843 IRS PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 843 IRS PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 843 IRS PDF with PDFSimpli.

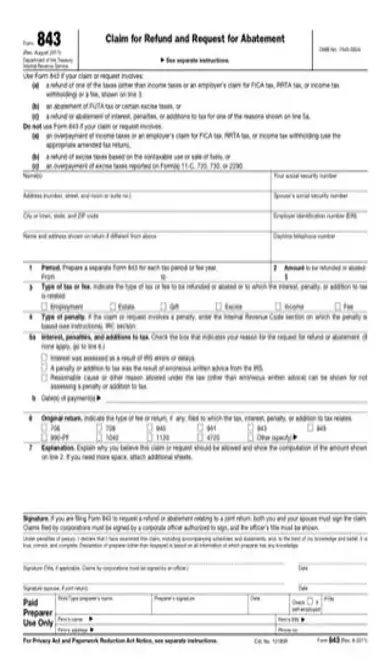

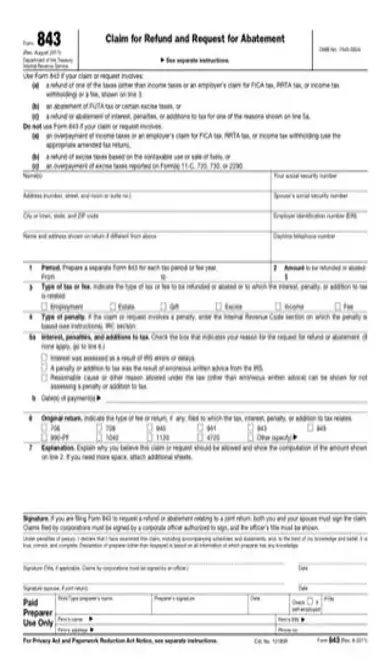

[toc] IRS Form 843 is an official document put out by the Internal Revenue Service. It is a request form used to petition the IRS to erase certain interest, fees, penalties, and taxes that you owe. In most circumstances, interest payments can only be erased if the issue was due to an IRS delay or error.

There are a great deal of reasons that a person might use this form. The purpose is to request that certain taxes, fees, and interest rates be levied. You can use the form to aid you in the following circumstances:

You need to request a tax abatement that is not related to your gift, estate, or income tax

You need to request an abatement due to an IRS delay or error

You need to request an abatement because the IRS provided incorrectly written advice

You need to request an abatement due to a reasonable cause, other than errors caused by the IRS

You wish to request that your paid penalties be refunded

You wish to request that employer-withheld taxes be refunded to you, if the taxes were mistakenly withheld and the employer is unwilling to fix the problem

You need a refund of the IRS penalty for misusing dyed fuel

If you have multiple taxes or fees that you need refunded or waived, you’ll need to use a new Form 843 for every individual aspect. Similarly, if you need refunds over multiple tax years, you’ll need to complete a new form and submit it at the beginning of each relevant fiscal year. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/form-843-irs.pdf”]

People who file this form must meet the following circumstances:

They have paid outstanding fees to the IRS, and they wish to be given a refund

They still owe fees or taxes to the IRS, and they need these fees to be waived

They are making a reasonable request, with legitimate reasoning for why the refund is necessary

Alternatively, the fees are due to an IRS error or payment delay

There are only certain types of tax, fees, penalties, and interest for which you can request an abatement. You cannot request to have your income tax abated, but you can request that the penalties and interest rates associated with your income tax be abated. It’s important to consult the regulations to make sure your request qualifies.

If your request meets the qualifications outlined in the regulations, you can use Form 843. However, the following reasons are ways that you cannot use a Form 843:

Attempting to amend an employment or income tax return that was previously filed

Attempting to claim refunds on lien fees, offer-in-compromise costs, or agreement fees

Requesting that estate or gift taxes be abated

For employers, requesting an abatement or refund of the Railroad Retirement Tax, income tax withholding, or the FICA tax

It’s also possible that you will need to file your request using a form other than the Form 843. If you’ve been sent any official correspondence or notices from the IRS, you should comply with whatever instructions are listed on the document.

If you don’t file this form with the IRS, you won’t be able to have your qualifying fees and taxes abated.

Review the information about when to use Form 843, and when not to use Form 843. This is printed at the top of the form. If you meet the required circumstances, you can proceed to fill the form out.

Provide your name, or the name of both you and your spouse. Give your Social Security number, along with the Social Security number of your spouse. You’ll need to provide your street address and employer identification number, along with a daytime telephone number.

If the address and name shown on your tax return are different from the already-listed name, write the return address and name in the appropriate box.

Note the tax time period that you’re filing for in Box 1. If you’re filing for multiple years, each year needs a separate 843 form. Box 2 is the dollar amount you wish to have abated or refunded. Indicate what type of fee or tax is being abated by checking the appropriate box in Question 3.

If your request involves a tax penalty, you need to find the Internal Revenue Code regulations regarding the penalty. Write the section in Box 4.

Use 5a to indicate the reason you’re making the request, while 5b indicates the date or dates of payments made.

In Box 6, check the type of return or fee that is related to the penalty, interest, or tax you want abated. If none apply, leave the question blank.

Use Box 7 to explain why the IRS should approve your request. You should also provide step-by-step computation of whatever sum was written in Box 2. If a complex computation requires more space, you can attach more sheets to the form.

Sign the form. If you filed a joint return with your spouse, have them sign as well. Write the date the form was completed and signed.

This isn’t the right form for that. A different IRS form should be used to express financial hardship. You might be required to fill out a financial status form instead.

To make an abatement request with Form 843, the IRS must have caused the error. There’s also a provision for reasonable cause under the law.

You’ll need to create a new one for every fee, tax, and expense you want waived. There’s no limit on the number you can file.