Stock Purchase Agreement Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Stock Purchase Agreement with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Stock Purchase Agreement with PDFSimpli.

Pick from the colors and templates below

Millions of shares of stock are traded on the market every day. Whether they are a part of normal buying and selling, financial packages or alternative compensation packages, every stock transaction will be attached to a contract. This contract is commonly known as a Stock Purchase Agreement.

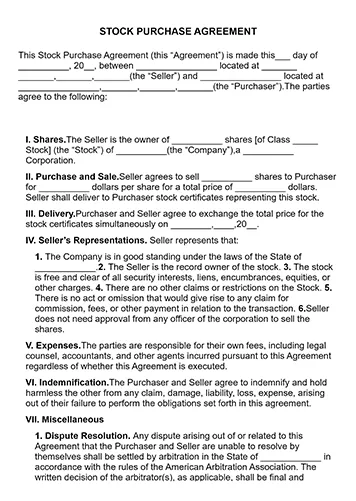

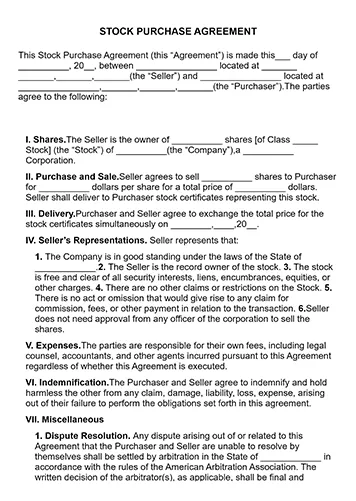

A Stock Purchase Agreement or Share Purchase Agreement is a document signed by both the buyer and seller of the stock. They are meant to outline the details of the transaction such as the number and price of the shares being purchased as well as specifications about type of share, expenses and indemnification. Both state and federal governments strictly regulate stocks, and well written Stock Purchase Agreements adhere to every rule. They will often have a specific section for state laws.

These agreements are critical to any individual or company that trades or invests in stocks. Without a purchase agreement, there is nothing legally binding about a trade. This can lead to significant losses. The flexible nature of stocks and their use in a wide variety of financial packages means that purchase agreements can be highly customized. They are also highly valuable because they contain warranties and representations of both the seller and purchaser, which helps maintain the integrity of trades.

Stock Purchase Agreements are used by buyers and sellers for the purpose of recording a transaction and laying out the specific terms of the agreement. Some of their most important functions include specifying the type, price and amount of the stock as well as when it terminates. Stock purchase agreements are regularly referenced when employees accept stock options as part of their compensation from a company. They are also used by smaller companies who may not have a lot of capital in order to attract employees that require a higher salary. Stocks are commonly used in this way by start ups who want to hire top level talent.

There is no reason not to use a Stock Purchase Agreement when buying or selling shares. They are crucial to the fairness and legality of trades, not to mention safety. If one chooses not to use an agreement they run the risk of losing their assets, being taken advantage of and even breaking the law. This is because Stock Purchase Agreements make transactions legally binding. They also provide terms for dispute resolution should conflict between the buyer and seller occur. Regardless of whether the stock is part of a compensation package or part of a financial deal, using a Stock Purchase Agreement should be considered essential.

Shares of stock are a versatile financial instrument that can be used in a wide variety of dealings. The stock purchase agreement must address the trade from beginning to end as well as provide for any disputes that may occur. It is essential that it has precise and comprehensive information about the trade and its stipulations. Here are some of the most important elements:

Type, price and number of shares being sold

Which laws the agreement is governed under

Identities of the seller and purchaser of the shares

Representations of the buyer and seller

Warranties of the buyer and seller

Notarization and witness signatures

Conditions of termination

Date, time and location of the transaction

Articles related to the transaction

Total price, deposit amount and due date of payment

Some companies may also wish to use a restricted stock purchase agreement. These types of agreements prevent employees from owning the shares until a set period of time. This encourages employees to remain with the company for a longer period of time and protects the companies assets. In addition to the regular components, restricted agreements may also include the vesting schedule (when the employee gains ownership of the stock) in the agreement.

Before you start making a document, you will need to gather all of the necessary information. This includes the names of the buyers and sellers as well as the terms of the agreement. Collecting this beforehand will make the writing process smoother and reduce the chance that you will have to re-write or start the process over.

Good legal software can help mitigate the headache of creating legal documents. They can take care of formatting and provide templates for you to fill out. Software like PDFSimpli even allows you to e-Sign PDFs. Their templates are also certified and easy to edit, which makes it a great choice for creating a Stock Purchase Agreement from start to finish.

Once you select a template the next step is to fill it out. This is where the information from the first step will be useful. Make sure the numbers are exact and double check spelling as you go. This will lessen the chances of the agreement containing errors.

Even if you have been double checking as you go, chances are there could be an error. Review it from start to finish to make sure it is ready to save and/or send. Consider having a colleague review it. They can catch errors that you do not.

When you are satisfied with the Stock Purchase Agreement and it has been approved, it is now time to send it. PDFSimpli gives you a variety of options for saving and downloading so you can print or share the completed document. You can even send it for e-Signing.

While both the buyer and seller must sign the document, a notary and/or witnesses are not always required. It is still prudent to have it notarized because it prevents either party from claiming that they never signed the document. A notary ensures that the contract is legally binding and can help avoid a messy dispute down the line. It may seem like an inconvenient expense, but the guarantee of a notary increases the integrity of the agreement and provides insurance should things not go to plan.

Stock Purchase Agreements are sometimes part of an employee compensation package or other financial package. This means that the employee benefit policy or other related policy may affect the agreement. In this case the Stock Purchase Agreement between the company and the employee would include the benefit policy and tax policies that affect the shares of stock as an article in the agreement. Other financial information that is crucial to business operations can also be included in this section.