printable promissory note for personal loPDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant printable promissory note for personal loPDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant printable promissory note for personal loPDF with PDFSimpli.

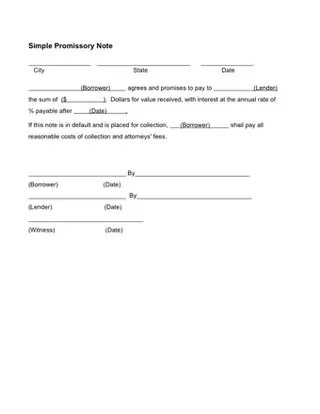

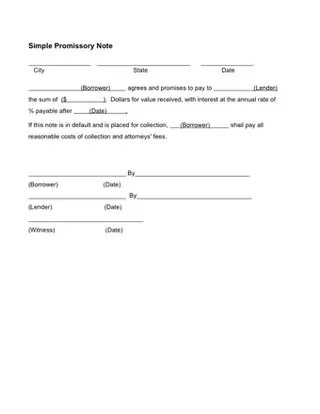

[toc] A promissory note for personal loan is a written documentation of an agreement between two competent parties. The parties can be individual or partners. The document will contain who the agreement is between, the terms of the agreement, and the length of the contract. The agreement can be detailed or very simple as long as both parties have a clear understanding of what is to be expected, and using a printable contract is the best way to achieve that using a systematic line-by-line process.

One of the reasons a promissory note PDF is used is to define the amount, payment schedule, and interest on the personal loan. The loan amount is the total original amount the borrower is getting before any interest. The payment schedule can be monthly, quarterly, or any length of time that is suitable to both people. The interest on the loan is also a negotiable figure. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/free-printable-promissory-note-for-personal-loan.pdf”] The promissory note PDF contract is also used to identify what date the payments are due and what date the payments are late. The contract can go over what are the penalties for a late payment or nonpayment. The document should go over prepayment penalties. A prepayment penalty is a penalty the borrower pays if the loan is paid off earlier than expected. A lender may want to add a prepayment penalty because they are expecting the total amount of the loan plus interest, and if the borrower pays it off early, the lender may still receive some or all of the interest, depending on the contract. The Nasdaq recommends borrowers look for the phrase no prepayment penalty, and if it is not on the contract, research and question it before signing. In some states, a prepayment penalty is illegal.

Someone that might use a printable promissory note is an individual or couple who cannot qualify for traditional financing because of bankruptcy, divorce, or tax issues. Persons that have undocumented income are candidates for personal loans. Often times, these people have steady monthly income or make large sums of money every few months. They are comfortably able to make a reimbursement payment to a personal loan, but they do not necessarily qualify or want traditional financing.

Family members and friends may use a promissory note PDF. Using the contract makes the agreement clear, and it should help catch any misunderstanding before they become family matters.

The Federal Reserve Graph shows the growth and value of family loans starting from 2013 to 2016. A family loan can be between parents and children, brothers and sisters, or other relations.

A promissory note contract should be filled out and signed before any money is exchanged hands. You should use the PDF when any amount of money is loaned for any amount of time. Using the document can be very helpful even if the loan is for a month or a few hundred dollars because smaller loans maybe thought of as gifts by the other party. To make sure there is a clear understanding that a certain amount is indeed a loan a signed personal loan document is necessary.

Any lender or borrower can use a promissory note to clarify terms and conditions like:

Who pays legal costs if the borrower defaults

What actions can be taken if the borrower defaults

Witnesses

Legal Depot says a witness is anyone who does not have monetary or other interests in the agreement. Furthermore, a witness does not have to understand the documents. The witness is there to watch the parties sign the loan agreement. In the event of a trial, the witness can be called to testify.

For the borrower, not having a personal loan contract could mean a damaged credit score. If there is any misunderstandings and the lender believes there is money owed on a verbal or handshake agreement, the lender may pursue legal actions against you. Debt.org explains that if a borrower is marked as having defaulted on a loan a collection agency might pursue the borrower. In short, if there is a written contract in place and the borrower can show they are indeed not in default, it will save their credit.

If a person making the personal loan chooses not to use the PDF, they may have no legal grounds to stand on if the borrower never returns the money. Entrepreneur recommends getting the agreement in writing and attaching a payment plan to the contract. Go over the payment plan with the borrower to make sure they understand what is to be expected. Have them sign the plan also. In the event you have to go to court, you will have the contract and the signed payment plan to help make your case.

There are several steps involved in filling out a promissory note for a personal loan. Some of the basic requirements are:

The dollar amount of the loan

What day the payments start

Length the agreement

Interest rate and/or a balloon payments

Responsible parties

What happens in the event the payment is not made

Almost anyone can enter into a personal loan agreement. HG.org Legal Resources notes that minors can enter into a contract, but the contract may not be enforceable. A minor may be able to void the agreement. People who are deemed mentally incapable can also enter into the loan agreement, but again the contract may not be enforceable.

The dollar amount can be negotiated between the parties. The lender will want to make sure the borrower has the means to pay back the loan, and the borrower will want to understand the terms and conditions of the payment. The borrower should use a loan calculator to calculate and see the total cost of the loan.

If a borrower stops making payments on your personal loan, your recourse is spelled out in the PDF agreement. It may involve going to court, mediation, arbitration, or a combination of these settlement actions. The contract should spell out who pays for legal fees incurred by the default.