2016 W3 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2016 W3 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 2016 W3 with PDFSimpli.

This 2016 W3 form is a transmittal form for businesses to use that’s sent to the Social Security Administration. It shows all the total earnings, Social Security wages, Medicare wages and withholding amounts for all employees in the previous year. You can find it here – Get Started Now. The official title is Transmittal of Wage and Tax Statements.

The form is used for primarily small businesses, so they can report their employees’ total earnings, Social Security wages, Medicare wages and withholding amounts for all of their employees in the previous year. It’s required by the IRS that they submit this form along with all W2 forms for their employees. The owner, accountant, or whoever is in charge of preparing taxes for a small business, must add up wages for each employee in each category, using each employee’s W2 form and the W2 totals. Information from each employee’s W2 form is needed to complete this form, W3. Both forms W2 and W3 may also be filed electronically, but this PDF form gives businesses the chance to print out a hard copy in case they want to fill it out by hand. This form is submitted by small businesses before the end of January of the following tax year. So, for instance, 2018 W3 forms must be submitted before the end of January 2019.

Small business owners would use this form because it allows them to report the total earnings, Social Security wages, Medicare wages and withholding amounts for all of their employees.

Small business owners must submit a W3 form along with all W2 forms for all employees before the end of January of the following tax year. So, when a small business owner has prepared W2s for all employees for the tax year 2016, you would submit all of them plus the transmittal form W3 (this form) by January 31, 2017. This January 31 deadline is the same for both electronic and paper filing methods. The date was changed recently in 2017. W2s must also be given to employees by this date, so they can file their personal income tax returns in a timely manner. It’s generally a good idea to give employees these forms as early as you can in January, so in case there are any mistakes, you still have time to make corrections before the deadline. What are the Consequences for not Using a 2016 form W3 PDF? The consequences of not using this form can result in penalties from the IRS, as reporting employee wages is required by law for your business to operate. If you fail to file the form on time, you may be able to apply for an extension through the IRS, but small businesses should work hard to meet this deadline especially since it affects their employee’s ability to file their income tax returns, as they need accurate W2s to be able to do that.

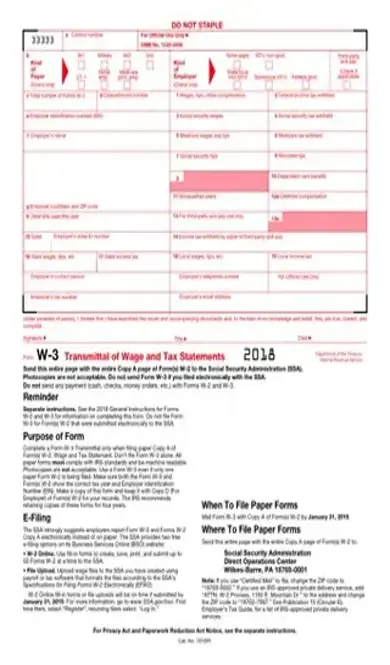

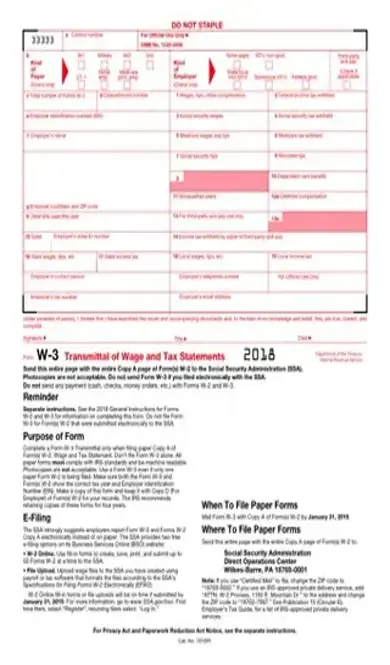

The employer information is entered into boxes A-H. For box B, Kind of Payer, most businesses check 941, which is a quarterly wage and tax report form completed by most employers. Other options include household employer among others. For Kind of Employer, most businesses will check none apply because the other options are for non-profit organizations and government employers. The rest of the boxes A-H let you fill in your Employer Identification Number (EIN), name, address and zip code of the business.

The second section, boxes 1-19, corresponds with numbered sections on Form W2. You must provide totals here in these boxes for all W2s you are submitting.

The final part of the form as you fill in your contact information, including a name, phone number, and email address.

The final step is to sign the form and write in your title and the date.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/2016-w3-form.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

A W3 form is sent by the employer to the Social Security Administration. A W2 form is filled out by the employer and given to the employee to complete their personal income tax returns. A copy of the W2 also goes to the Social Security Administration and the IRS. The W3 form is a summary report of earnings details for all employees in a company, whereas the W2 documents earnings information for individual employees.

The Social Security Administration strongly suggests e-filing. The Social Security Administration provides two free e-filing options on its Business Services Online (BSO) website: W2 Online or direct File Upload. You can also mail paper forms to the Social Security Administration at the address at the bottom of the form.

Contact the Social Security Administration. They will likely tell you to fill out a W2-c form or W3-c form, depending on your situation. Those forms are also submitted to the Social Security Administration.