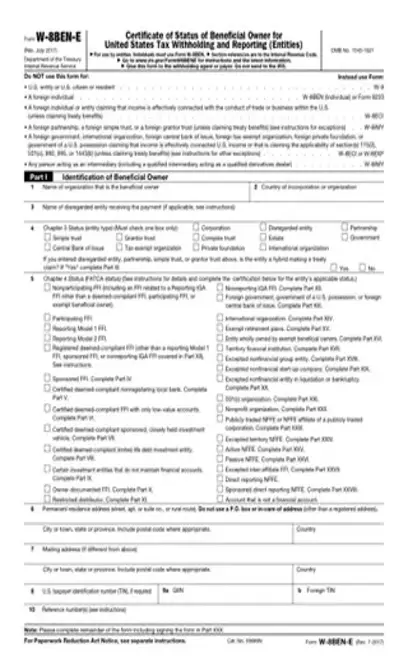

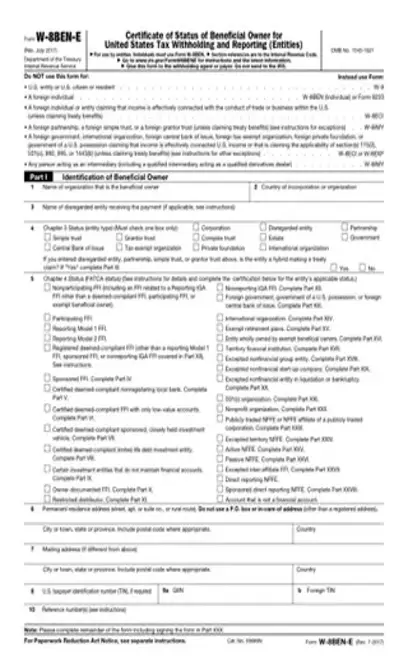

IRS W 8BEN E PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS W 8BEN E PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS W 8BEN E PDF with PDFSimpli.

[toc] After new compliance requirements were introduced by Congress, with legislators passing the FACTA (Foreign Account Tax Compliance Act) bill, the IRS has created a new form. Form W-8BEN-E is a tax form that covers United States taxpayers who do business with foreign parties. The form seeks to document foreign entity status for United States income taxes, benefits related to tax treaties, and FACTA compliance.

There are four main reasons to file the Form W-8BEN-E:

The establishment of non-United States status

The claiming of a beneficial owner status

The ability to claim exemption from United States withholding tax, or reduction in tax rates, citing Chapter 3 of the old withholding laws for foreign tax

Identification of the foreign entity’s category according to FACTA Chapter 4

If any foreign entity engages in a service transaction with a United States taxpayer, that entity has a responsibility to give the taxpayer a complete Form W-8BEN-E. Filling out the form is the responsibility of the foreign party, not the taxpayer.

The form will determine whether that particular entity will be subject to the normal 30% withholding rate on payments made to foreign entities. Additionally, the complete form determines whether the foreign entity meets any eligibility requirements for reduced withholdings. Such reductions would be related to any applicable tax treaties.

For United States taxpayers who do business with foreign parties, the revised Form W-8BEN is more appropriate.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/irs-form-w-8ben-e.pdf”]The form concerns service transactions made between United States taxpayers and foreign entities. Product-related transactions are not part of the form. The “E” in the form stands for “entity,” referring to the foreign party. It is the responsibility of the foreign party to fill out the form and present it to the taxpayer. The taxpayer, meanwhile, is responsible for filling out IRS Form W-8BEN.

This is one of the most complex forms the IRS has put out, with eight pages encompassing 30 separate sections. However, the foreign entity will not be required to complete all 30 sections. Instead, they must complete whichever sections are relevant to its services. Regardless of this, all foreign business owners are required to fill out both Part I, the Identification of Beneficial Owner, and Part XXX, Certification.

The form should be used in the following circumstances:

A transaction was done between a United States taxpayer and a foreign entity or individual

The transaction involved services rendered, rather than products exchanged

The U.S. taxpayer meets eligibility requirements to fill out a Form W-8BEN

It’s important to note that this particular form is only meant to be completed by foreign entities. United States taxpayers will continue to use the same W-8BEN form to report their transactions with foreign individuals. This policy was implemented as of 2015 and continues moving forward.

If a party fails to provide the form, there are serious potential ramifications. The entity may lose access to tax treaty benefits. They may also be determined to be noncompliant with FACTA regulations, which means that any United States based payments might be subject to a high withholding tax.

As previously mentioned, the form is 8 pages long and has thirty separate sections. Foreign entities should adhere to the instructions provided and only complete the sections that are relevant to their business.

All foreign entities must complete Part I and Part XXX. Part I is designed to identify the foreign entity as the beneficial owner. They will be required to name their organization, their country of incorporation, and the name of any disregarded entity receiving payments. They’ll also need to choose their entity type according to the definitions provided in the instructions. The instructions will give additional information on FACTA status, which the entity must report.

Part XXX is the last portion of the form. The entity must review the terms of certification and provide their signature, their printed name, and the date. They must also check that they have the ability to sign for whatever organization was previously identified.

The entity should go through each section of the form and fill out the ones that apply to their business. The relevant sections will vary widely depending on the services provided, the tax treaties at play, the amount of money exchanged, and other variable factors.

After the entity delivers the form to the taxpayer, the taxpayer should double check that all information is recorded correctly.

FACTA is an amendment made to the FCRA, or Fair Credit Reporting Act. The main goal of the addendum was to offer protections against identity theft. The Act has requirements regarding privacy and information disposal, and it places limitations on the sharing of consumer information. Foreign businesses must be FACTA-compliant to continue receiving tax treaty benefits.

The entity should not send the form directly to the IRS. Instead, they should deliver it to the party requesting it. This party is considered the withholding agent.

The withholding agent will use the form to determine whether certain tax amounts should be withheld from payment. The tax withholdings will vary depending on the entity, country of origin, and any tax treaties currently in place.