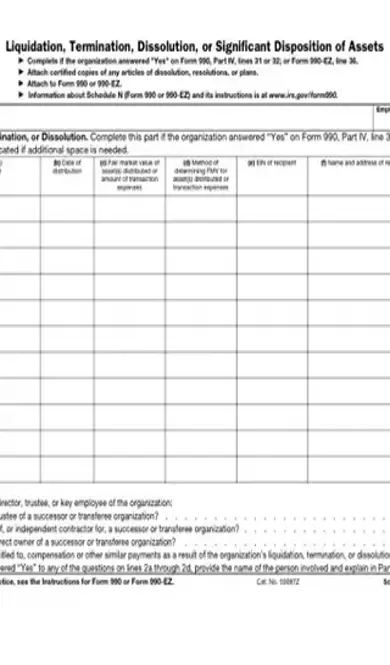

Part II refers to the balance sheets for the organization. You should attach these to the form. Part III is the statement of the program’s accomplishments. Part IV captures a list of the key employees, trustees, directors, and officers who received compensation.

Part V is mostly answering yes and no questions regarding the organization, and providing explanations where you’re asked to do so. Part VI should only be completed by organizations that meet Section 501(c)(3) qualifications. Finally, the filing officer should provide a signature and date. If a paid preparer put together the form, they’ll fill out the information at the very bottom.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/2016-990-ez.pdf”]

The information it asks for isn’t as exhaustive. It’s easier to file.

You still need to fill out a full Form 990 instead of the EZ form.

You’ll need to provide balance sheets. Depending on the circumstances, you might also need to provide different schedules.