VA Form 10-10EZR Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant VA Form 10-10EZR with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant VA Form 10-10EZR with PDFSimpli.

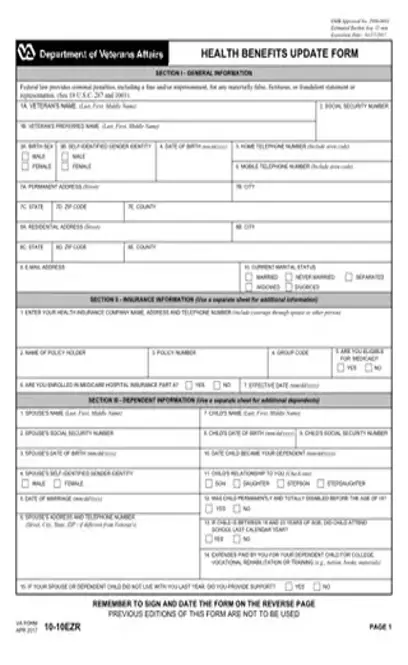

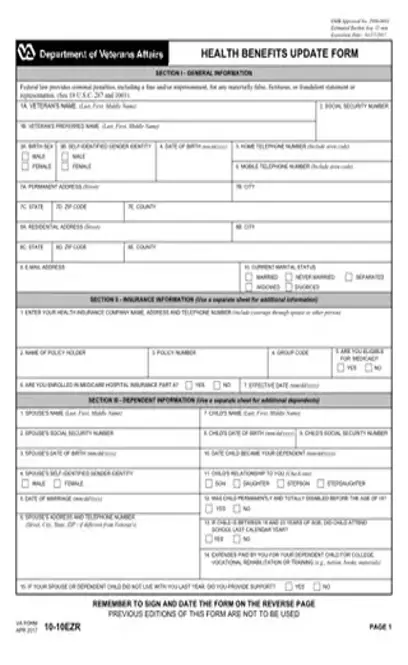

When you have had military service provided as a veteran, you may already have a comprehensive health care package through the VA health care system. However, life happens, and things change. If any of those changes affect your annual gross income or personal information, you need complete and submit VA Form 10-10EZR to make sure the VA can update your record once you’re enrolled. You can learn more about who needs this form and how to fill it out here. The Va Form 10 10EZR is known as the Health Benefits Update Form for the Veterans Health Administration. You will have to provide personal information like social security number, dependent child and spouse information, address, veterans’ health insurance information, income information and some expense information like recent burial expenses. You will be able to fill this document here online with PDFSimpli.

Legal in all 50 states, the VA 10-10EZR is also known as an Update Your Data form. It is used by veterans to notify the Department of Veterans Affairs about changes to their personal information, such as an address, phone number, health insurance, or income. This form takes approximately five to 15 minutes to complete, and it must be sent via the postal service, not emailed or faxed. You can only use it if you are a veteran enrolled in the benefits program. The form requires that you supply specific documentation:

Full name

Contact information

Social Security number

Most recent tax return

Account numbers for current health insurance, including Medicare, private insurance or insurance through your employer

Are you a veteran who has enrolled in the VA health benefits program? Do you need to update your financial, personal or insurance information? If you answered yes to both of these questions, this form is likely the right one for you. Many government forms are used for similar purposes. Make sure you have the right one:

If you have not previously enrolled in the VA Health Care System, you need to use VA Form 10-10EZ, not 10-10EZR.

If you need to change your information or cancel benefits and you are a federal employee, not a veteran, use Form SF 2810.

If you wish to apply for VA disability benefits, you must complete VA Form 21-526EZ.

To change or update health care information for the VA, you must list all health insurance plans that cover you, including coverage you receive through your spouse or significant other. Attach a copy of the insurance cards, as well as your Medicare and Medicaid cards, if applicable. This can help ensure the right information is supplied with the form. When Should You Use the 10-10EZR Form? You can use this form to update employment or income changes at any time. However, even if your job and paycheck remain the same, this form needs to be submitted annually to show you’re still financially eligible if you don’t have a financial assessment on file as of March 24, 2014. The VA uses it to confirm the enrollment priority group assignment and the accuracy of VA copay status. Each year, employers can change the coverage in the employee health plan. If that has happened in the last year, you should also submit this form with the updates to ensure your copay and eligibility are accurate. Use the 10-10EZR form to update your contact information when you relocate, whether it is within the same city or state or across the country. This can ensure there’s no gap in communication and benefits. If your number of dependents, phone number or next of kin needs to be updated, use this form as needed. What Are the Consequences if You Don’t Use the 10-10EZR Form? Veterans who do not fill out the form annually or when their financial or personal information changes may lose some or all of their benefits.

If your previous year’s income was more than the maximum amount allowed by the VA and it is not reported, you could be liable for the difference in benefits and subject to a fine or jail time.

If you relocate, payments and vital information may not reach you in time to make critical deadlines.

If the VA has wrong or outdated information, your current or ex-spouse, dependents or next of kin may not receive the benefits they are due.

There are no complicated steps to complete the 10-10EZR form.

Read the instructions carefully and note any terms you do not understand. If you have questions or need assistance, there is a phone number located on the form that you can call.

Everyone must fill out Sections I, II, VI, and VII. Make sure all of the information entered is accurate.

Fill out section three if your dependents have changed since the form was last completed (e.g. new or no spouse, a new child or a child who is no longer a dependent.). Use another sheet of paper if you need more space.

If you need to fill out section IV for Gross Annual Income, you must also fill out part III.

If you are adding deductible expenses from the previous year, make sure you will not be reimbursed for them through insurance or other sources; otherwise, you may be required to pay back any amount you receive.

Take the time to read Section VII, the Paperwork Reduction and Privacy Act Information.

Sign and date on the lines provided. If you sign with a X, two witnesses must sign and print their names on the form for the VA to consider it complete.

Attach all copies of documentation and additional sheets used.

Review the form and make sure all sections that you need to fill out are complete.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/va-form-10-10ezr.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

New contact info

Health insurance

Emergency contacts

Next of kin

Employment or financial details

Resources https://www.va.gov/vaforms/medical/pdf/vha-10-10ezr-fill

No. You also do not have to report need-based payments received from welfare, profits from the sale of a property, scholarships, grants or income tax refunds.

Mail the original version of the application along with copies of your insurance and financial information to your VA health care facility. If you don’t know the address, go to http://www.va.gov or call toll-free 1-877-222-8387 for more information.