Small Business Balance Sheet Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Small Business Balance Sheet with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Small Business Balance Sheet with PDFSimpli.

[toc] Businesses use a number of financial reports to regularly analyze their fiscal health. A balance sheet provides part of the fiscal picture. This report reveals the company’s current net worth.

The balance sheet helps evaluate firm assets against liabilities. This provides insight into the its financial strength and its overall value.

Broadly, it uses the equation:

Assets = Liabilities + Owner’s Equity

but you’ll also see it as:

Owner’s Equity = Assets Liabilities

which provides an accurate picture of equity.

The balance sheet efficiently shows the balance of incoming and outgoing funds. It reveals company health to determine its ability to expand. It also reveals operational information, including necessary collections to occur, inventory and bills paid.

You can calculate a balance sheet on a monthly, quarterly, semi-annual or annual basis. It’s recommended that you run it at least monthly and annually.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/small-business-balance-sheet-example.pdf”]While no organization hunts you down if you don’t complete your monthly balance sheet, it does benefit a business to generate one. If you took out a bank loan for your business, it may ask to see your monthly or quarterly balance sheets.

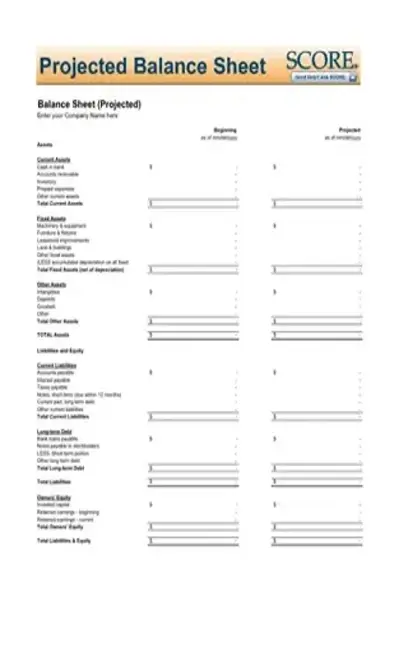

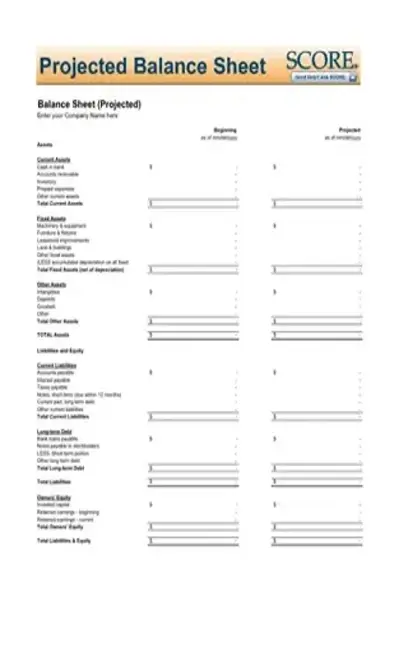

Although the categories remain the same on each firm’s balance sheet, the specifics differ from firm to firm. For example, inventory comes under current assets, but not all companies have inventory. A service-based firm would not have physical products.

1. Fill in the appropriate current asset blanks of the balance sheet. The common items under assets include current cash on-hand broken into accounts receivable and reserve for bad debt, inventory, prepaid expense and notes receivable. 2. Fill in the amounts for the appropriate fixed assets for your firm: vehicles, furniture and fixtures, equipment, buildings. Underneath each category, note the depreciation line. Fill in the accumulated depreciation for the item(s).

3. Fill in the amounts for the appropriate other assets for your firm. This includes items like its trademark and a line for amortization.

4. Fill in the amounts for the appropriate current liabilities for your firm: accounts payable, business credit cards, sales tax payable, payroll liabilities, other liabilities,current portion of long-term debt.

5. Fill in the amounts for the appropriate long-term liabilities for your company: notes payable, mortgage payable and the current portion of long-term debt.

6. Sum the current assets.

7. Subtract the depreciation from the appropriate fixed assets that you filled in during step two. Sum the remainders.

8. Subtract amortization from trademark.

9. Total the assets sub-totals

10. Sum the current liabilities.

11. Sum the long-term liabilities.

12. Total the liabilities.

13. Subtract the liabilities from the assets to obtain the current equity of the company.

Assets comprise anything that adds value to your company. Think of the building you own, the vehicles, equipment, furniture, trailers, inventory, supplies, etc. Cash, checking, savings, investment/securities all qualify as assets. Liabilities include any operational cost, debt or material expense. This includes the monthly bills like electricity, water, Internet, mailboxes, advertising, etc. It also includes money owed to a supplier or vendor, credit card balances, mortgage payment, taxes, employee compensation, workers compensation insurance, commercial liability insurance, etc.

The equity is the same, but the company ownership differs. When a company is a sole proprietorship, the equity is referred to as owner’s equity. When it’s a public company with shareholders, the equity is referred to as stockholder’s equity.

Because a balance sheet shows all of a firm’s assets and liabilities in a summary report, it makes it easy to spot imbalances. For example, if the firm overextended its credit by taking out multiple credit cards and a loan, this shows easily on the firm. If inventory numbers drop in specific months during a year, this can indicate periods of high sales. The balance sheet provides a business’ whole health in a page or two. It helps the owner spot what to tighten up to save money and when business increases.