dispute transunion PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant dispute transunion PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant dispute transunion PDF with PDFSimpli.

[toc] To your dismay, the bank has turned down your request for a home loan. The roadblock to home ownership comes from a low credit score, based on information in your credit report.

Protecting your credit means reviewing your report for errors. Here, we explain a tool that can help you fix those mistakes that rob you of points and potential loans, insurance or jobs. You’ll learn why, when and how to complete a dispute Transunion form.

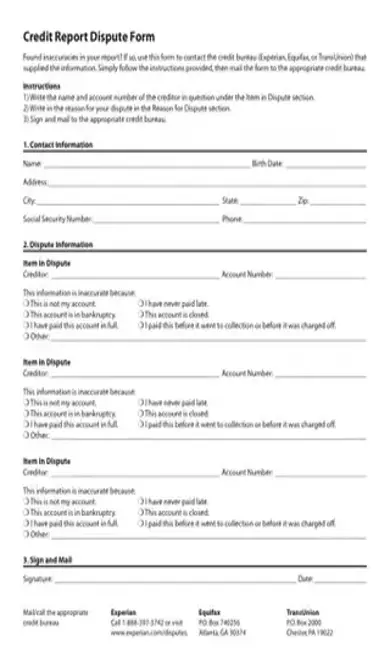

With this dispute form, you tell TransUnion why your credit report is wrong. For each piece of information disputed, you can choose reasons such as This is not my account, The account was paid, I paid this account before it went to collection or before it was charged off, or I have never paid late. You can also present other grounds.

Using the form starts the process of getting the report corrected. TransUnion may instantly correct obvious mistakes. In most cases, TransUnion will send the dispute form and any accompanying information you submit with it to the creditor. Upon receipt, the creditor then must review the information and its records, verify that the disputed information is in fact right and give TransUnion its side of the dispute. The creditor must tell TransUnion about mistakes it has made and update its records on your account.

To know that you need to dispute your credit report means that you or someone else has pulled the report.

You get for the asking one free credit report once per year from each of the major credit reporting bureaus–Equifax, Experian and TransUnion. A visit to AnnualCreditReport.com leads you to these free reports. Federal law also entitles you to your credit report at no charge if you were denied a loan, job, insurance or a rental because of something on your credit report or you’re the victim of identity theft.

The credit reporting agencies do not impose deadlines for disputing inaccurate information. However, don’t delay if you see something you think is wrong.

As inaccurate information stays on your credit report, you run the risk that the information will keep you from getting a mortgage, card loan, apartment or a credit card. Lenders, landlords, insurance companies and others use your credit score to determine your creditworthiness. That is, the score predicts the chances you’ll miss payments and default. The credit score turns on information in your credit report. Additionally, you risk losing the billing statements, receipts and other evidence that may help you show that the information on your credit report is truly wrong.

In addition, federal law does not allow you to sue a creditor who furnishes inaccurate information or the credit bureau that reports it. To get relief, you must file the dispute form. You can take the creditor or credit bureau to court if it doesn’t properly investigate the dispute.

The ability to fully explain your position is the main reason to complete the form rather than submit your dispute online. The more you say to support your version, the less chance the credit bureau or the creditor has to successfully claim that it didn’t get enough information to decide if you’re right.

The online approach gives you relatively little space for an adequate explanation of your position. The bureaus will allow you to attach a letter and other documents if you dispute online. However, submitting the paper form, your letter and other exhibits by mail reduces the chance that technical glitches or mistakes in the way you scan or type will prevent that information from getting to the bureau.

Provide your full name, birth date, street address, social security number and phone number in the Contact Information Section.”

For each item you dispute, provide the full name of the creditor and the full account number.

Fill the bubble next to the reason that most closely identifies why you’re disputing the information. If you don’t see one of the choices, fill in the circle next to “Other” and write in the reason.

Attach a letter or statement to provide details.

Include documents to help you prove that the information is not accurate. For example, attach payment receipts or confirmations if you pay bills online. Send a police report or print-out of you FTC Identity Theft Report if you claim the account was opened because someone stole your identity. If you choose This account is in bankruptcy, include a copy of your bankruptcy petition, the form in which you listed the account and a copy of your discharge order.

Do not send original documents. Submit only copies and keep the originals.

Sign your name and date the form. Make a copy of what you are sending before mailing.

Send your dispute and supporting documents to the TransUnion address listed on the bottom of the form.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/dispute-transunion-form.pdf”]

The investigation lasts normally 30 days, although TransUnion advises waiting up to 45 days. Call TransUnion 1-800-916-8800 or go online to check on the status of your dispute.

You can send TransUnion a 100-word statement to be added to your credit report. You can explain that you dispute the information and why.

No. Credit scores are calculated by companies such as FICO. Scoring models rely upon information in the credit report. Direct your questions about your credit scores to either the lender or other person using your report or to FICO.