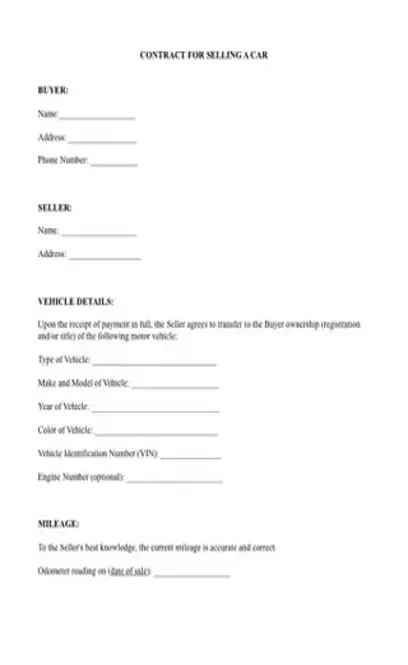

First, gather information about the buyer and the seller. The agreement should show the full name, Social Security number, and physical address of both parties.

First, gather information about the buyer and the seller. The agreement should show the full name, Social Security number, and physical address of both parties.

Describe the vehicle being sold, including its make and model.

Describe the vehicle being sold, including its make and model.

Write the purchase price.

Write the purchase price.

Record the initial down payment.

Record the initial down payment.

Write down the amount to be paid in each installment, along with the time period between installments.

Write down the amount to be paid in each installment, along with the time period between installments.

Write the date at which the balance should be fully paid.

Write the date at which the balance should be fully paid.

Record the amount of time that can pass before late fees are issued. Then, record the initial late fee along with information about its compounding should the balance continue being unpaid.

Record the amount of time that can pass before late fees are issued. Then, record the initial late fee along with information about its compounding should the balance continue being unpaid.

Have an attorney double-check the contract to make sure there are no legal loopholes or mistakes.

Have an attorney double-check the contract to make sure there are no legal loopholes or mistakes.

Get the date of the sale, along with the signatures of the seller and the buyer.

Get the date of the sale, along with the signatures of the seller and the buyer.

Have the form notarized at a local notary’s office.

Have the form notarized at a local notary’s office.

Procure copies for both the buyer and seller to keep for their records.

After the seller has received a signature and notarization of their installment agreement, they should prepare the rest of the vehicle sale documents. These include the transfer of title and registration papers. Depending on the state, they might need to file a bill of sale. Bills of sale will use the same information recorded on the installment plan [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/private-car-sale-installment-agreement.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]