Certificate of Origin Fillable PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Certificate of Origin Fillable PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Certificate of Origin Fillable PDF with PDFSimpli.

[toc] If you own a business, and you plan to expand your services beyond your country’s borders, you will need to use international trade documents. There are a great deal of different documents that you might need to fill out depending on your circumstances. One of the most important of these documents is the Certificate of Origin. A Certificate of Origin is one of the most commonly used forms in all foreign trade, and it’s so important that it has a history.

In 1994, there was the conclusion of the North American Free Trade Agreement. The agreement had created one of the largest free trade zones in the world, leading to the development of trade-related connections and economic growth for all North American countries.

A free trade zone means that a goods producer and exporter is able to import goods to any North American country without being subject to any fees or preferential tariff rates during customs proceedings. The exporter is responsible for the filing of all proper documentation that should accompany the goods, including a Certificate of Origin. This certificate will only be used by countries who participate in the North American Free Trade Agreement. It is a claim form for lower customs-related duties.

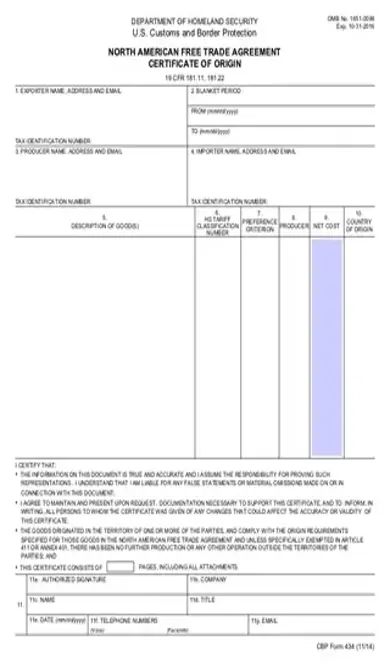

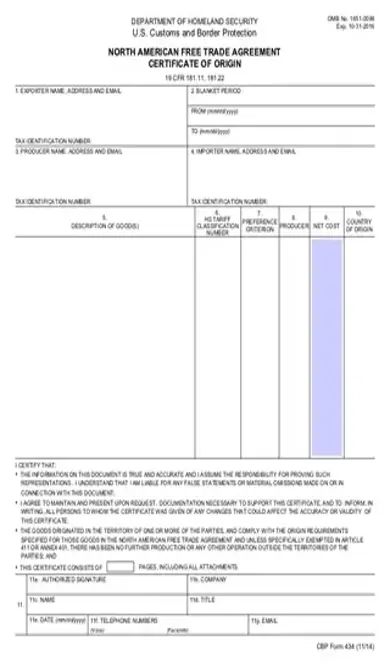

The main purpose of the form is for the Department of Homeland Security to receive information regarding the producer and exporter of the goods. There is also detailed information concerning goods that are imported into the United States. United States Customs and Border Protection will then use this data to decide whether the goods can enter the country without needing to pay a duty fee.

The person responsible for filling out the form is the producer or exporter. This is the individual who is bringing the goods across the United States border. They will need to give information about themselves and the goods. After the form is filled out, they will present it to the importer during customs proceedings. If a person wishes to enter the United States without having to pay duty, they need to make sure they fill the form accurately and completely.

This form should be used whenever an exporter or producer who is part of NAFTA wishes to bring their goods across the United States border without being subject to fees. The importer will use the information gathered on the form to make a decision. Forms are viewed by Border Protection as well as the Department of Homeland Security.

In most cases, this won’t be the only form that you need to file. You will generally accompany it with a bill of lading and a commercial invoice. Certain goods might need to provide additional supporting documentation, but it will vary widely from case to case. The Customs official does have the right to ask for additional supporting documentation to be provided.

The certificate will be filed in accompaniment to the goods. Upon the arrival of the goods at customs, the importer will receive the form. The exporter must make sure the form is completed and certified prior to their shipping of the goods.

The certificate is an essential piece of documentation for people who wish to import their goods into the United States at a lower customs rate. If this form does not accompany the goods, the exporter will need to pay a higher customs rate.

In the first part of the form, the exporter will provide information about themselves. This includes their name, physical address, email, and their tax identification number. This is also the point at which the exporter will indicate what blanket period the certificate covers. Blanket periods only need to be used if the certificate is covering a number of different shipments of identical goods that will be arriving at different times.

The second part will be completed by the importer and producer. The producer will need to give their contact information, such as their phone number and email. The importer will also need to give their contact information when they receive the form, including their phone number and email.

The third portion of the form will describe the goods in the shipment. Several columns are available. You need to give a description of the goods, along with their tariff classification number. The preference criterion should be noted, as should the producer of the goods. Finally, the net cost of the goods should be noted along with the country in which they originated.

The fourth and final portion is where you’ll give your certification. The exporter will sign the form, give the name of their company, and give their email and phone number.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/certificate-of-origin-fillable-form.pdf”]

After a certificate of origin has been completed and signed by the exporter, they will need to attach it to any other official documentation that accompanies the cargo. It will be forwarded to the customs office alongside the goods.

If a person wants to get the lower customs rate, they should give as much detail on the form as possible. The main important point is that they shouldn’t leave any parts of the form blank. All contact information should be accurate and relevant, while all details about the goods should accurately reflect the shipment.

If you’re part of NAFTA, you’re eligible to receive a lower customs rate when your goods cross the United States border. But you will only be eligible for that rate if you provide a Certificate of Origin form. This is an official NAFTA form that the United States government takes very seriously. If you decide not to fill out this form, you won’t be able to receive the lower customs rate. Depending on the types of goods you have, along with the other documentation you’ve provided, your goods might not be able to cross the border at all.