NJ Reg PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant NJ Reg PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant NJ Reg PDF with PDFSimpli.

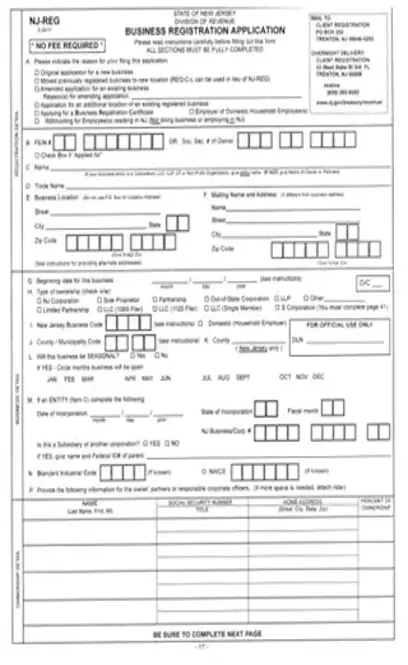

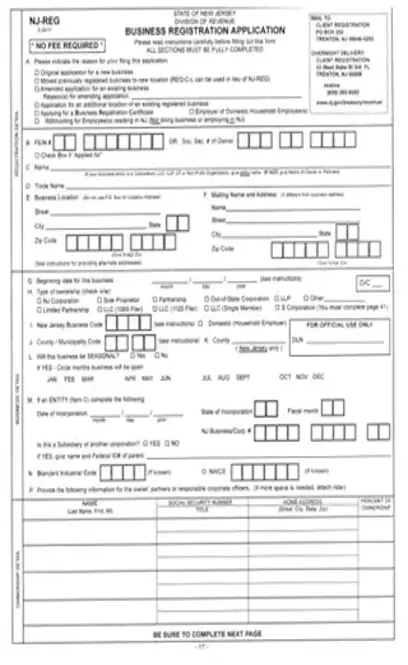

[toc] When you operate a business in the state of New Jersey, the NJ-REG form is an essential document. This document streamlines the process of business registration, which allows your business to legally operate in the state. After registration is complete, you’ll be able to pay taxes and take responsibility for any other liabilities.

The NJ-REG form is the official name for the business registration form in New Jersey. People who plan to operate businesses in New Jersey are legally obligated to fill this out. Registering a business used to be a pain, but the NJ-REG form aims to mitigate some of the hassle. Rather than needing to fill out multiple forms with different state and federal agencies, you can use this one form to get your registration needs out of the way.

The NJ-REG form must be filled out by all businesses intending to operate in the state of New Jersey. It is the responsibility of the business owner to make sure that the form is filled and filed before the business begins to operate. A person would also fill out a NJ-REG form if their business is outside New Jersey, but they need to withhold taxes for employees who live in New Jersey. These employees would be paying New Jersey state income taxes, and therefore the taxation part of the NJ-REG form is relevant.

Sole proprietors are only required to fill out pages 17 through 19 of the NJ-REG packet. However, if you have employees, you will be required to fill out the other forms included in the packet. Page 29 has the NJ New Hire Reporting form. For people whose business is a partnership or a corporation, you’ll also be required to fill out the relevant questions found on pages 23 and 24 of the packet. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/nj-reg.pdf”]

You will need to file the form in the following circumstances:

You are filing an original application for a business that is just starting

Your business has been previously registered, but you moved to a new location

You need to amend your application for an already-existing business

You are applying to add a location to an already-existing business

You are applying to receive a Business Registration Certificate

You employ domestic household employees

You are withholding tax income for employees that reside in New Jersey

As you can see, there are multiple circumstances besides registration of a new business. If your previously-registered business was registered with New Jersey rather than another state, you can fill out the REG-C-L form instead. If you need to amend your application, you’ll be asked to provide the reason for the amendment.

The NJ-REG form is a legally binding document. This packet is the government’s way of consolidating and streamlining the business registration process. If you do not register your business, then you don’t have the legal means to pay taxes.

If your business is a sole proprietorship, you might not need to register. People have a Constitutionally-protected right to make contracts with others on an individual basis. However, if you have employees other than yourself, or you want to separate your business income from your own income, registration is a must.

There are benefits to registration. You’ll be able to make out checks in the name of your business. If you make purchases related to the business, you can also use them as tax-deductible writeoffs.

Download the PDF.

Check off your reason for filing the application.

Fill out the information about registration details, business details, and ownership details, located on page 17.

Answer each of the questions on pages 18 and 19, then sign and date the form.

If you need to complete any other parts of the packet, do so.

Submit the form online.

This is a type of certificate that serves two main purposes. If you’re a public contractor, the certificate proves that you have legally registered your business with the Division of Revenue in New Jersey. If you’re an unincorporated contractor doing construction in NJ, you also need this certificate.

The NJ-REG form is free to fill out. However, all domestic and foreign profit businesses will be required to pay a filing fee of $125. This is also the cost for foreign non-profit institutions. If you’re filing as a domestic non-profit, the filing fee is $75.

This depends on the specifics of your business. If you’re functioning as the sole proprietor of a company, you only need to complete pages 17 through 19 of the packet. However, if you are going to employ anyone else, you need to fill out additional portions of the packet. The same is true if you intend to register as a corporation or partnership rather than a sole proprietorship.