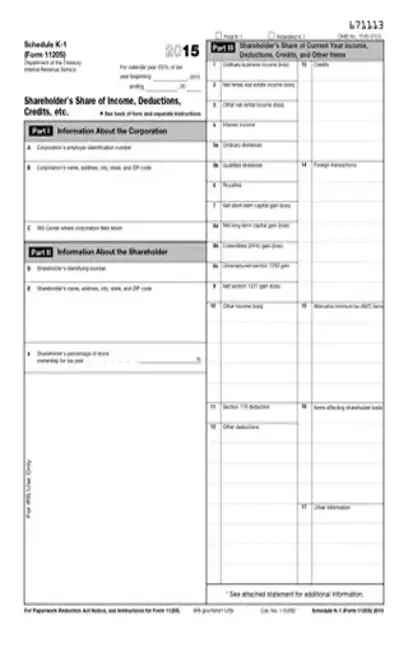

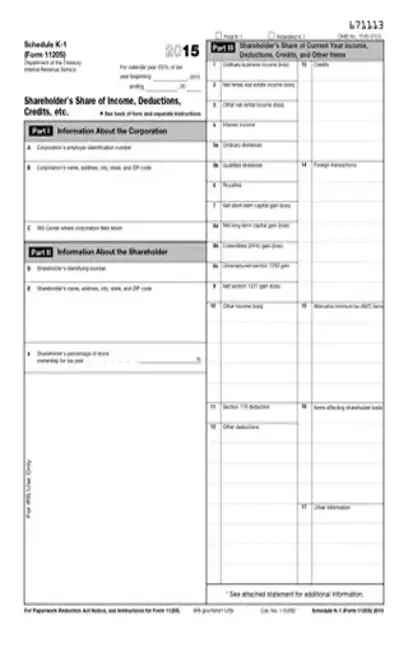

irs form 1120s 2015 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant irs form 1120s 2015 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant irs form 1120s 2015 with PDFSimpli.

IRS Form 1120s 2015 is the official form used by companies classified as S corporations to file taxes. Filing Form 1120s provides these business structures with certain tax privileges and benefits not available to normal corporations. If you need help completing your own 1120s, you can find important filing information below.

IRS form 1120s 2015 is used by the Internal Revenue Service to decide how much loss and profit should be assigned to each shareholder of an S corporation. The IRS allocates these losses and profits in percentages to shareholders, and if a company sells any of its holdings or purchases additional shares during the tax year, the amount will be prorated. If there is no change throughout the year, a much simpler calculation technique will be employed. The IRS uses the information regarding a company’s losses, income, credit, and deductions to decide how much the company owes in taxes. By filing form 1120s, S corporations can also avoid the burden of being taxed twice by the IRS. Normal corporations are considered separate entities, and as such, the IRS requires them to file taxes on the revenue they earn, in addition to the dividend payments they make to shareholders. This is known as double taxation, and when the IRS receives Form 1120s from a corporation, it will not subject the corporation to this burden. Filing the form also limits the amount of tax liability each shareholder must assume. If one shareholder fails to pay taxes, the others, as well as the corporate structure, will not be penalized.

To use IRS Form 1120s, a company must be defined as an S corporation with the IRS. Companies must meet the following requirements to gain S corporation status: ¢ Be headquartered in the United States ¢ Have 100 or fewer invested shareholders ¢ Only have one class of stock ¢ Only have allowable shareholders, such as individuals, estates, and trusts; this does not include non-citizen shareholders, partnerships, or corporations ¢ Not be a type of company ineligible for S corporation status If a business meets all the requirements listed above, it may utilize IRS Form 1120s when filing taxes. It is also important to note insurance companies, international sales corporations, and certain types of financial institutions are prohibited from filing taxes as an S corporation. S corporations are not required to pay federal taxes at the level of the company, which allows them to save a significant amount of money. If a company qualifies as an S corporation, it may also transfer certain assets and make changes to property ownership without tax consequences. If the dividends of a company exceed the value of its stocks, it may classify itself as an S corporation as long as it meets the previously mentioned requirements. These allowances allow the owners of S corporations to reduce their self-employment tax liability to some degree.

S corporations, like other corporate structures, are required to file taxes by a certain date each year. The normal due date for IRS Form 1120s is March 15 for all S corporations. By this date, corporations must pay any taxes due, as well as any penalty amounts and interest accrued throughout the year. The IRS recommends giving each shareholder a copy of the form, and even if a company files for an extension, it will still need to pay what is due by March 15. If an S corporation fails to pay what it owes by this date, the balance due will be subject to additional late fees and penalties. Running an S corporation can be time-consuming, and many shareholders automatically request a six-month extension. The extension allows S corporations to file their 1120s forms by September 15 as opposed to the normal March 15 date. To apply for an extension, companies must complete and submit IRS Form 7004 by the initial March 15 date. To avoid penalties and late fees, the IRS recommends companies estimate their tax liability and make a payment when submitting their tax forms in March. If they do not make an estimated payment, they will have to pay six months’ worth of late fees and penalties when they file in September.

If an S corporation fails to use IRS Form 1120s, it will be subjected to a variety of consequences. Filing the form gives shareholders immunity from double taxation and limited tax liability, and if the company does not file as an S corporation, it will not enjoy such benefits. Before filing, S corporations should always be sure to select the correct form to avoid any potential tax problems in the future. As with any taxpayer, failing to pay taxes in a timely and accurate fashion can result in a variety of legal and financial issues. Late fees and penalties are added to tax balances each month they are left unpaid, and over time, they can become so great companies are unable to pay them. If this occurs, the IRS has the right to take what is owed from the profits and assets of the company until the debt is satisfied. To prevent this from occurring, many companies are forced to hire expensive lawyers and spend long periods of time negotiating with the IRS. If the IRS suspects an S corporation is intentionally failing to file taxes in an effort to avoid paying taxes, the shareholders can be taken to court for tax evasion. Tax evasion is a criminal offense which can result in federal prison time if a person is found guilty.

To complete IRS Form 1120s, you must download the appropriate form from the tax year 2015. This form can be found online or by contacting the IRS directly. Taxpayers need the following information about their S corporation to complete the form:

Personal and business information

Employer identification number

Stock information

Accounting information regarding assets, debt, credit, profits, and losses

Date of incorporation As previously mentioned, S corporation stockholders wishing to apply for an extension should also file Form 7004 when filing 1120s. Form 1120s may be sent directly to the IRS via mail or filers may elect to utilize an electronic filing service (more convenient).

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/irs-form-1120s-2015.pdf”]

Sources: https://www.irs.gov/forms-pubs/about-form-1120s https://www.investopedia.com/terms/f/form-1120s.asp

Yes, to amend your S corporation tax return, file Form 1120x along with the original Form 1120s. Check box H4 on the original return prior to refiling.

A 2015 version of IRS Form 1120s can be downloaded from the official IRS website. Click on forms and instructions, and choose the year you wish to download forms for.