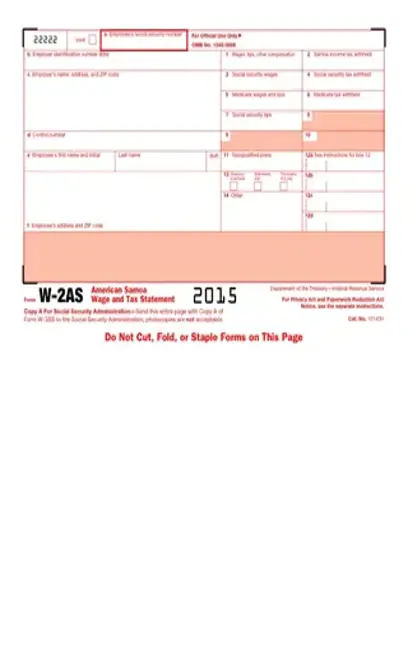

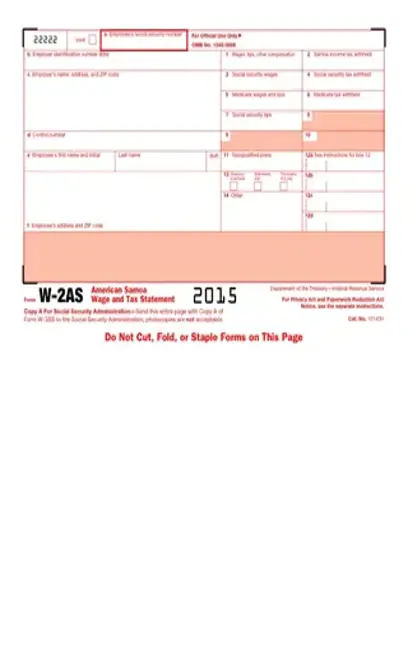

W-2 2015 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant W-2 2015 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant W-2 2015 PDF with PDFSimpli.

The W-2 is one of the most important forms required by the Internal Revenue Service (IRS). Every taxpayer receives a W-2 at the beginning of the year. This record is vital for tax purposes and can help with filing taxes for the previous year. The W-2 is a taxpayer’s record the amount of income and taxes that were deducted in 2015.

The W-2 form must be sent to an employee by a certain deadline. This form is completed by the employer. According to Investopedia, employers must send a W-2 to employees to whom they paid a salary, wage or another form of compensation.” The W-2 form reports the employee’s annual wages to the IRS. It also is a record of the amount of taxes that were withheld from the employee’s paycheck. A W-2 does not have to be filled for a contractor or self-employed worker. There are others forms that are used under those circumstances. The form plays an essential role during the tax filing season. It allows the taxpayer to calculate which taxes are owed to the government. The IRS uses two different types of W forms. A W-2 must be filed by an employer. A W-4 form can be completed by the employee.

Most taxpayers in the United States will use this form. It allows for proper documentation of wages and taxes withheld during 2015. The IRS keeps a record of the wages for every income earners throughout the year. This allows the IRS to verify that the income was properly reported. Taxpayers use the form to calculate taxes for the previous year. Without a W-2 form, figuring out taxes can become very difficult. Employers complete a W-2 to verify that they have paid wages and withheld the correct taxes from each paycheck.

TaxAct states, “Form W-2 is called an informational return because it informs several important parties about your earnings and amount of taxes paid for the year.” The IRS requires all employers to report wage and salary information to their office. An employer must complete the form for every employee that has been compensated for work. The W-2 reports the state, federal and other taxes that have been withheld from an employee’s paycheck. The information on the form is important for filing taxes as an employee and employer. The IRS imposes strict deadlines to receive the form. It must be postmarked by January 31 to avoid any fines.

An employer must complete a W-2 form for their employees by January 31 of each year. The IRS considers the forms completed when they are sent in the mail. For employers that cannot complete the forms on time, the IRS may grant an extension. The employer will have to explain their circumstances for not completing a W-2 form on time. The IRS is not obligated to extend the deadline. The IRS requires its own copy of a W-2 form by February 28. For employers that select the e-file option, the deadline to file is April 2. If an employer fails to file by the deadline, the penalty is $50 per W-2 form.

Fill out the employee’s Social Security Number in Box A.

Your Employer Identification Number should go into Box B. The EIN is assigned to a business for tax purposes.

All the employee’s personal information can be entered in Box C.

Box D needs a unique control number. This can help identify a particular employee. A control number is needed if filing several W-2 forms.

Boxes 1 – 8 must be completed in full. These boxes contain information for the employee. The total wages, tips, and other compensation need to be listed in Box 1. The withholding tax information for federal and state have their own separate boxes.

Box 12 needs to be completed if the employee received any additional benefits throughout the year.

Any other miscellaneous deductions should be listed in Box 14

Fill out all state and local tax information for Boxes 15 – 20.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/w-2-2015.pdf”]

If the information from the employer is incorrect, an employee can request a corrected form. The employer has until February 28 to make the adjustments. If the employer fails to issue a new W-2 by the deadline, the employee can file a complaint with the IRS.

The W-2 can either be sent to the employee in a digital or paper form no later than January 29. A copy of W-2 can be filed to the IRS through e-file as well.

If an employee has made at least $600 in the year, a W-2 form will need to be issued. A W-2 should be issued if there were any tax withholdings from an employee’s paycheck.