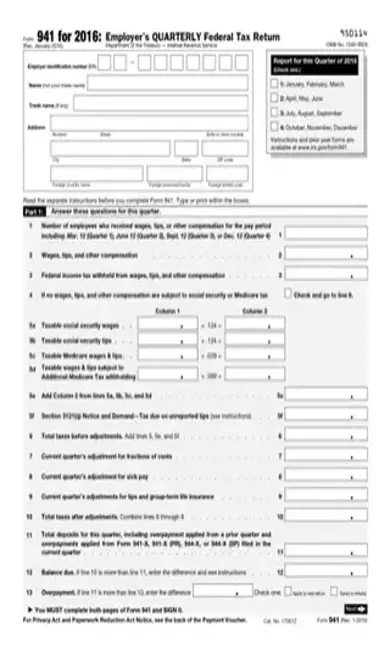

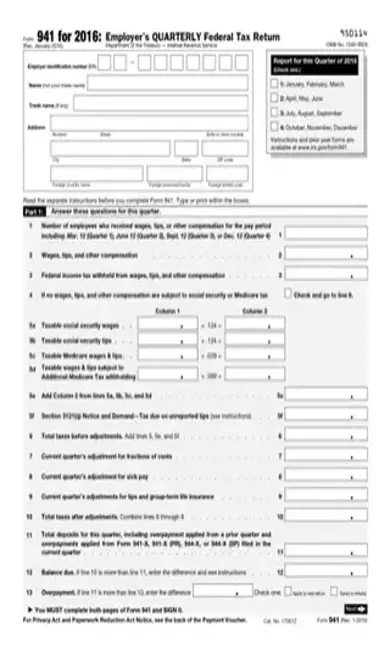

941 2016 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant 941 2016 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant 941 2016 PDF with PDFSimpli.

A Form 941 is also known to be called the Employer’s Quarterly Tax Form. This form is used by employers to report the withholdings of their various employees. The information is collected and given to the IRS so that employment taxes taken from employee pay can be calculated. A variety of different information is needed when determining employment taxes such as social security and Medicare withholdings.

The Form 941 reports quarterly the various federal tax returns required of an employer’s employees. A separate Form 941 is necessary to be filed for each quarter. The quarters that make up the year are as follows: January through March, April through June, July through September, and October through December. The last day of the month corresponds to the appropriate deadline. The form is used to report wages and tips that were paid to the employees and various necessary employment taxes such as social security and federal income taxes.

If you are a person or business that is responsible for paying wages to any employees it is necessary to file an IRS Form 941. It is an employer’s responsibility to withhold federal incomes taxes as well as the various taxes related to a payroll. The Form 941 reports the total amount of tax withholdings.

A Form 941 is filed separately for the various quarters as noted by the IRS. It is important to be considerate of the four separate deadlines for these four quarterly forms. The deadlines occur on the last day of the month at the end of each quarter. These months are April, July, October, and January.

Numerous penalties can occur if a Form 941 is completed at the wrong time or incorrectly. In some cases, individuals can be liable for a 25 percent penalty. Furthermore, if the amounts you report on your quarterly Form 941s do not match the report of your W-2 forms, this could lead to a variety of different issues with the IRS. Be mindful of deadline and accurate in your calculations when it comes to completing the Form 941.

Complete the first box of information accurately and check the correct quarter. – Identify the employer identification number – State trade name if applicable – Mark addresss

Complete Part 1 by marking questions accurately by quarter – Mark all applicable witholdings – Calculate taxable social security wages, social security tips, Medicare wages and tips, and taxable wages. – Calculate the appropriate tax adjustments by quarter – Mark any balances due or overpayments that have occured

Report information about business in Part 3. – Note if business has closed or stopped paying wages – Mark if you are a seasonal employer

Report if the IRS may contact your third-party designee – Mark no if this does not apply – Provide name and contact information by phone if this does apply

Sign the document – Include paid preparer information if applicable

Proofread document

Make sure that both pages of the Form 941 are fully completed.

Take note of the 941-V Payment Voucher – Make sure voucher is correct and complete in order to receive prompt payment of any tax credits – Be mindful that all information is correct to avoid any delays in payment of tax returns

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/form-941-2016.pdf”]

The only exceptions relating to the Form 941 include individuals that are filing for seasonal employees. These employees may not need to be filed for more than a given quarter or will not be paid wages during certain quarters.

The IRS website is an extremely beneficial resource for more information related to the Form 941. Their current service number can be accessed on their website.

A 941 form is a quarterly report that occurs four times throughout the year. In contrast, the 944 must be completed annually rather than quarterly. This would be relevant for employees participating in an annual payroll or those receiving withholdings that total to less than one thousand dollars.