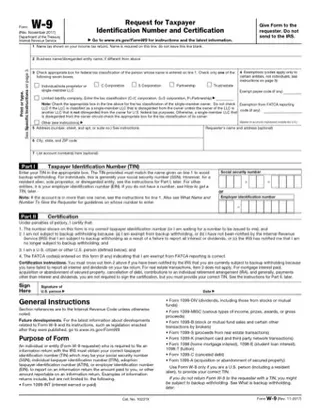

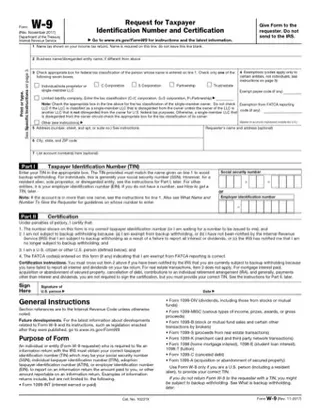

W9 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant W9 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant W9 PDF with PDFSimpli.

The Form W-9 is an official document of the U.S. Internal Revenue Service (IRS), and it is used by the tax agency to confirm a person’s name, address and Taxpayer Identification Number (TIN) for income-generating or income-loss purposes. A TIN is either your Social Security Number or your Employer Identification Number (EIN, which is also available from the IRS). An entity that is required to send out a Form 1099 (of which there are several types), must obtain your correct W-9 information to report any earnings or losses that will affect your taxable income.

A Form W-9 is a record used to confirm a person’s personal information, such as name, address and Taxpayer Identification Number (TIN), for tax purposes. Most U.S. citizens and some noncitizens use their Social Security Number (SSN) as their TIN. Other persons, such as independent contractors, can get a free Employer Identification Number (EIN) from the IRS. This is a substitute for using their SSN. Legal resident aliens working in the United States must obtain an Individual Taxpayer Identification Number (ITIN), also free from the IRS. This works in place of an SSN. In all cases, a W-9 is needed to receive a Form 1099, which is income information needed to complete yearly taxes.

In global partnerships, a W-9 form might be required for their U.S. partners to allocate tax liability in the partnership appropriately.

Form W-9 is used when an entity is required to collect an individual’s personal information and Taxpayer Identification Number. This information might be required for various reasons.

The Form W-9 generally applies to these circumstances:

An individual earning non-employer income who either is a United States citizen or is a legal resident.

A corporation, partnership, association or company organized or created within the United States or under United States laws.

Any non-foreign estates.

Some domestic trusts.

You fill in and submit a Form W-9 to an individual, corporation or partnership that will pay you $600 or more for your services during the calendar year. This is not related to traditional employment. The individual, corporation or partnership then uses your Form W-9 to send you a Form 1099 early the next year. You then use the information on Form 1099 to complete your yearly tax return. This is why there are fines for not properly submitting a Form W-9.

Most of the time, a person uses their SSN as their TIN. U.S. citizens who are independent contractors can apply for a free EIN from the IRS. They then use this EIN instead of their SSN on the W-9. However, individuals lawfully residing and working in the United States but who do not meet the eligibility requirements for obtaining an SSN must use Form W-7 to apply to the IRS for an Individual Taxpayer Identification Number (ITIN). These individuals use their ITIN in the SSN section of the Form W-9.

In most cases, a business or individual will use a Form W-9 to request the taxpayer information of a person they hire as an independent contractor. When a business receives services from an independent contractor and pays that contractor at least $600 per year, these payments must be reported to the IRS using a 1099-MISC form. Businesses use the completed Form W-9 to issue the 1099-MISC form.

Failure to submit a Form W-9 when required can lead to fines from the IRS. This is because a Form 1099 cannot then be issued for tax-filling purposes.

Write your full legal name on Line 1. If you own a business under a different name or as a DBA (Doing Business As), add the name on Line 2.

In Section 3a, check the appropriate box regarding the type of business you own.

In Section 4, note any tax exemptions you can claim.

On Lines 5 through 7, insert your address/city and zip code.

There is space for optional information related to account numbers and the requestor’s name and address.

That’s actually all there is to the form completion process. The fill-in part of the form is easy. The bulk of the form includes general instructions and explains the sections of Form W-9. When you send your Form W-9 to an individual, corporation or partnership, you only need to submit page

If a business or an individual hires you as a freelancer during the year and pays you at least $600 for the year for services rendered, the business or individual has a legal obligation to report the payment to the IRS. They do so using the 1099-MISC form. They get this information from your Form W-9, which you filled out and submitted to the business or individual.

It’s best to file this form well before tax season and even at the start of any work if it will pay more than $600 for the year. That way, a business or individual can send out their 1099-MISC to you promptly. You then use this dollar amount and other information on the 1099 to file your taxes.

If they did business with an independent contractor who has a TIN, then yes, they do. They should also ensure they fill out any other required documentation for foreign tax filing.