Employment Income Verification Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Employment Income Verification with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Employment Income Verification with PDFSimpli.

[toc] There are a number of different times throughout your life that you might find yourself needing to provide financial documentation. Official forms for endless government organizations, companies, and basic transactions abound. When you’re applying for a mortgage, or you’re seeking rented housing, your potential landlord is likely to require a number of different documents. An Employment Income Verification is one of them.

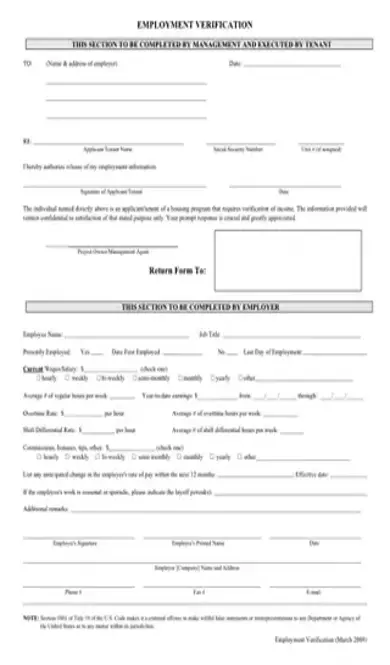

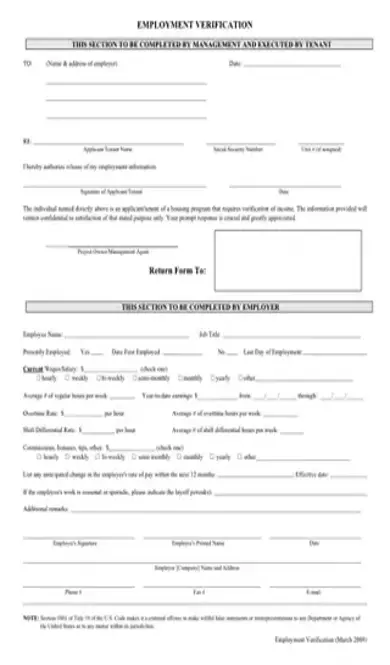

This form is usually created in a letter format. The main form has a few different components. First, it verifies that the person in question does have regular employment somewhere. Second, it verifies the amount that the potential tenant or buyer makes.

If a person is seeking a mortgage, they’ll go to banks and other financial institutions to find out if any one of them will approve a loan. This loan allows them to pay for the house or other property. However, the house will technically be owned by the bank until you manage to pay the entire mortgage off, usually over a period of fifteen to thirty years.

When any institution or individual gives another person a loan, they run the risk that the loan will not be repaid. With mortgages, the loan is secured. This means that if the property owner fails to make their mortgage payments, the bank can repossess the house. However, there’s still an inherent level of risk to the bank.

If the bank is going to approve you for a mortgage, they need to be sure that you have enough income to handle the monthly payments. This means verifying that you are employed, and verifying that your paychecks bring in enough for you to budget your payments. This is one of the first steps in the mortgage process, because if you can’t prove your ability to pay, you’re not a risk worth taking.

This type of verification form is generally used in any situation in which a potential lender wants proof that the potential debtor has a steady income. You’ll most commonly see it with the aforementioned mortgage payments and housing loans. However, landlords for rental properties will also often require this form to be sure their tenants can pay their monthly rent expenses.

No matter what type of loan is being discussed, the potential lender will be the person who requests the verification letter. They’ll probably also request other forms of documentation to be presented at the same time. The burden is then on the potential debtor to make sure the employment verification letter is completed quickly and accurately.

If a potential lender wants to make sure that their potential debtor has a steady income and steady employment, they would make the request for the employment verification letter. The following items will be verified:

The current employer of the potential debtor

The title of the debtor’s current occupation

The start date of the employment

The salary or pay per hour

Whether the job is a full-time or part-time job

If people have multiple jobs, they’ll need to file an employment verification form for every job they have.

If a potential lender fails to make the request for employment verification, they might suffer a variety of consequences. If they approve the debtor for a loan or rental agreement, but the debtor does not have a steady income with which to make payments, the lender is likely to lose a great deal of their investment. Some of this can be mitigated by verifying employment through other formats and documents, but it’s easiest to use this verification form to get all the important employee information in one place.

If a lender does request that a verification form be completed and filed, and the debtor chooses not to do so, it’s likely that the lender will not approve their loan application. At the very least, the lender will refuse to go through with the review and decision-making process until the debtor provides all required documentation.

The form should be completed by the potential debtor’s employer, rather than the debtor themselves. In the top section of the form, the employer will need to provide their name or the name of their company. They will also need to give the street address, including the state and zip code.

When the employer reaches the first entry field, they have to enter the employee’s name. They must do this again when they get to the second field. The remaining two spaces are for the employer to enter the dates that the employee began working at their business, along with the name of the business.

The employer should give specifics about the employee, including:

Their name and title

Whether they work part-time or full-time

The total hours worked each week

Wages

Frequency of payments

Whether any bonuses were given, along with the amount of any bonuses

The phone number for the employer

The employer will sign the form, type their name, and note their title.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/employment-income-verification-form.pdf”]

The employer should provide their contact information. At the very least, they should give their phone number. It’s then the lender’s job to follow up with the employer by calling them, discussing the letter, and double checking all the information to verify that it’s correct.

This is not a document issued by the government, although some states do have formatted verification letters that you can use. The main point of the document is to provide information to the lender, not to be filed with a government agency.

The paperwork will vary greatly from case to case. You might be required to provide past employment history, information about your previous place of residence, and a listing of your assets.