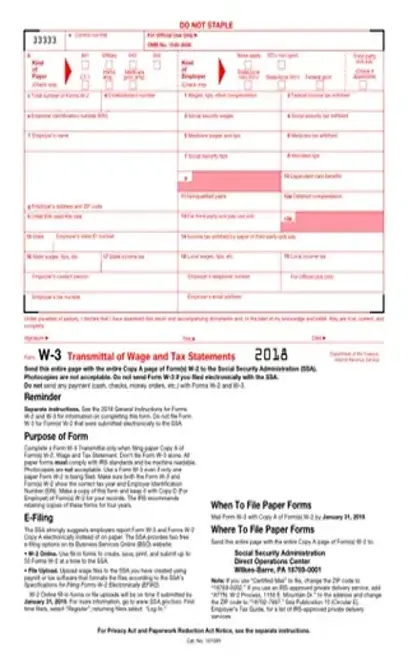

Boxes A through H on the W-3 form are about the employer. The majority of businesses will use the 941 checkbox to select “Kind of Payer.” A 941 form refers to the quarterly tax and wage report that most employers file. There are other options, including household employers.

For the “Kind of Employer” section, most businesses will check “none apply.” There are boxes that you’d check if you run a non-profit organization or are an employer for the federal government.

You can fill out the establishment number section in order to identify your different areas of business by division, subsidiary, or location. Each establishment must have its W-2 and W-3 forms separated if you choose to identify the number of establishments when filling out this section. Alternatively, you can combine the information for every establishment and submit all employee W-2 forms with just one W-3 form.

The second section of the document is labeled with numbers 1 through 19. Each number on this section corresponds with the same information on a W-2. For business owners, you’ll need to add up the totals for all employee W-2s and record these totals on the W-3.

Finally, you’ll give your contact information. You must include an email address.

You might want to consider sending out the employee W-3 copies before your official tax filing. That way, you can correct any potential errors that your employees point out. It saves you a lot of time and hassle.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/printable-w-3-form.pdf”]