941 for 2015 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 941 for 2015 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 941 for 2015 PDF with PDFSimpli.

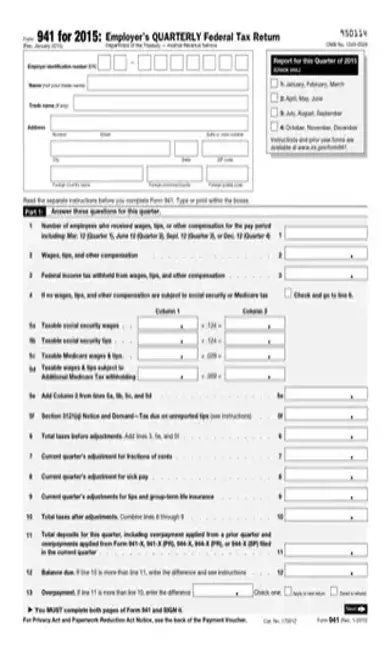

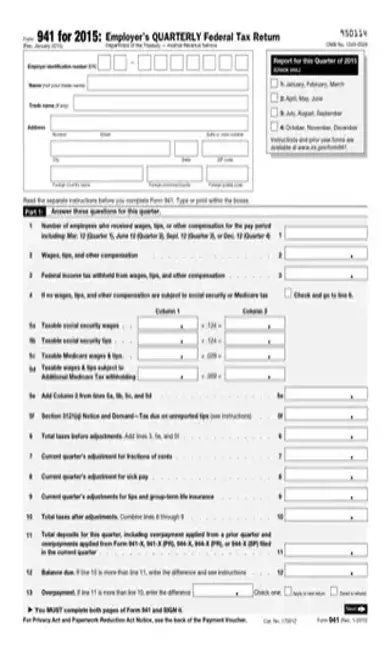

[toc] The IRS Form 941 is used for employers to file their quarterly federal tax returns. As such, it should be filed every fiscal quarter during a relevant tax year. Instructions sometimes vary slightly from year to year. The instructions for 2015 may be slightly different from the instructions given for the following years. It’s important that employers fill out the appropriate form for the appropriate tax year.

This form is filed quarterly with the IRS by employers across the country. It’s where they give information about their overall federal tax return. In 2015, consderations must be made for the Medicare and Social Security taxes. The tax rate for social security is 6.2% for both the employer and employee, which is no different from the previous years. The tax rate for Medicare is 1.45% for both the employer and employee, which is no different from the previous year.

In 2015, these taxes must apply to the wages of certain household workers. To qualify, the workers must be paid at least $1,900 in cash or equivalent types of compensation. Election workers who are given more than $1,600 must also pay these tax rates.

Another change made in 2015 regards the work opportunity tax credit. This credit now has availability for unemployed veterans who meet the eligibility requirements and began working sometime between January 1, 2014 and December 31, 2014. Tax-exempt organizations who hire unemployed veterans that meet the eligibility requirements can claim this tax credit against their tax liability for payroll.

If your return has a balance due, you might be able to apply for an installment plan online. This is an opportunity given to people who cannot pay their tax burden in full, but who want to get paid up as soon as possible.

Most employers across the United States need to file this form with the IRS. The form captures these amounts:

Wages that the employer has paid to their employees

Any tips that the employees have received while working

The amount of federal income tax that the employer withheld

The Social Security and Medicare taxes for both the employee and the employer

Any additional Medicare taxes that were withheld from employee wages

The adjustments made in the quarter regarding the Social Security and Medicare taxes to account for sick pay, life insurance, tips, and fractions of cents

Some employers do have special exceptions that apply to them:

If you are a seasonal employer, you only need to file Form 941 during the quarters in which you paid wages to employees

If you employ people around your household, you will generally not need to file Form 941 unless you meet certain wage threshold requirements

If you employ people on your farm, you generally will not need to file Form 941; you’ll be responsible for filing Form 943 instead, as this is the form made for agricultural employees

The initial form should be filed for whatever quarter that you first paid employee wages that are subject to federal taxes. You will be required to file the form for each quarter following this, even if there are no taxes to report. The only exception is if you’re a seasonal employer, or your business is closing and the quarter’s report is your last one.

The form should only be filed once for every employer each quarter. When you file electronically, you should not submit an additional paper form.

If you don’t file this form for every quarter, you could be subject to late fees and penalties from the IRS. If you have an outstanding balance on your taxes, and you lack the ability to pay it on time, you will probably have to pay it back in installments plus a hefty interest rate. It’s best for your business to make sure you file this form, along with all other important employer tax forms, before the associated due dates.

At the top of the form, you’ll provide your employer identification number. You’ll then give your full name, along with any trade names your business has. Provide your address and check the particular quarter that you’re filing for.

Part 1 will ask you to answer questions. You will need to give the number of employees you have, the total wages they have, and the amount of federal income tax you withheld. You’ll also need to make notes about the Medicare and Social Security taxes. At the end of this part, you’ll use your totals to calculate your total taxes along with your total deposits. If a balance is due, you’ll need to pay it. If you have overpaid, you’ll receive a tax return.

Part 2 is used to inform the IRS about your company’s tax liability and deposit schedule for the quarter. You’ll need to explain your tax liability for each month of the quarter. In Part 3, you’ll give information about your business, and in Part 4, you’ll provide the contact information of a third-party designee. You will then sign and date the form in Part 5, provide a printed version of your name and title, and note the best daytime phone that you can be reached at.

Paid preparers will use the section of the form labeled for “Paid Preparer Use Only.”[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/941-for-2015.pdf”]

Yes. This is the point at which you’ll pay any outstanding quarterly taxes.

You can either send your payments electronically or use the payment voucher attached to the Form 941. Form 941-V makes payments easy through the internet.

It’s best to get everything up to date as soon as possible. If you file your quarter late, you might only need to pay a late filing fee.