IRS 2159 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS 2159 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS 2159 PDF with PDFSimpli.

[toc] A payroll deduction agreement is established when an individual taxpayer finds themselves unable to pay their taxes. The IRS will then enter an installment agreement with the individual, accepting extra monthly tax payments until the debt is fully paid. The debt will also be forgiven if the statute of limitations on the taxes expires. Payroll deduction is one of three main ways the IRS can collect back taxes, and it’s outlined in form 2159.

Sometimes, a taxpayer will be unable to pay all of their taxes when those taxes are due. This can happen when a person miscalculates their taxes or doesn’t factor in all relevant taxes. Regardless of the reason, it’s important to get paid up with the IRS. To do so, the IRS will structure an installment agreement, in which the individual will pay a small amount of their back taxes each month. The agreement terminates when the amount is fully paid or there’s an expiration of the statute of limitations.

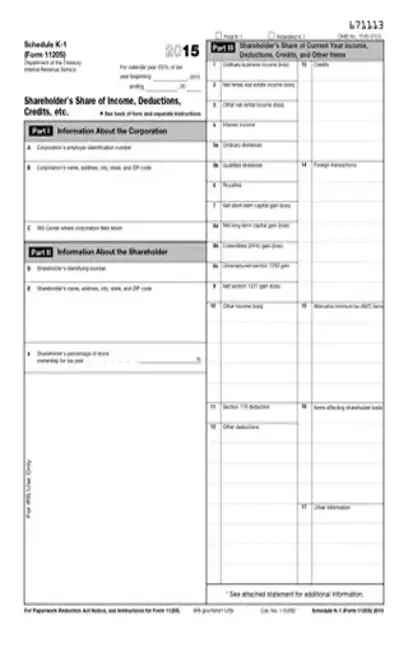

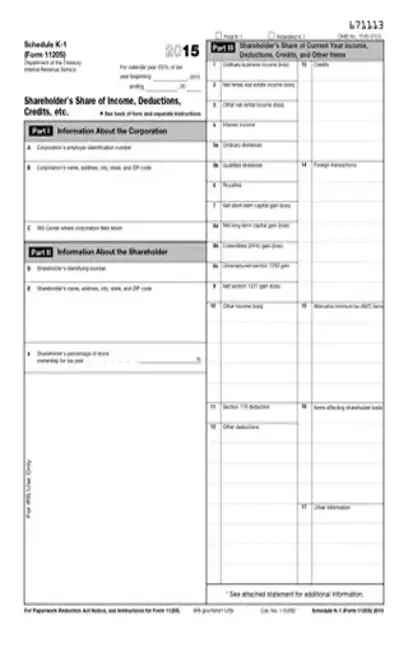

An installation agreement can be paid in three ways: by check, direct debit, or payroll deduction. If the taxpayer chooses to use payroll deduction, they’ll need to complete Form 2159. This form is made up of three parts. One copy is returned to the IRS, while one copy is for the taxpayer’s employer, and one is for the taxpayer themselves.

While every copy of the document is the same, the associated instructions on the second page are different.

You’d use a Form 2159 if you meet the following circumstances:

You have back taxes that you were unable to pay the IRS at tax time

You have entered into an installment agreement with the IRS to pay your back taxes

You have chosen to have the sum deducted from your payroll rather than taken from your bank account

You won’t be the only one filling out the form, though. Your employer will also be responsible for parts of it. The employer will be informed of the installment amount to be withheld monthly. This will be added to the normal amount withheld for the current year’s taxes. According to the employer instructional page, the employer is responsible for paying this amount until the IRS notifies them to stop.

There are a few potential drawbacks to using the form. Legally, the form includes an “increase/decrease” clause, which allows the IRS to increase your monthly payment without your consent. You might also run into trouble with the “additional terms” box. Because this field must be completed by the IRS, any additional terms that are added will not benefit the taxpayer.

That said, payroll deduction is a good method to use if you want to mitigate potential hassle. Your employer is responsible for the payments rather than you. You don’t need to calculate your monthly installment, worry about writing checks on time, or accidentally spend money you don’t have. Since the money never touches your bank account, you never have a chance to miss it.

If you owe back taxes, you do have other options besides the Form 2159. One is to write a monthly check to the IRS with your installment amount. Another is to have the IRS automatically take your installment payments from your bank account, similar to automatic bill pay procedures.

You must choose one of these three methods if you have back taxes. The IRS will insist on an installment agreement plan. If you refuse to pay, you could face hefty fines and even jail time.

Write the name and address of the taxpayer’s employer on the top line, with the taxpayer’s name and address on the right. Fill out the relevant boxes with contact information, employee identification numbers, and Social Security numbers.

The employer must fill out the “Employer” section by checking off the payment frequency and providing a signature. They should also include the types of taxes and relevant tax periods.

If the taxpayer is unable to make debit-based payments, they should check the box indicating so. The taxpayer should also note the amount owed as of the starting date.

The taxpayer must check off the box noting the frequency with which they’re paid. They should note the amount they agree to have deducted, and the date that these payments will start.

If the taxpayer intends for the payments to increase or decrease at any point in the future, they should note so.

The taxpayer should sign the bottom of the document.

The IRS is responsible for filling out other required fields.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/irs-form-1120s-2015.pdf”]

The taxpayer’s employer will complete the employer information section. Then, they’ll file the form with the IRS. As long as the taxpayer completes their portion of the form, they don’t need to worry about filing it.

The installment plan will vary depending on your income, ability to pay, and total amount owed. If you owe a large amount of money, you’ll continue making installment payments until after the expiration of the statute of limitations.

You should keep an eye on your wage stubs to see how much is being withheld each period. When you’ve paid the full balance, the IRS will inform your employer that your obligation has ended.