Self Employment PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Self Employment PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Self Employment PDF with PDFSimpli.

A PDF self employment form is easy and free. People filing taxes or completing a contract where some tax money will have to be held back will need this form. You can fill out this form if you are self employed or completing contract work for someone that could be considered self-employment. The form provides your tax and contact information so that end of quarter and year taxes can be completed. The form provides proof of income and helps you tally your earnings as well as provides contact information for the people you complete work for.

This form is used because people who are self employed need to file taxes quarterly and yearly. The forms help you file your income accurately by having a finished pay amount sent back to you with a stub. If you keep a copy of your W-9 and the amount that you earned per contract you will have a full list of income sources so that your taxes are easy to keep straight. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/self-employment-form.pdf”] People who pay for contracted or self employed work need an official way to contact you. They also need to know your tax withholding information. If you give someone one of these forms, that is a certification for taxes to be withheld in a certain amount. They are legally covered as long as they withhold the proper amount according to the form you gave them. Conversely, sometimes people who are self employed need to pay taxes on their income quarterly, or they may need to pay business taxes separately from income taxes. A W-9 helps them keep track of what income came from where and how much to withhold for taxes.

People who are self employed and the people they are working for would use this form. They would need to use it to find official addresses and mail end of year tax information. The government also uses the form to keep track of proper mailing addresses and make sure that income is properly reported and taxed. For example, people filling out a 1040 would need to provide pay stubs and income verification with other forms to show that they have properly paid the quarterly tax on their self employment income.

You can use your forms to provide income verification to the bank for a loan, to apply to a school loan, or to apply for buildings and purchases as well. People who use income to make decisions for things such as housing, business rentals, or business insurance may need to see proof of income to make such decisions. So, these forms help keep people in the know about your income. You can give them to landlords and insurance companies for projects that you take on, or you may need to provide them if they are required by other people.

You should use the form when required by law and when you need it to acquire funding or products such as insurance for your business. The form should be filled out in a timely manner for tax purposes. It should also be provided for people when you are completing work for them so that they have your legal contact information and know that you are self employed. This way, they can contact the proper party for insurance and work completion purposes as well as tax withholding information.

You should also provide the form completed to people when you go to bank meetings for account updates or loan purposes. These can be school loans, mortgages, or long term purchase loans such as car loans. The bank needs this information to decide an interest rate for you, whether you are eligible, and what kinds of loan products you have access to. You will need to make sure that your information is accurate and complete when bringing the form for banking.

The form can be brought to other kinds of financial meeting such as school entrance meetings and places that rent storage, for example.

If you do not bring or provide the form when required by law, you can be penalized with interest charges on the taxes you owe. You can also be audited if the information is either not provided or incorrect. Avoid this inconvenience by providing accurate, timely information and by making sure that your forms are turned in to the correct person.

If your form is incomplete or not provided, you may be turned down for certain bank loans or purchases, such as mortgages or storage rentals. People who do not have enough information to verify your income cannot often give you financing legally, or they may not be convinced that it is in their best interest to give you the purchase. You should convince them that you are organized and easy to work with as well, by having your forms organized and filed properly.

You will need to log in to Adobe Acrobat or get an account online to edit a PDF form.

Download the form, then begin by filling out your information using the cursor icon.

Click on the blank space above the line and start typing.

Carefully fill out each area with proper spelling.

Check boxes by clicking enter and tab through boxes that you want to leave blank.

You can input an electronic signature into the signature area if you have one downloaded, or you can sign your name by typing it.

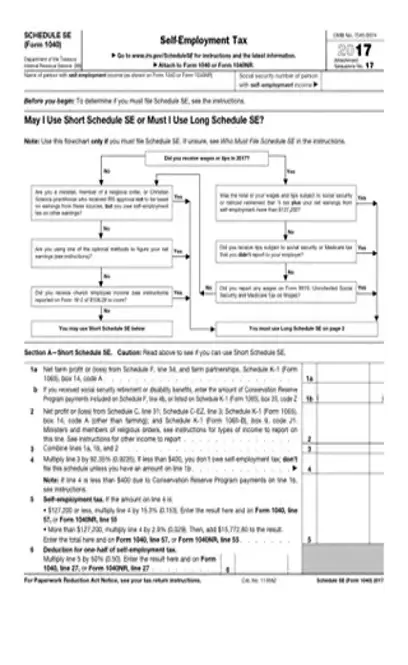

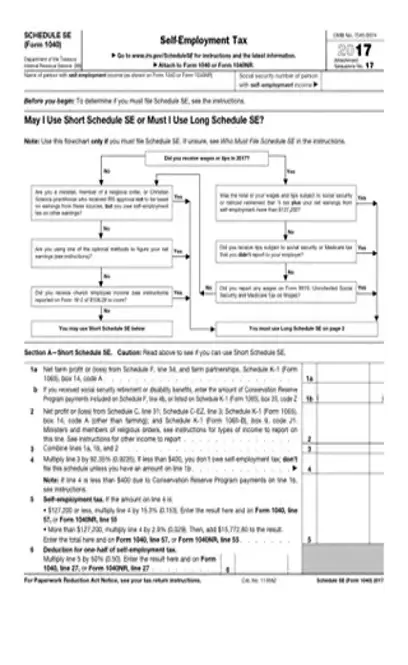

The form is a SE (Self Employed) 1040 in the United States. It contains several exemptions and helps you file the correct amount of taxes for your tax bracket.

Schedule C goes with the form 1040 and the form 1040 EZ. It will tell you the different tax rates and the amount you owe.

Form 1040 holds all income types and levels for self employment in the United States. Form 1040 EZ works for simpler income levels, usually under $20,000 USD.