DD 1351-2 Fillable PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant DD 1351-2 Fillable PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant DD 1351-2 Fillable PDF with PDFSimpli.

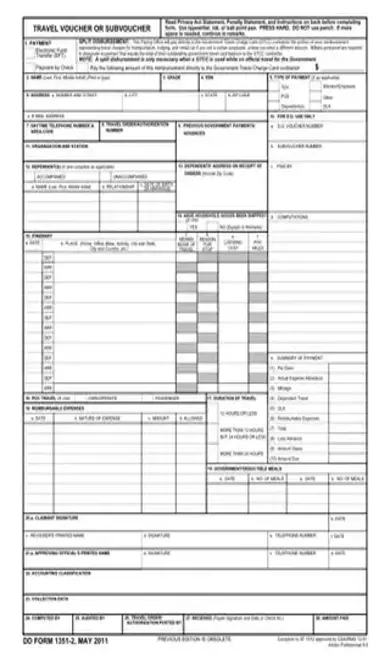

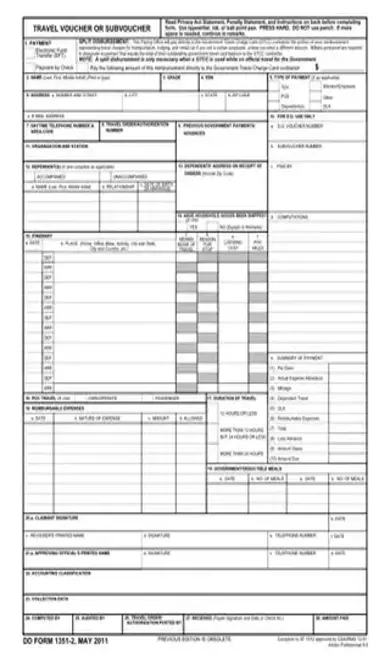

[toc] In the United States, employees of the federal government need to fill out a lot of paperwork. Different branches of government cover different legal areas, and the military has stacks of official forms to use. One form is the Department of Defense’s DD 1351-2, which is more commonly known as a subvoucher or travel voucher.

Government employees use this form to document any travel costs they incur related to work. The form is also an application to have the employer cover or reimburse these costs. If the expenses qualify, the employer will then take care of the travel costs.

The form asks for some personal information about the applicant in addition to questions about the travel. For the best chance at reimbursement, you should be as detailed and thorough as possible when filling out the forms. This means that you should keep a trip itinerary that includes dates, times, and locations. If anybody accompanied you on the trip, you need to list them as well.

All expenses incurred because of the trip are able to be listed on the form, along with a specific description and amount. A number of different costs are covered, including meals, transportation, and lodging.

A great deal of different jobs, both in the federal government and in the private sector, have the ability to file for travel compensation. This particular form is specific to the Department of Defense. It’s meant to be filled and filed by Department of Defense employees who need federal reimbursement for their overall travel costs.

If any Department of Defense employee is traveling for work-related purposes, they’re entitled to compensation for the associated costs. You wouldn’t be eating at restaurants, staying in motels, and guzzling gas if it weren’t for your job. Therefore, it doesn’t make sense to pay those expenses out of pocket, right?

One thing to keep in mind is the amount of information required for the form. You should keep a list of details that you’ll need before you embark on your travels. That way, you won’t accidentally miss or forget any of them. FEMA even has a helpful guide on how individual travelers can prepare their travel vouchers.

These are a few expenses you might want to record:

Cost of meals and food including restaurants, fast food, and snacks purchased for the trip

Cost of gas if you’re traveling in a vehicle, and cost of airline ticket if you travel by plane

Cost of your motel or hotel lodging

For the most part, you won’t be able to receive compensation for unnecessary activities like sightseeing, nightlife engagements, and museum touring. If you want to be a tourist in the area you travel to, that’s totally fine, assuming you aren’t working. But you should build those costs into your budget, because you won’t get them back. An unnecessary sightseeing excursion isn’t a work-related expense.

Make sure you keep all your food, gas, and lodging receipts together. It will make life much easier when you’re filling out the travel voucher.

For Department of Defense employees who are traveling for work, this travel voucher is the only means through which you can seek compensation. You cannot fill out any alternative forms or travel vouchers. If you fail to file this specific form with your supervisor, you’ll never receive reimbursement for your travel costs.

Keep your receipts so you have a to-the-cent accounting of your expenses.

The first box is where you’ll select your preferred payment type. Your options are for a check to be mailed to you, or for an electronic fund transfer to go directly into your bank account. Underneath, you’ll supply basic personal information like your name, address, SSN, e-mail, and phone number. Make sure you keep track of your travel authorization number, since you’ll need it for Box 8.

In Box 9, you’ll record any payments and advances that you’ve previously received from the government. Box 11 is where you denote your main organization and station. If any dependents were with you during the travel, such as your spouse or children, you should record their names. For your spouse, you’ll write your date of marriage; for your children, their date of birth. Check whether these dependents accompanied you or did not during the travels.

In Box 13, you’ll write the address of your dependents. If any household goods have been shipped, check “Yes.” If not, check “No.” No answers must be explained in the remarks section later.

Ideally, you’ve been keeping a travel itinerary. You’ll need it for Box 15. Copy your entire itinerary down with the date of every departure and arrival. Record every place you stopped. Then record the way you traveled – boat, car, plane, or train – the reason you stopped in that area, the cost of lodging, and the number of miles covered between destinations.

In Box 16, you should check Own/Operate if you drove your own car. If you were a passenger in a car or used alternative transportation, check Passenger. Box 17 covers your duration of travel.

Get your receipts out for Box 18. This is where you’ll list all reimbursable expenses. Write the date on the receipt, the type of expense, the total amount, and the amount you were allowed to spend. Box 19 is where you’ll put deductible meals with the date and number of meals consumed.

Sign and date the form in Box 20a and 20b. The rest of the boxes will be filled out by the people processing your application for reimbursement.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/dd-form-1351-2-fillable.pdf”]

If you fill the form out online, email it to the Claims department of the Defense Agency Accrual office. The email is dfas.rome.jft.mbx.army-travel@mail.mil.

If you need an advance rather than reimbursement, you can email your Travel Orders to the address listed above.

Advances will only cover 80% of your meals and lodging, but they will cover 100% of reimbursable expenses set in the budget. These include conference fees, a rental car, and any other expenses directly related to your orders.