IRS 940 2016 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS 940 2016 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS 940 2016 PDF with PDFSimpli.

[toc] If you employ anyone at your company, you will be responsible for the tax forms related to your employees. Some of these tax forms involve federal unemployment taxes, otherwise known as FUTA taxes. A Form 940 is the document you’ll use to report your current tax liability to the IRS.

The majority of employers have a responsibility to pay federal unemployment taxes. FUTA taxes are used to provide unemployment funds when an employee loses their job. You don’t need to withhold employee’s wages to pay the FUTA tax. However, you will use the wages of each employee to calculate the amount of money you owe.

The standard rate of FUTA tax is 6% on each employee’s first $7,000 in earnings. The maximum amount you can pay for every employee each year is $420. With that said, the majority of states are given tax credits with a rate of up to 5.4%. Employers in these states will only need to pay 0.6% of the employee’s first $7,000, rather than the full tax percentage.

Form 940 is the form you’ll use to report your tax liability to the IRS.

A Form 940 must be filed when you meet either of the following qualifications:

An employee was paid at least $1,500 in wages over any period of the standard calendar year

Any employee, regardless of whether they were full-time or part-time, worked for you during at least 20 weeks of the calendar year

PDFSimpli is the best solution for filling out documents, editing & annotating PDFs and converting document filetypes. Don't delay, start today.

These 20 weeks don’t need to be consecutive. If you generally have employees, but these employees weren’t paid over the calendar year, you still have a responsibility to file the Form 940. You will just need to make a statement explaining that no employee payments were made.

The 2016 form should be filed with your 2016 taxes. In general, you’ll file this form with the rest of your business tax documentation during tax season.

There are certain businesses that will have to follow specially outlined rules regarding their FUTA tax liability. Outlying circumstances will be determined by the type of workers that the company employs. In particular, there are conditions regarding agricultural employees.

If you employ agricultural employees, you’re only required to file this form if you paid cash wages of at least $20,000 to farmworkers. Alternatively, you’ll need to file the form if there were more than 9 farmworkers employed during some time of the day for at least 20 weeks. Again, the 20 weeks do not need to be consecutive.

It’s important to note that not every employer has a responsibility to file Form 940. If an organization is tax-exempt, they won’t need to pay. Indian tribal governments are also not required to pay as long as they participate in the unemployment systems for their state. Government entities also aren’t required to pay FUTA tax.

If you’re one of the businesses required to file this form, you might be subject to hefty late fees by the IRS. This is the main form you use to calculate and file your FUTA tax. Failing to use it means that your business could be in hot water with regards to taxes.

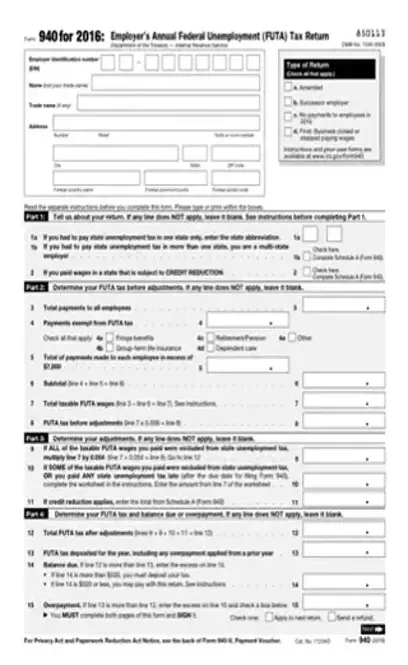

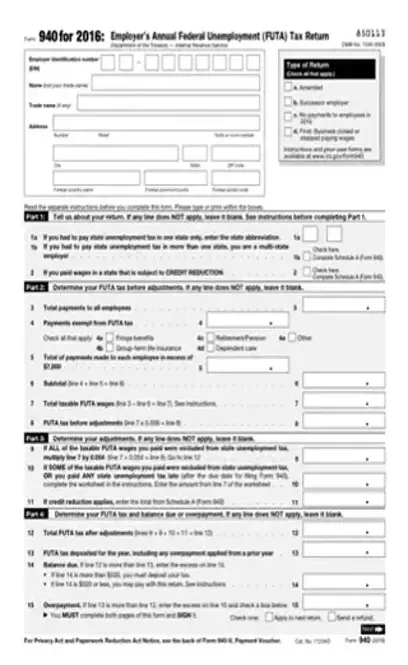

Use the top of the form to give your basic information. You’ll need to provide your employer identification number, any trade name you have, your legal name, and your address.

In Part 1, you’ll need to tell the IRS about your tax return. Any lines that don’t apply to your situation should be left blank. Part 2 is where you’ll calculate your initial FUTA tax. You’ll do this by recording the total payments you made to all your employees, along with any payments that are exempt from the FUTA tax. The total payments that you made to every employee in an excess of $7,000 will be recorded.

You’ll use these numbers to calculate your total taxable FUTA wages, which will give you your initial FUTA estimate. In Part 3, you’ll determine whether you have any adjustments. In Part 4, you’ll determine what balance is due or whether any overpayment has occurred. Any lines that don’t apply should be left blank.

Part 5 only needs to be filled out by certain applicants. If the amount recorded on line 12 exceeds $500, you should use this part of the form to report your total tax liability for each quarter. If you don’t meet this requirement, you can skip this part and go to Part 6.

In Part 6, you’ll give the contact information of a third-party designee. Part 7 is where you’ll sign the document, date it, and give your daytime phone number. If a paid preparer fills out the form, they’ll need to give their information on the bottom of the form.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/irs-940-form-2016.pdf”]

After you finish filling out the PDF form, you can either print it out and mail it to the IRS, or you can submit it online. Electronic filing must be done through a third party and also requires a fee payment.

Yes. Some businesses will pay the entire balance due at once. Others will make quarterly payments instead. Make sure you understand what your responsibility is.

You only need to file the form if you meet the eligibility requirements. This means that tax-exempt organizations don’t need to worry about it.