SSA-521 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant SSA-521 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant SSA-521 PDF with PDFSimpli.

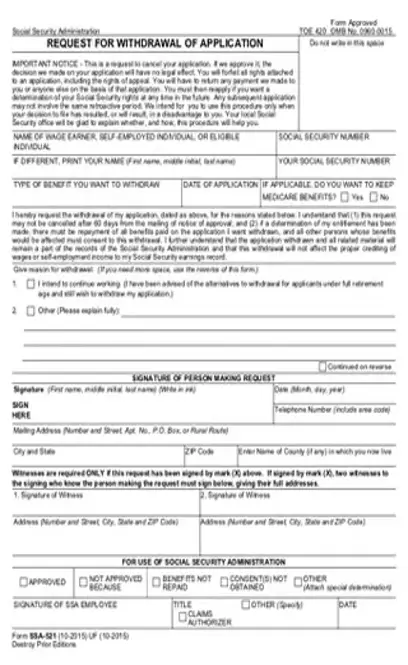

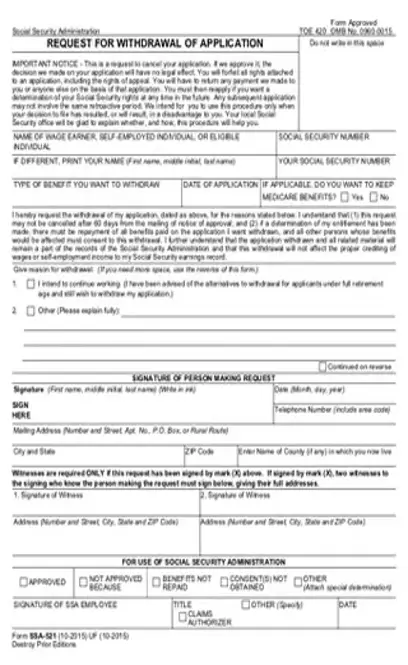

[toc] After you begin receiving your Social Security Retirement benefits, it’s possible that there will be an unexpected change. If you receive retirement benefits, but you’ve changed your mind about when those benefits should start, it’s possible that you can withdraw the claim and apply at a different date. The SSA-521 form is used to do that.

This form is used to request a withdrawal of a filed application for Social Security benefits. This request, if approved, will stop the previously-made decision about the application from having legal effects. If you’ve been given any payment, you’ll need to return it to the SSA. If you want to receive Social Security payments in the future, you’ll have to file another application.

You’ll be asked to provide reasons for the withdrawal of your application. You’ll also need to sign the application and provide information about where you can be contacted.

The form is meant to be used by individuals who wish to withdraw an application they filed for retirement benefits. It can be filed even if you’re receiving retirement benefits already. That said, withdrawals can only occur in the 12-month period after you begin receiving your retirement benefits. If it has been more than 12 months, you won’t be eligible to withdraw your application. You are also limited to only one withdrawal in your lifetime.

The form should be used if, within 12 months of beginning to receive your Social Security retirement benefits, you change your mind and wish to withdraw your application. However, there are a few factors that you should consider before you make the decision.

You are legally required to repay any benefits that you received already. If you withdraw your application, any decision made regarding that application is considered void. From there, all payments made based on the decision are also voided and must be returned.

Repayments of benefits include:

Retirement benefits you received because of your application

Benefits received by your children or your spouse because of your application, regardless of whether they live with you or not

Any money that has been withheld from the checks including voluntary tax withholding, Medicare premiums, and garnishments

If there are other parties who receive benefits because of your application, they will be required to give written consent to your application withdrawal.

If you’re a person who is entitled to Medicare benefits, you can choose to withdraw this coverage. However, it isn’t a requirement. Additionally, if you have any entitlement to veteran’s or railroad benefits, you should get in contact with the respective organizations to find out how your application withdrawal will affect these benefits. The Department of Veterans Affairs and Railroad Retirement Board both make their own decisions that are not affected by SSA rulings.

If you’ve reached full retirement age, you won’t be able to withdraw your application. However, if you haven’t yet reached the age of 70, you can ask the SSA to suspend your benefit payments.

This form is the only way you can request to have your retirement application withdrawn. It’s an official document set forth by the Social Security Administration. There’s no way to cancel your application through a simple phone call or email. If you intend to cancel your application, you need to complete this form within 12 months of beginning to receive benefits. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/ssa-521.pdf”]

If you’ve weighed the pros and cons of a withdrawal, and decided you still want to go through with your retirement application withdrawal, you can complete the form in the following steps:

Write the name of the eligible individual along with their Social Security number

If you, as the person filing the application, are a different individual, print your name and give your Social Security number

Note the kind of benefit you wish to withdraw, the date the application was filed, and whether or not you wish to keep your Medicare benefits

Explain the reason for the withdrawal. If you intend to continue working, check Box 1. For any other reason, check Box 2 and give a full explanation.

Sign the form, provide the date, and give the telephone number you can be reached at

Provide your mailing address including the county name in which you are a resident

If witnesses are required, have two witnesses who saw the signing also provide their signatures and full mailing addresses

The rest of the form is to be filled out by the Social Security Administration.

When you reach the age of 70, you don’t have the option to suspend your benefit payments. If you’re between the ages of 65 and 70, you won’t be able to withdraw from retirement benefits, but you can request that the payments be suspended. If you’re under the age of 65, you can have your retirement benefits suspended entirely.

The form can take anywhere from a few weeks to a few months to process.

You can get in contact with your local SSA office to find out how they’d prefer to structure the repayments.