Separation Notice Georgia PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Separation Notice Georgia PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Separation Notice Georgia PDF with PDFSimpli.

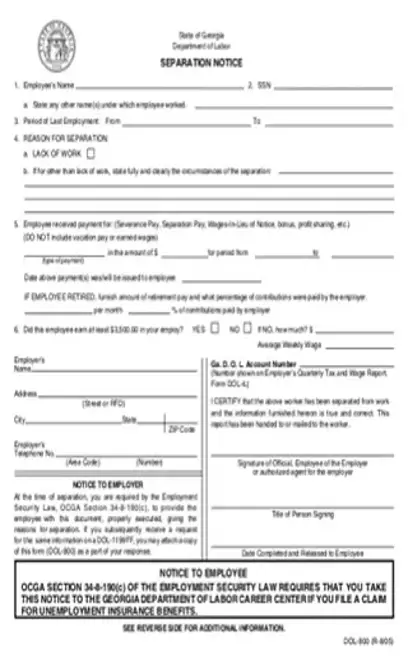

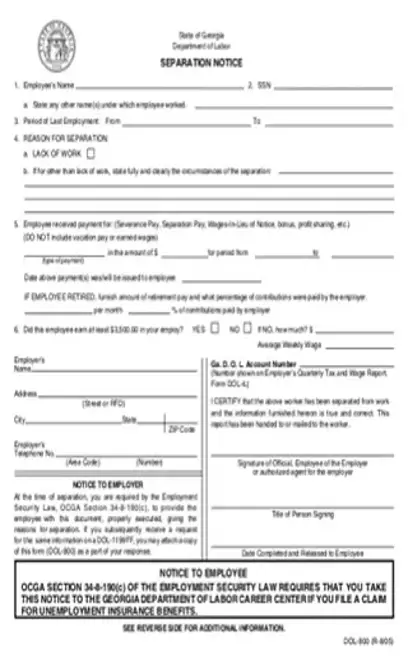

[toc] When an employee leaves a company in Georgia, that company is required to provide a notice of separation called a Georgia Separation Notice. Go figure. This notice must legally be provided regardless of whether the separation was voluntary or not. The separation notice is a way for the employer to protect their opportunity for contesting their employee’s claim for unemployment compensation. The notice constitutes a legal separation between employees and an employer required by the Georgia Department of Labor. The separation notice form will indicate the reason for separation, any benefits the employee is entitled to, terminationdate, and other important information. Find Your Georgia separation Notice here!

This is called the DOL-800 form and is put out by the Department of Labor. Its main use is to inform an employee about their separation from the company they work at. The form must be used regardless of whether the employee has quit, been fired, or been laid off.

The form takes down information about both the employee and the employer. It also notes whether the employee has received any payments, including separation pay, severance pay, and profit-sharing. The form doesn’t include any earned wages or vacation pay.

If the employee chooses to make an unemployment insurance claim, they’re required to bring the form with them. The employer should provide the form to the employee on their last day of service. If the employee isn’t present on their last workday, the employer must mail it to their last known residence. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/seperation-notice-georgia.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

The employer is the one responsible for filling out the separation notice. However, the employee is the recipient of the form. If the employee plans to seek compensation or unemployment benefits, they’re legally required to bring the form to their Department of Labor Career Center.

The employer must comply with the provided instructions to correctly fill out the separation notice.

According to Georgia law, this form needs to be used whenever an employee separates from their employer for any reason. This includes both voluntary and involuntary separations. If an employee is laid off, the employer must issue them this form. Similarly, the firing of any employee must be accompanied by this form. If an employee chooses to leave the company, this form must be provided on their last day of work.

Georgia law mandates that separation notices be used. Failure to use an official separation notice can cause an employer’s right to contest employee compensation claims to be revoked.

First, enter the name that appears in your employee records. If the employee’s name is different in your records than it is on their Social Security card, you should report both names. Then, enter the Social Security Number of the employee. Make sure it’s verified as correct.

First, enter the name that appears in your employee records. If the employee’s name is different in your records than it is on their Social Security card, you should report both names. Then, enter the Social Security Number of the employee. Make sure it’s verified as correct.

Enter the dates that the employee most recently worked.

Enter the dates that the employee most recently worked.

If the employee is being separated because of a lack of work, you should put a checkmark in the indicated box. If the employee’s separation is for any other reason, use the provided space to write complete details about the separation. If it’s necessary, you should add another sheet of paper.

If the employee is being separated because of a lack of work, you should put a checkmark in the indicated box. If the employee’s separation is for any other reason, use the provided space to write complete details about the separation. If it’s necessary, you should add another sheet of paper.

If the company made any kind of payment to the employee, such as separation pay, you should indicate what type of payment was made. Also indicate the time period the payment was made for beyond the employee’s last day of work. You’ll need to provide the date that the payment either was or will be issued. Make sure you don’t include earned wages or vacation pay.

If the company made any kind of payment to the employee, such as separation pay, you should indicate what type of payment was made. Also indicate the time period the payment was made for beyond the employee’s last day of work. You’ll need to provide the date that the payment either was or will be issued. Make sure you don’t include earned wages or vacation pay.

Check “Yes” or “No” regarding whether the employee’s earnings exceeded $3,500. If the answer is no, you should write the wage amount earned while the employee worked for you. Also indicate the average weekly wages when the separation occurred, not including overtime.

Check “Yes” or “No” regarding whether the employee’s earnings exceeded $3,500. If the answer is no, you should write the wage amount earned while the employee worked for you. Also indicate the average weekly wages when the separation occurred, not including overtime.

Fill out the full name of the employer.

Fill out the full name of the employer.

Give the employer’s full mailing address regarding the place where they will receive communications about potential claims.

Give the employer’s full mailing address regarding the place where they will receive communications about potential claims.

Check the Quarterly Tax and Wage Report for your company to find your state DOL account number for unemployment insurance.

Check the Quarterly Tax and Wage Report for your company to find your state DOL account number for unemployment insurance.

Sign and date the document. The date should be the date the document is given to the worker.

Yes. Even if the employee is voluntarily leaving the company, you’re still required by law to give them a notice.

The form should be completed prior to the employee’s last day. Give it to the employee on their last day of work. If they aren’t present, mail it to them.

This is an official government form put out by the Department of Labor.