sample balance sheet PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant sample balance sheet PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant sample balance sheet PDF with PDFSimpli.

[toc] A balance sheet PDF form is an accounting statement that outlines a company’s financial position for a given period of time. It shows the company’s assets, liabilities and even the amount of money invested by shareholders. The financial statement shows the company’s current situation such as its performance, cash flow and it should be filled quarterly for Public Traded Companies. It shows the amount of money taken in and expenses taken out.

A financial statement will show you how your business is doing. It will give a clear indication of the direction of your cash flow. A sample balance sheet demonstrates whether you are operating at a loss or you are making profits. The clear exhibition of your financial undertakings gives you a good basis for making proper decisions to ensure you stay on track and achieve your goals according to your prior plans. Assets, liabilities and equity ownership are aspects of a financial statement that will show you how money flows in your company’s system; how much is spent on suppliers, how much sums up to employee’s salaries, pension schemes, whether it is a good idea to borrow from a bank or get the money needed from investors in exchange for equity in the company. All these are questions that a balance sheet can provide the answers to as well as enable you to evaluate a company’s capital structure.

An individual needs some organization in his or her life and more so in financial matters. It is not mandatory to have a full time accountant but you can hire one when you need a balance sheet to be prepared. Asking for financial assistance from one can be very helpful in keeping your financial records on track. This financial statement is very useful and important to both Public Traded Companies as well as Private Companies. Any person who owns or operates a business should use the financial statement so as to understand how the business is performing. Whether you have just started a business or you have been operating for the last five to ten years, this document is very crucial to gauge where your company stands financially. There are different institutions that look into your company’s financial statements like the bank, IRS, prospective investors and even existing ones, all these people will have the need to understand how their money will be used and if any profits will be forthcoming.

When running a business, challenges are bound to occur down the road and you need to have a plan to avoid being caught off guard. With the ever proper outline of your business’ performance, you have at least the sense of what will happen if your business behaves in a different economical manner other than what is expected. A balance sheet can also help you when you are in need of funds, for example you can approach a bank for some funding in your business and this is the document that you need to produce so as to show them what they are dealing with. Shareholders are also approached in the same way; they need to see whether the business is worth their money and if the equity offered matches up the amount of cash requested. Thorough research and evaluation should be put into preparing a balance sheet. When it comes to filling taxes, you will have it easier because all the information you need can be derived from the financial statement. There are deadlines when it comes to submitted a balance sheet and for Public Traded Companies is every quarterly.

As earlier stated balance sheets are very important for your business and should not be taken lightly at all. You need to have ready and up to date accounting statements that are indeed accurate. There are risks involved if your calculations are wrong. First of all, you will get into trouble with the regulatory authorities such as the IRS, secondly your fund support system like the bank or investors might feel cheated and worst of all stop funding your company which can translate to closing down the business. A balance sheet should be done by a professional; someone who actually understands what needs to be done and delivers exactly that. Hire an accountant and an experienced bookkeeper if you have to so as to get very accurate calculations. Keeping monthly records is a good way to be on top of things, to ensure you have all the relevant information at your fingertips.

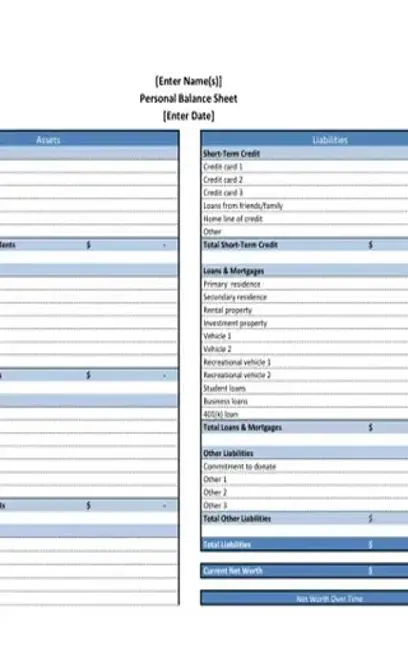

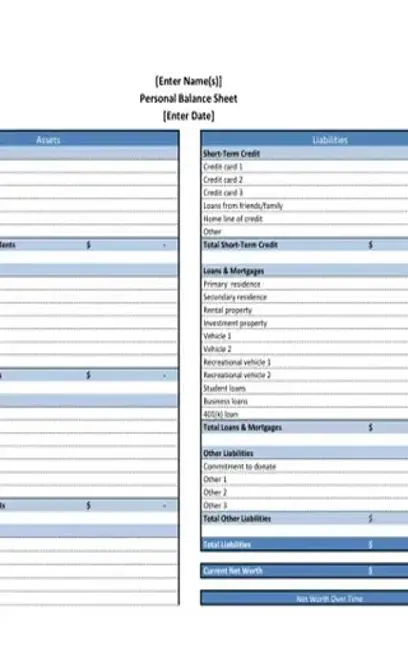

A balance sheet has three distinctive parts that is, the assets, liabilities and shareholders’ equity. Let’s have a look at how to fill a balance sheet.

Identify your company by name and give the date The company’s name that is the regulatory authority should be clearly indicated as the title of the balance sheet. The correct date should also be given.

List all the assets on the left side Assets are what the company owns and can be converted into cash and benefit the company economically like prepaid insurance. Assets are divided into two; current assets which include cash or accounts receivable and long-term assets which include land or equipment that can be sold to get the company some money if need be. You should feel the blanks accordingly.

List all the liabilities and shareholders’ equity on the right side Liabilities are what the company owes like salaries, paying taxes and suppliers. They also fall into both current and long-term liabilities. The percentage that an investor owns in a company should also be clearly filled out.

Balance out all the assets, liabilities and equity The sole purpose of a balance sheet is to ensure that total assets equals to total liabilities and equity ownership. Proper calculations should be done to ensure the math balances well

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/sample-balance-sheet.pdf”]

IRS 1040 is the tax filing form used to fill one income or combined income of over $50,000 while IRS 1040a deals with less than $50,000. The income might sometimes vary and it itemizes deductions while IRS 1040a doesn’t itemize deductions.

Both deal with income of below $50,000 but the 1040a covers more ground than 1040ez.

According to the IRS, there are seven tax brackets. Amount of income and filing status affect your tax amount.