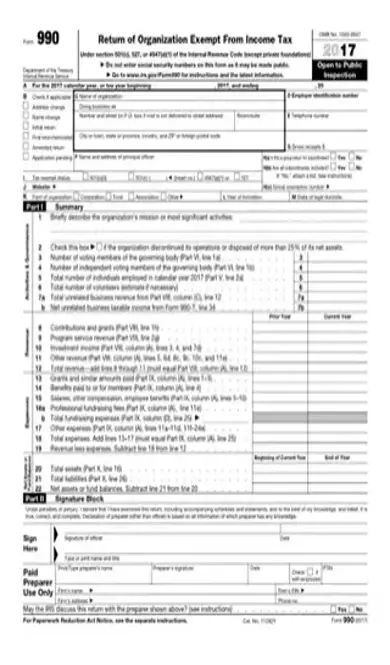

This form applies to the majority of organizations who claim an exemption from income taxes through the regulations outlined in section 501(a). The type of Form 990 that an organization is required to file will vary depending on their total assets and gross receipts. Organizations with a certain low range of assets might be able to file Form 990-EZ, while larger organizations will need to complete a full Form 990. Annual electronic notices might also be required, which are submitted through a Form 990-N.

A full Form 990 must be filled out by a tax-exempt organization if it meets the following qualifications:

The gross income for the year was greater than $200,000

Alternatively, they had total combined assets with a value in excess of $500,000

This applies to all organizations that are covered in the section 501(c)(3) guidelines, with the exception of private foundations. It also applies to any organizations that the other 501(c) subsection guidelines refer to, with the exception of benefit trusts for black lung.

In some cases, organizations aren’t required to file any kind of Form 990 even if they meet the eligibility requirements for filing. These organizations might include:

Churches and interchurch organizations

Organizations affiliated with churches

A school below university level that is operated by a religious order or affiliated with a church

A mission society organization affiliated with a church denomination

Religious activities performed by any kind of religious order

State institutions who have an exclusion from gross income

Certain political organizations

Certain organizations that have a limited number of gross receipts