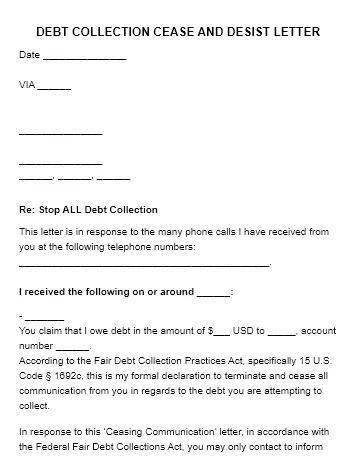

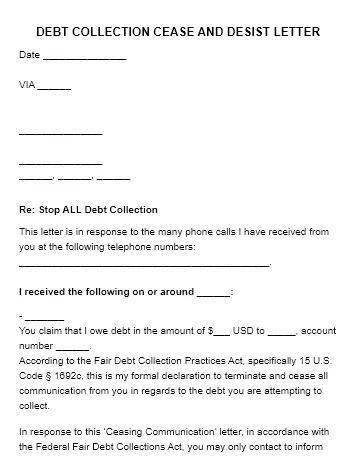

Debt Collection Cease and Desist Letter Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Debt Collection Cease and Desist Letter with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Debt Collection Cease and Desist Letter with PDFSimpli.

Pick from the colors and templates below

A debt collection cease and desist letter is a document that threatens debt collection agencies with legal action if they don’t stop harassing you. There are several types of cease and desist letters, and all focus on getting another person or business to stop doing something that is harming you. When the problem is related to abusive debt collection practices, it’s important to select a legal cease and desist letter that focuses specifically on this issue.

The legal basis of the debt collection cease and desist letter is the Fair Debt Collection Practices Act. The FDCPA prohibits debt collection agencies from harassing, abusing or oppressing anyone. This includes individual consumers, business owners and employees. In the case of debt collectors spamming false, negative online reviews about your company or spreading lies intended to harm your business, we recommend using a defamation cease and desist letter instead.

According to the Consumer Financial Protection Bureau, abusive practices by debt collectors include things such as repeated debt collection calls designed to irritate or harass the person answering the phone. Debt collectors that use obscene language, call late at night or threaten your safety to intimidate you also violate the FDCPA. It’s even against the law for debt collection agencies to call you without informing you of who they are.

If you’re being harassed by a debt collector, you can use a debt collection cease and desist letter to warn them to stop. This letter says that if the debt collection agency doesn’t stop its abusive practices toward you, you will seek a court order and damages. The law says you don’t have to put up with constant phone calls, threats of arrest, obscene language and other illegal behavior by debt collectors. Use a debt collection cease and desist letter to tell the collection agency to stop harassing you right away.

Harassment by debt collection agencies can harm you, your family, your employees and your business. Your children or spouse shouldn’t have to put up with being called ugly names or frightened by a collection agent who won’t identify themselves. You need to get a good night’s sleep, not get woken up at all hours of the night by abusive debt collectors. No debt collection agency has the right to disrupt your company’s activities by tying up your phone lines constantly or harassing your employees. The first step in getting this behavior to stop is to send a debt collection cease and desist letter.

Filling out a debt collection cease and desist letter is relatively easy. You don’t even need a lawyer to make one. If you use a template, most of the work is done for you already. How you deliver the finished document is up to you, but sending it via certified mail or getting an e-signature on a PDF version gives you proof the debt collection agency received it. Here’s what to include:

Probably the most important part of creating a debt collection cease and desist letter is describing the specific harassment as clearly as you can. This includes mentioning exact dates, words, and actions, if possible. You may need to look through your records or email inbox to gather this information. Also, make sure you have the right name and address for the collection agency or debt collector.

Next, you need a PDF editor that can help you fill out the debt collection cease and desist form. PDFSimpli is a great choice because it has tools that make editing and filling out PDF files a breeze. You can add text quickly, add photos and make tons of other changes. PDFSimpli can also convert Word files to PDF files automatically.

In most cases, you shouldn’t need to change the cease and desist letter too much. However, you will need to fill out the blank spaces with information related to your specific case. To do this, use the Add Text Tool. Click on any box, or any other part of the document, and just start typing. If you want to add a picture, press “Add Image” from the Edit Menu. When it comes to attaching extra documents as proof, you can use the “Add File” command or combine the documents with the Merge PDF Tool in PDFSimpli. Both methods work, so you can choose the one that gives your PDF the layout you like.

Before you send the finished cease and desist letter, check all of the details one last time. Make sure the names, contact info and description of harassment are all correct. To be effective, the document needs to be exact and truthful, so it’s important to resist the temptation to exaggerate any details.

Once everything looks good, click “Download” at the top-right part of the screen. This takes you to a save menu where you can name the document, save it, download it, print it out or send it directly to the debt collector electronically. The Send for Signature feature in PDFSimpli lets you get e-signatures quickly. If you’re going to use certified mail for delivery, choose “Print” instead. The finished document stays saved in your PDFSimpli account, so you can use more than one method.

A debt collection cease and desist letter is only a warning of legal action. It doesn’t actually oblige debt collectors to stop calling. If debt collection agencies keep harassing you or your business, you have no choice but to follow through on your threats of legal action and take them to court. A judge can issue a cease and desist order, a decision that forces debt collectors to stop, and potentially award you damages as well. Fortunately, cease and desist letters often have solve the problem without legal action needed.

The FDCPA only applies to independent debt collection agencies and third-party debt collectors. In other words, you can only use a debt collection cease and desist letter for companies that are dedicated to debt collection. However, the law doesn’t protect you against communications by in-house accounting staff, such as the billing department of an electronics store. If you get repeated calls from a store requesting payment, it may be better to try to reach a payment arrangement with the business.

The CFPB recommends keeping careful records of any communications from or with debt collectors. Save any letters, text messages or emails they send you, and any messages or payments you send them. In the case of phone calls, write down the exact date and time they call, as well as any harassment or abusive things they said to you on the call. You don’t need witnesses to the conversations, but if an employee or family member heard what the debt collector said, it adds even more weight to your legal case.