Owner Financing Contract Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Owner Financing Contract with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Owner Financing Contract with PDFSimpli.

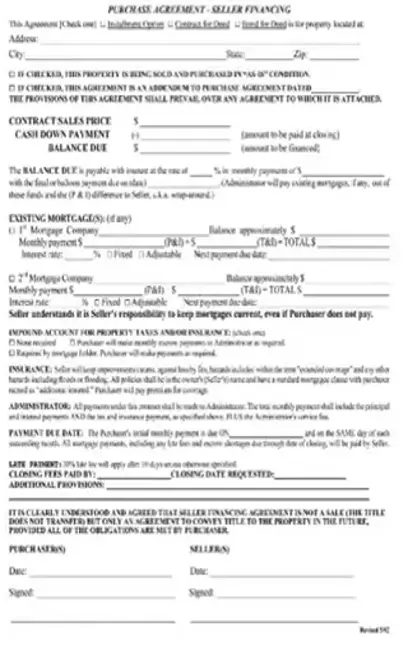

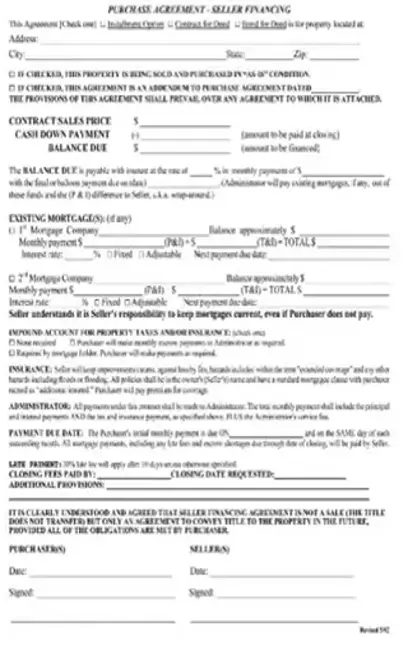

[toc] If you are selling or want to purchase real estate or other property, owner financing can be a good option as long as both parties understand the terms of the agreement. This method is opposed to traditional mortgage financing with a mortgage company. You will come to terms with a financing arrangement, closing costs if any, payment and purchase agreement, Some of the areas a contract will spell out are the payments, the length of the agreement, the rules for a promissory note, property taxes, lease options, sale agreement, amortization period, land size and the consequences of nonpayment. A form makes it easy for the buyer and seller to understand what to expect and when. It also helps to identify precisely the subject property and the contracts for deed. You can also lower your processing costs with this template PDFSimpli has brought for you to edit as you like.

The owner financing contract is used to define the terms and agreement a seller and buyer have come to. Without the contract, issues could arise later that could have been quickly resolved with a written deal. Often, there is a simple misunderstanding that could have been clarified in a written contract. Some of the areas an owner financing cover are:

Payment schedule

Payment schedule

Amount of payment

Amount of payment

Length of agreement

Length of agreement

Item being sold

Item being sold

Late payment penalties and exactly when the payment is considered late

Late payment penalties and exactly when the payment is considered late

Will the property be covered under a warranty or guarantee or is it sold “as is”

Will the property be covered under a warranty or guarantee or is it sold “as is”

Will there be a balloon payment or will the payments ever increase

Will there be a balloon payment or will the payments ever increase

What will take place if the payments are not made

What will take place if the payments are not made

Legal names of the parties involved

Legal names of the parties involved

Other areas it can cover are what extra products or things come with the sale. Buyers and sellers sign contracts so that both parties get protection and have rights if one side fails to uphold their end of the deal. It is a way to make negotiations simpler, well defined, and easy to understand.

An owner financed contract can be used by two individual people or groups of people selling their property, such as a husband and wife selling to a brother and sister. Other entities that can enter into the agreement are trusts, but make sure to verify who can legally sign for the trust. If a trust is entering into the contract, Legalzoom recommends having the verbiage as trustee after the person or persons names as shown in the first signature line of this document. It may be that there is only one person that has to sign for the trust, but there might be two or more people that must sign for the trust.

The contracts can be used to sell to a person or group that does not meet standard lending conditions. For example, a buyer may have gone through a recent bankruptcy or foreclosure but still has the income to make a monthly payment. The two parties are free to use the contract and come up with their own terms and conditions, but the seller will want to make sure the buyer has the means to make the payment states LegalWiz.

This document should be used when the current owner is going to relinquish property over to someone else without full or immediate compensation. The buyer may put some money down, no money down, or trade work or other items as part of the deal. All parties document the deal in the contract. For example, a seller may agree to sell a buyer a property, but the buyer has no cash to put down on the deal, but the seller is fine with that because the buyer is going to do remove the debris off the property in the first month at no cost to the seller. The seller believes it to be a fair agreement because he does not have to pay for or figure out how to get the debris removed, and the buyer gets to come into the deal with no money down. Situations such as this call for written agreements to keep all of the arrangements in place.

Dealing with disagreements after a sale can be extremely difficult without a written document to refer back to. Without a written contract it can be costly to try an prove what the original agreement was. The buyer or seller may have to hire legal counsel or spend hours of time at court trying to explain to the judge what happened. The University of Mexico Judicial Education Center states that in order to prove a breach of contract some of the evidence needed will be:

A signed contract

A signed contract

The date the contract was breached

The date the contract was breached

Were there any modifications to the contract

Were there any modifications to the contract

If there is no written documentation, the courts will have to decide if there really was a deal in place. If the courts deem there was an agreement without a contract, the courts determine what the damages are and how much the damaged party will be compensated.

Some of the information you will need to know are:

Date the agreement is to begin

Date the agreement is to begin

Date the agreement is to end

Date the agreement is to end

Description of the item being sold

Description of the item being sold

Legal names of the buyer and seller

Legal names of the buyer and seller

Payment information

Payment information

Interest on the loan, if any

Interest on the loan, if any

Date the payments are due

Date the payments are due

Late payment penalties

Late payment penalties

Down payment, if any, and the amount

Down payment, if any, and the amount

There are many details in any owner financing arrangement, and each situation is unique to what item or property each side negotiates into the deal. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/owner-financing-contract.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

On the seller’s side, all parties that own the property for sale need to be on the contract. If both a husband and wife own the item, they both need to be on the contract and sign. On the buyer’s side, all parties that are going to be held responsible for making the making need to be on the contract.

A notary verifies that the person signing is indeed that individual. The notary will not check any terms of the contract. It would not hurt to have the contract notarized. There usually is a small fee for each signature, and each individual will need proper identification. Here is an example of a notary stamp.

Yes. If sellers state they are willing to carry, it means they are willing to take the loan on an item. It is the same thing as owner financing. Other terms that mean the same thing are OWC and owner will carry papers.