990 Schedule A 2015 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 990 Schedule A 2015 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 990 Schedule A 2015 PDF with PDFSimpli.

[toc] Charities, also known as non-profits, file a form 990 Schedule A 2015 to accompany its Return of Organization Exempt From Income Tax (Form 990) or Short Form Return of Organization Exempt From Income Tax (Form 990-EZ). Instead of filing an income tax form, the charity files a form that explains its legal status, what it does and its level of public support or donations.

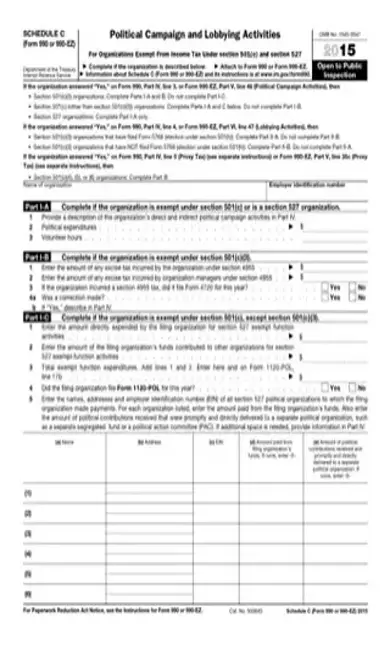

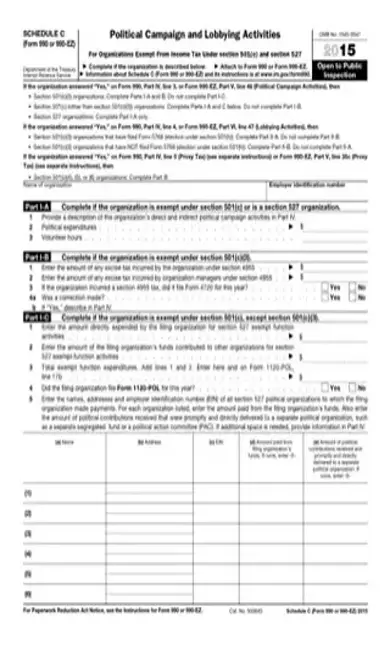

SCREENCAP: PDF form

The 2015 on the end of the form name indicates the tax year for which it applies. At this time, a charity would only file this form if amending its taxes or filing late. A non-profit would not file the 2015 form for the current year.

Any organization that answers affirmatively to line one of part four of IRS form 990 needs to complete this form. That means if the filer checked “Yes” on line 1, Part IV to Form 990, then this form must accompany the Form 990. This applies to any section 501(c)(3) organization. It also applies to organizations treated like 501(c)(3) organization. Any organization that files a Form 990-EZ also must complete schedule A and attach it.

Those organizations treated like a 501(c)(3) include those that meet the description of those in sections 501(e), 501(f), 501(j), 501(k), or 501(n). It also applies to nonexempt charitable trusts that the IRS does not treat as private foundations. These are described in section 4947(a)(1) of the tax code.

The Schedule A form should attach to the Form 990. Although these non-profits do not pay taxes, they file their forms at the same time as organizations. The charities’ tax preparer should complete and return the Schedule A and other forms of a current tax year by April 15. Since this form applies to a prior year return that of 2015 the organization should file it as soon as possible, even if simply amending a return.

If a non-profit that the IRS does not require to file Form 990 or 990-EZ does so, it also must file a complete tax return. This includes all required information and schedules.

The form has multiple parts. Part One defines the reason for the organization having charity status. Part Two provides the support schedules for organizations described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi) of the US Tax Code.

Check the appropriate organization type out of the choices delineated in lines one through 12. Only one line will apply. For example, a school would choose line two, but a hospital would use line three.

Complete Part Two if in Part One you checked off line five, seven or eight. Complete it using the appropriate dollar amounts. Do not report all zeros. Do not leave it blank.

If you check the line 13 box, stop. Do not complete the remainder of Part Two.

If you check the line 18 box, complete all of Part Three. This determines if the organization qualifies with the IRS as a publicly supported organization as described in 509(a)(2).

If, according to Part Three, the organization does qualify, return to Part One and check line 10. Erase or change the previous entry used on any other of lines one through 12.

Complete Part Four, Supporting Organizations, if your organization checked line 12a, 12b, 12c, or 12d of Part One. You will not complete the entire part. Each organization type completes specific sections. Type One completes sections A and B. Type Two completes sections A and C. Type Three completes the sections for those functionally integrated – sections A, D, and E or Type Three completes the sections for non-functionally integrated – sections A and D, plus Part Five.

Complete Part Six with the narrative information required to supplement the above questions. Prepare the narrative information in the same order as used on Schedule A in the questions, identifying the supplemental information by relevant part and line number.

You may duplicate Part Six, if needed.

The IRS makes Part Six public, so do not include the names of contributors, donors or grantors.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/990-schedule-a-2015.pdf”]

The IRS constantly updates its website. You can find the latest tax law changes regarding this form on the IRS website.

Complete Schedule A of Form 990 or 990 EZ using the same accounting method used on line one, part 12 of Form 990. This should be the same accounting method the organization uses in its day-to-day accounting. If the charity changed its accounting method from the prior year, it must include Schedule O with its form 990 or 990 EZ and its Schedule A to explain why it changed its accounting method. Schedule O is also referred to as the Supplemental Information form. The IRS provides a much denser explanation of this form and its requirements in a booklet that it provides as a .pdf. You may also read it online as a rather lengthy HTML document.