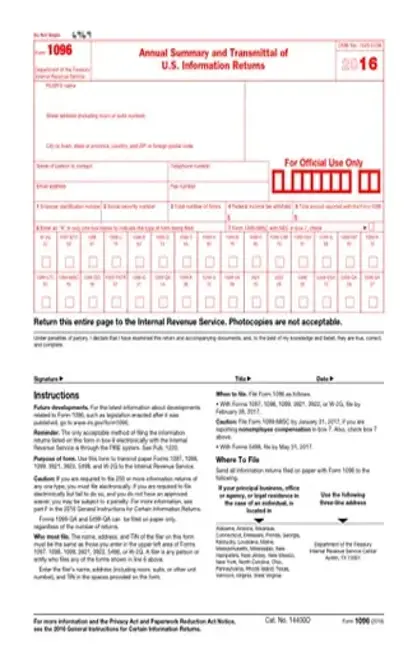

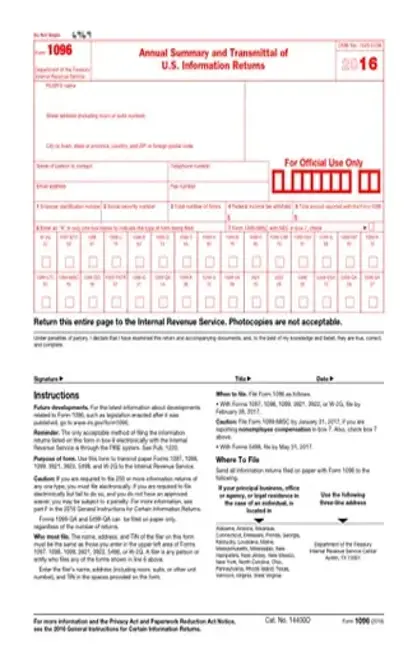

Printable 1096 Form 2016 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Printable 1096 Form 2016 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Printable 1096 Form 2016 with PDFSimpli.

If you submit information forms to the IRS and other recipients, such as independent contractors, you’ll also need to fill out IRS 1096 Form 2016, also known as the Annual Summary and Transmittal of U.S. Information Returns. This is a compilation document that shows all the totals from your information forms. Remember, you’ll need to complete separate 1096 forms for each kind of information return on taxes. This is an IRS practice 1096 tax statement for the income tax return season. When the income tax season arrives, we sometimes do not know how to fill so many tax forms required by the Internal Revenue Service. This tax year you can use this fillable template to practice for your 1096 filing form. This Form basically states what are the income tax return forms you are submitting this year. You will be required to provide your taxpayer identification number(social security), what federal tax forms you are submitting this for, revenue generated, and Federal Income tax withheld among other general information. US PDFSimpli’s amazing editing tool for this and all your other IRS paperwork.

The purpose of this form is to summarize all your information returns to the IRS. While you may send information returns to recipients, you don’t send Form 1096 to them. You only send this form to the IRS. You’ll need to send a 1096 Form to the IRS to transmit the following paper forms: 1097 1098 1099 3921 3922 5498 W-2G Each of these documents must be sent along with its own Form 1096. Even variants of forms should be treated as different types. For example, each variant of Form 1099, such as Form 1099-K and Form 1099-MISC, is treated separately by the IRS. You may need to fill out multiple 1096 forms to summarize all the documents. Make sure you don’t send a printable 1096 Form 2016. Rather than downloading and printing this form from the internet, you need to order Form 1096 directly from the IRS. You’ll receive a red scannable form. One important note is that you don’t need to send Form 1096 if you e-file the above documents. Form 1096 is only applicable to physical filings. If you only file forms electronically, don’t use Form 1096. For instructions on filing these forms electronically, you’ll need to refer to IRS Publication 1220.

You would use Form 1096 if you submit any of the documents listed above to recipients and the IRS. Generally, some of the institutions and individuals that should submit Form 1096 to the IRS include: Insurance companies Government units Educational institutions Payrolls Financial institutions Mortgage lenders Brokers Multiple homeowners Real estate agents Multiple lenders Subsequent loan holders Small business owners Gambling operations If you have independent contractors, transfer stock, issue certain tax credit bonds, receive a certain amount of mortgage interest, maintained an IRA for an individual, or received gambling winnings, you’ll likely need to send Form 1096. However, Form 1096 only applies to you if you handle forms physically; you may send certain forms in digital files. Only individuals and institutions who file physical documents need to submit a 1096 Form. For example, if you send a physical 1098 but a digital 1099-MISC, you only need to send a 1096 for the physical 1098. Don’t be afraid if you’re still not sure if you’re required to file Form 1096. If you still have concerns about whether you need to send a Form 1096, you can contact the IRS directly to confirm.

The due date for Form 1096 is different depending on what forms accompany it. If you used Form 1096 for Forms 1097, 1098, 1099, 3921, 3922, or W-2G, you’ll need to submit it by the last day in February. However, if you’re sending Form 1096 for a Form 5498, the due date is the last day in May. Keep in mind that the exact due date may get pushed back to the next business day if the last days of these months fall on a Saturday, Sunday, or holiday. Double-check your deadlines every year to make sure you don’t get penalized for being late. The IRS will always have updated information on exact deadlines. If necessary, you may be able to file for an extension using Form 8809, Application for Extension of Time to File Information Returns. This gives you a 30-day extension period to file Form 1096.

Missed tax due dates can be costly. If you don’t send this form in time, you will face fines per return. The exact penalties differ depending on whether you’re a small business or large business and your average annual gross receipts from the last three years. The IRS made the penalties higher after January 1, 2016. Not only will you need to pay the initial penalty, but they may be adjusted according to inflation. There are also monetary consequences for failing to file correct returns or failing to provide correct payee statements. A penalty also exists for submitting a printed version of Form 1096 that you downloadyou must only submit the scannable form you order from the IRS. Make sure you file everything correctly and on-time. If you think you’ll need an extension, request one sooner rather than later.

Here’s a step-by-step guide for how to fill out Form 1096:

Order Form 1096 from the IRS.

Provide the name, address, and contact information that matches the information you entered on your corresponding form.

Provide either your Employer ID Number in Box 1 or Social Security Number in Bo 2. The number must match what you used on your corresponding form.

Provide the total number of forms you’re submitting with your Form 1096 in Box 3. Don’t put the number of pages; some documents have multiple forms per page.

Provide the total federal income tax withheld on the forms you’re sending in Box 4.

Provide the total amount of reported payments on the forms you’re sending in Box 5.

Put an X in the box indicating what kind of form you’re submitting in Box 6.

Put an X in Question 7 if you’re not sending other forms

Sign and date the form.

File your 1096 according to the instructions on the form.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/printable-1096-form-2016.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

Resources https://www.irs.gov/pub/irs-prior/f1096–2016

You can only physically file up to 250 copies of Form 1096. If you’re filing 250 or more, you need to file electronically using the IRS’ Filing Information Returns Electronically (FIRE) system.

No. If you’re sending a W-2, you use Form W-3 instead of Form 1096.