VA 5655 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant VA 5655 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant VA 5655 PDF with PDFSimpli.

[toc] The Department of Veterans Affairs is in charge of benefits for veterans across the United States. Different veterans will receive different benefits, depending on the circumstances and eligibility requirements. A Financial Status Report form is used by the VA to understand the big financial picture for each of its benefit recipients. PDFSimpli offer the option for you to fill your VA 5655 Form online here – Get Started Now!.

There are a number of reasons a person might fill out a Financial Status Report. For the most part, this form is used if a person is meant to repay the VA, but they do not have the financial capacity to do so. The form captures a zoomed-out look at their overall finances. This record is kept by the VA to determine how to proceed with the repayment. Because the report often coincides with benefits claims, repayment problems, and collections, this might not be the only report you need to file. However, it is one of the most important. This is the report the VA will use to at-a-glance approve your application for a repayment adjustment. These are the most common types of repayment adjustments:

Waivers of overpayment or other owed fees, in which the claimant no longer needs to repay the debt

Waivers of overpayment or other owed fees, in which the claimant no longer needs to repay the debt

Compromises, in which the claimant negotiates with the VA to arrive at a sum they’re more easily able to pay

Compromises, in which the claimant negotiates with the VA to arrive at a sum they’re more easily able to pay

Payment plans, in which the claimant will adjust the schedule by which they’ll repay the full amount owed to the VA

Generally speaking, this form is filled out by the claimant. The claimant will need to provide information about their finances along with the finances of their spouse. Both the spouse and the claimant must sign the form to verify that all of the information is accurate. This form should be used by people who are in debt to the VA. Sometimes, this debt will be due to overpayment caused by a clerical error on the VA’s side. Sometimes, the debt accrues because the claimant either accidentally or purposefully withheld information that would affect their benefits. For example, a claimant might not mention that one of their dependent children had reached the age of 18 and moved out of the house. Since the VA believed that the child was still in the household, the benefits payments would reflect that. Each dependent receives an additional stipulation in order for the parents to best care for them.

You should use this form if you meet the following circumstances:

You are a veteran or the family member of a veteran who is eligible to receive benefits through the Department of Veterans Affairs

You are a veteran or the family member of a veteran who is eligible to receive benefits through the Department of Veterans Affairs

You have received a letter from the VA indicating that you were overpaid for your benefits, along with a repayment plan

You have received a letter from the VA indicating that you were overpaid for your benefits, along with a repayment plan

Alternatively, you are otherwise in debt to the VA

Alternatively, you are otherwise in debt to the VA

You do not have the financial means to adhere to the payment request and plan provided, so you need to apply to have a change made

If you are in debt to the VA, and you fail to file an application for any kind of relief, you’ll be expected to repay the debt at the rate indicated. The VA will either want a lump sum of the payment or payments made over time, possibly including interest rates. When you’re financially able to deal with these payment plans, there’s no need to file this form. But if you’re struggling to make ends meet, it’s essential that you fill out an application. If you fill out an application for relief, but you don’t include the Financial Status Report, the VA office will not have a comprehensive look at your finances. They’re far more likely to reject the claim, or alternatively to refuse to review the application until all the relevant forms have been completed.

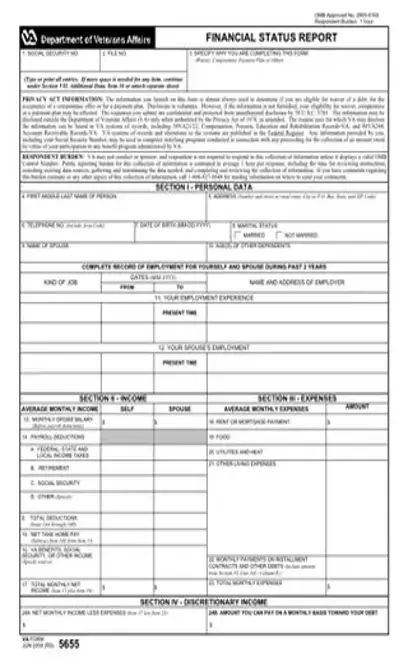

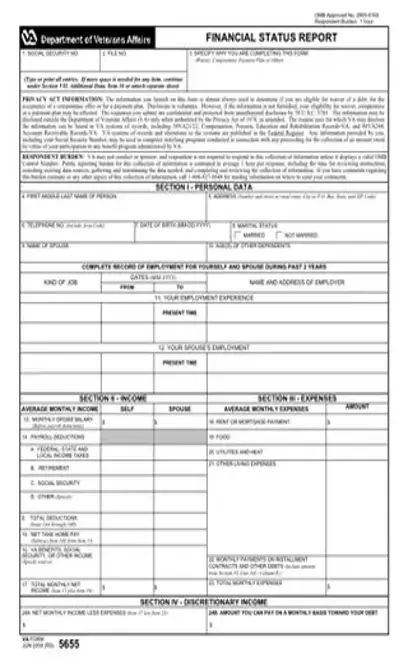

At the top of the form, you’ll write your SSN and your VA file number. Box 3 asks you to specify the reason why the form is being filled out. What type of application are you filing? Are you seeking a waiver, payment plan, compromise, or other solution? Section I is related to your personal data. You’ll write down your full name, address, telephone number, birth date, and marital status. If you are married, you’ll also provide the name of your spouse. You’ll need to give a complete record regarding the employment that both your spouse and you have had in the past 2 years. This includes the type of job and its income. Section III is the place where you’ll denote your monthly expenses, including rent, food, utilities, installment contracts, and any other living expenses. For Box 24A, subtract your total monthly expenses from your total monthly net income. This tells you how much monthly income you have after your expenses are paid. If this is a negative number, it means that you’re losing money each month. In 24B, you should mark the amount you can reasonably pay toward your incurred debt on a monthly basis. Section V is for your assets, including your cash in the bank and on hand, your vehicles, savings bonds, and any real estate you own. In Section VI, you’ll record any debts you have regarding installment contracts or other expenses. Section VII will ask you questions about whether you’ve ever filed for bankruptcy. Finally, Section VIII is where you’ll sign and date the form, and then your spouse will sign and date the form.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/va-form-5655.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”]

Yes. Your spouse’s information is recorded so the VA has a look at the total household income.

You don’t need to file this with the initial form. However, if the VA has any questions, they may ask for these documents later.

Yes. Any monthly VA benefits you receive should be added to your monthly income.