RT-6 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant RT-6 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant RT-6 PDF with PDFSimpli.

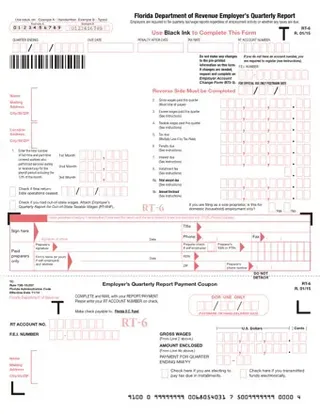

[toc] In the state of Florida, it is the responsibility of the Florida Department of Revenue to collect reemployment tax. If you are an employer, you can register online with Florida’s DOR website. Employers are responsible for the payment of reemployment tax when they have quarterly payrolls of at least $1,500 per calendar year, or if they employ one or more people per day over any 20 weeks of the calendar year. RT-6 is the Employer’s Quarterly Report, which is how an employer pays their reemployment taxes.

The majority of Florida-based employers must file their reemployment taxes by using the Employer’s Quarterly Report. As the name implies, this form is filed every quarter. Florida encourages all employers to file electronically, but if you employ more than nine employees during a quarter of the previous fiscal year, you’re required to complete this PDF and submit it electronically.

If an employer files their report late, they’ll be subject to flat late fees in addition to interest payments. The exact interest rates can be found in Florida’s Tax Information Publications. These documents are updated semiannually with new taxation information.

All tax payments must be made electronically, no matter how many employees you have.

This tax form must be used by any Florida employer who has at least one employee. It’s important to note that the form is about Florida-based businesses that pay Florida taxes. If the employer lives outside of Florida, but the business operates in Florida, the tax form must still be submitted. The same is true for out-of-state employees who work for a Florida company.

The form has an official due date. After every calendar quarter concludes, the form must be filed by the first day of the following month. As a quarterly form, it needs to be filed four times a year.

You’re legally required to use this tax form if you employ other people in your Florida-based company. Failure to do so will result in increasingly large legal fees and interest payments.

If you file late, you will face a penalty of $25 for every month that the report is late. Additionally, the late payments will incur an interest rate. As previously mentioned, you’ll find the most recent information about interest payments in the Florida Tax Information Publications. These documents receive their semiannual updates on July 1 and January 1.

If you’re an employer with more than nine employees, failure to file the form will result in a penalty of $50. You’ll also have to pay an additional $1 for every employee you have. If you don’t make your electronic payment, you’ll have to pay a $50 per remittance.

The employer is responsible for taking down the required information.

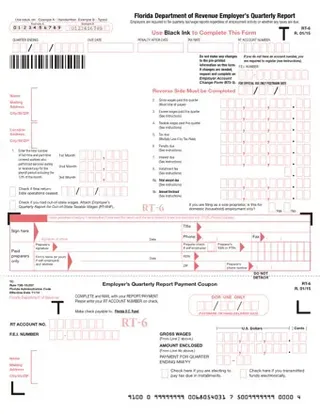

Under “Quarter Ending,” they should record the date that this particular fiscal quarter ends, including the year. They should also record the due date, the potential penalty they’ll face if they file after the due date, and the tax rate they’re paying at.

In the RT Account Number and FEI number sections, you’ll need to give your registered account numbers. If you don’t have an account number yet, you need to register before you can complete the form.

In Box 1, you need to write the total number of both part-time and full-time workers who received pay for their services. Divide the numbers up by month, with “1st Month” indicating the first month of the quarter, etc.

If this is your last report, you should check the date that your business closed. If there were any out-of-state wages, you should also check the appropriate box.

In Box 2, you must record the total gross wages paid during the quarter. The numbers must match up with the totals from all pages on the form. Box 3 is for excess wages paid during the quarter, Box 4 is for the quarter’s taxable wages, and Box 5 is for the amount of tax due. To find the tax due, multiply your Box 4 amount by your tax rate.

If there’s any late penalty or interest due, you’ll need to record the amounts in Boxes 6 and 7. Any installment fees are covered in Box 8. You’ll add up the tax amount, penalty and interest amounts, and installment fees to get the total amount due, which is recorded in Box 9a. Box 9b will explain what amount is enclosed with the tax form.

Sign the bottom of the form. Give the phone number you can be found at, your official title within the company, and a fax number if you have one. If a paid preparer is taking care of the form, they’ll also need to sign the form and provide their contact information.

In Box 10, you have to record the SSNs of every employee. Print their name beside it in Box 11. Their gross wages should go in Box 12a, while their taxable wages go in Box 12b. The added total of everyone’s taxable wages should be the same as the taxable wage amount noted on the first page.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/form-rt-6.pdf”]

An employee’s SSN is used as their main identification by the state of Florida. It’s used for auditing purposes and is confidential.

You’ll need to pay your applicable late fee and any interest, as well as the overdue amount.

Yes. The employer’s signature will still be required, but the paid prepare can sign with their name, the name of their firm, and their basic contact info.