Mortgage Deed Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Mortgage Deed with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Mortgage Deed with PDFSimpli.

Pick from the colors and templates below

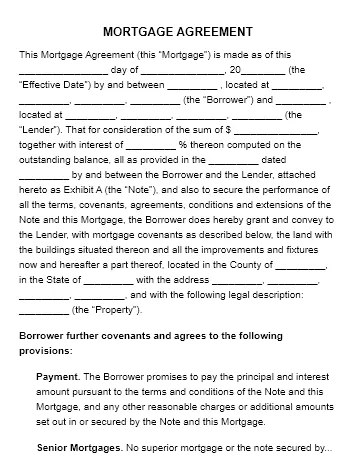

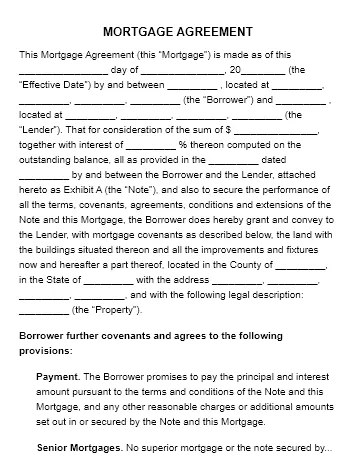

When a borrower and lender enter an agreement wherein real estate property becomes collateral, they create a mortgage deed. Specifically, the borrower gives the lender temporary ownership of real estate property as security interest until the borrowing party repays a loan in full. A mortgage deed is not the same as a promissory note or a loan agreement, which establishes the loan and its terms.

Alternate names for such deeds are mortgage form, chattel mortgage (for personal property), and mortgage contract. No matter the name, the agreement includes several general items, such as the mortgaged property, borrower, mortgage lender, principal amount and guarantor. Sometimes, a borrower needs a co-signer, the guarantor, to qualify for a loan. A borrower’s financial situation may serve as a hurdle for qualifying for a loan. Securing a co-signer with a high credit score or adequate assets may convince a lender to work with a hopeful homeowner. The co-signer bears financial responsibility for repaying the loan if the original borrower cannot keep up with repayments and adhere to other loan terms.

Not every state uses mortgage deeds and mortgage agreements. California, Alaska, West Virginia, Wyoming, Missouri, and Mississippi are a few states that recognize a deed of trust instead of a mortgage deed.

One of the biggest investments that a person makes in life is buying a home, so one of the biggest loans a person takes out is a mortgage. Lenders protect themselves before allowing borrowers access to a massive sum of money by creating a mortgage deed. Should the borrower default on the mortgage debt, the deed allows the lender to possess and sell the property to recoup the investment. For borrowers, mortgage deeds help them make their dream of becoming a homeowner a reality, and borrowers have the motivation to keep up with their loan payments to protect their dream and home.

Because of the major investment for borrowers and lenders, it is essential that both parties understand their separate and shared responsibilities during the life of the loan. Mortgage deeds layout expectations, obligations, rights, and penalties. The deed lets lenders avoid going through an extensive legal process should the mortgagee unexpectedly die, stop making payments, file for bankruptcy or face a lawsuit. If family members loan each other massive sums of money, they do not want the IRS to mistake the loan for a gift, which could come with a gift tax. To stay on the government’s good side, relatives should use a mortgage deed.

Poorly written mortgage deeds offer little protection, making it essential that a deed contains the most essential elements that protect all parties and avoid confusion. The document’s most essential elements include:

The person receiving and repaying the money

The person or entity lending the money

The individual co-signing on the loan, who must repay the mortgage if the borrower defaults

The address and legal description of the real estate property that the borrower has the right to use and the lender has the right to repossess and sell

The date the mortgage agreement starts and a declaration that the contract ends when the borrower pays the loan in full

The amount borrowed is the principal amount, and the deed must list how much the borrower pays in interest over the life of the loan

Borrowers may lease the deed’s listed property, which means the lender receives rent

The borrower bears the responsibility of maintaining the property, which may mean securing home insurance

If the lender spends money to maintain the property’s value, the loan amount may account for those payments

The deed may stipulate that the borrower must contribute to a fund to cover property assessments such as taxes and insurance

Parties must gather all necessary details for completing the deed. This is where lenders and borrowers should clarify all parties involved in the agreement, whether the contract requires extra provisions and how much money exchanges hands.

Not all PDF editing software has the tools and capabilities required to make creating a mortgage deed a breeze, and the same applies to word processors. PDFSimpli software lets users choose, edit and save their mortgage contract with intuitive tools that users access to work at their own pace. In minutes, users can draft a professional document.

PDFSimpli’s online editor makes it easy to fill in all the necessary details or edit placeholder information or named fields. Users can tweak the wording to their liking, better ensuring that all parties remain on the same page. The software also makes it a breeze to draw, type or upload a signature.

Looking over the deed for accuracy and missing information is a vital step. This is the last chance to double-check the spelling of names and addresses. It is best to allow everyone involved in the agreement to look over the final draft before the final step.

After ensuring all fields and information are correct, it is time to save the deed and download it to a computer for safekeeping. The lender, borrower and guarantor should have a personal copy of the document printed out for their records, and everyone should sign the deed. PDFSimpli lets users add an electronic signature for their convenience.

Mortgage contracts must have a maturity date, so the lender and borrower know how long the contract lasts. The maturity date indicates the loan’s last payment date.

A deed of trust and a mortgage deed serve the same purpose of placing a lien on real estate to facilitate loan repayment. One major difference between the agreements is that only two parties, the borrower and lender, enter a mortgage deed, but that could become three parties if the borrower requires a co-signer. A deed of trust involves three parties: the trustee, the lender, and the borrower. Depending on the state, parties may have no choice but to use a deed of trust.

Mortgage contracts qualify for judicial foreclosure if the borrower defaults on the mortgage loan. Before foreclosing on the property, the mortgagor must first file a complaint and wait until the court renders a judgment. Several factors determine how long the foreclosure process takes, including the borrower’s legal defense and how busy the court is.

Alternatively, a deed of trust gives the lender a nonjudicial foreclosure option, known as a power of sale clause. Borrowers involved in a deed of trust must do everything they can to keep up with payments; the completion time for the non-judicial closure process is two to three months.

States have varying rules, procedures, and notice periods for judicial and non-judicial foreclosure. Lenders must follow state law to sidestep obstacles to a foreclosure sale. Some states give borrowers the chance to buy back their homes through a redemption period.