Financial Affidavit Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Financial Affidavit with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Financial Affidavit with PDFSimpli.

Pick from the colors and templates below

To Whom it May Concern:

I, ____________________, is the legal guardians of ____________,

born ________.

To Whom it May Concern:

I, ____________________, is the legal guardians of ____________.

To Whom it May Concern:

Guardian Information. We, _____ and _____, are legal guardians of _____.

Travel Consent. Child has permission to travel with _____.

Medical Authorization. We authorize necessary medical treatment.

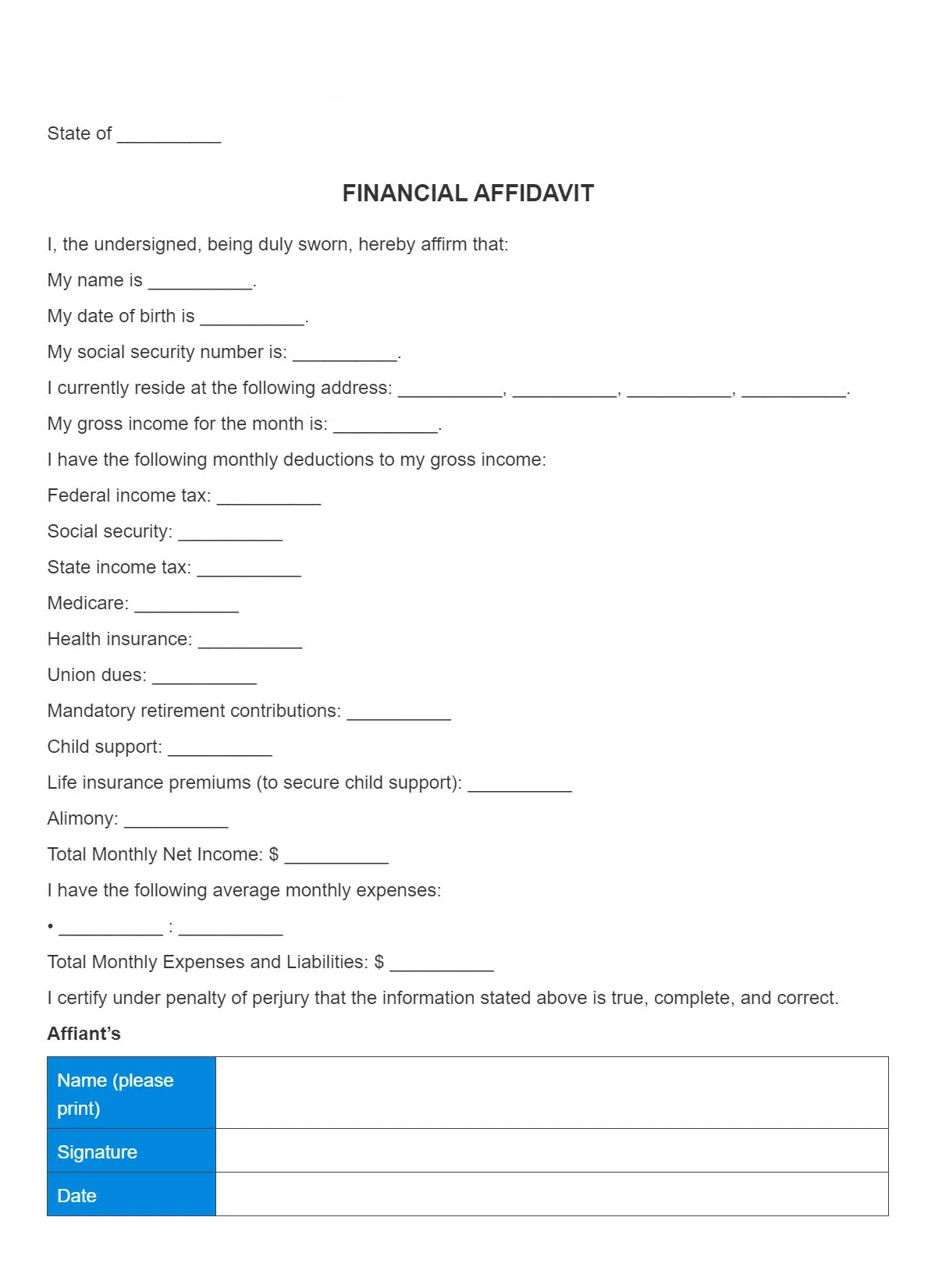

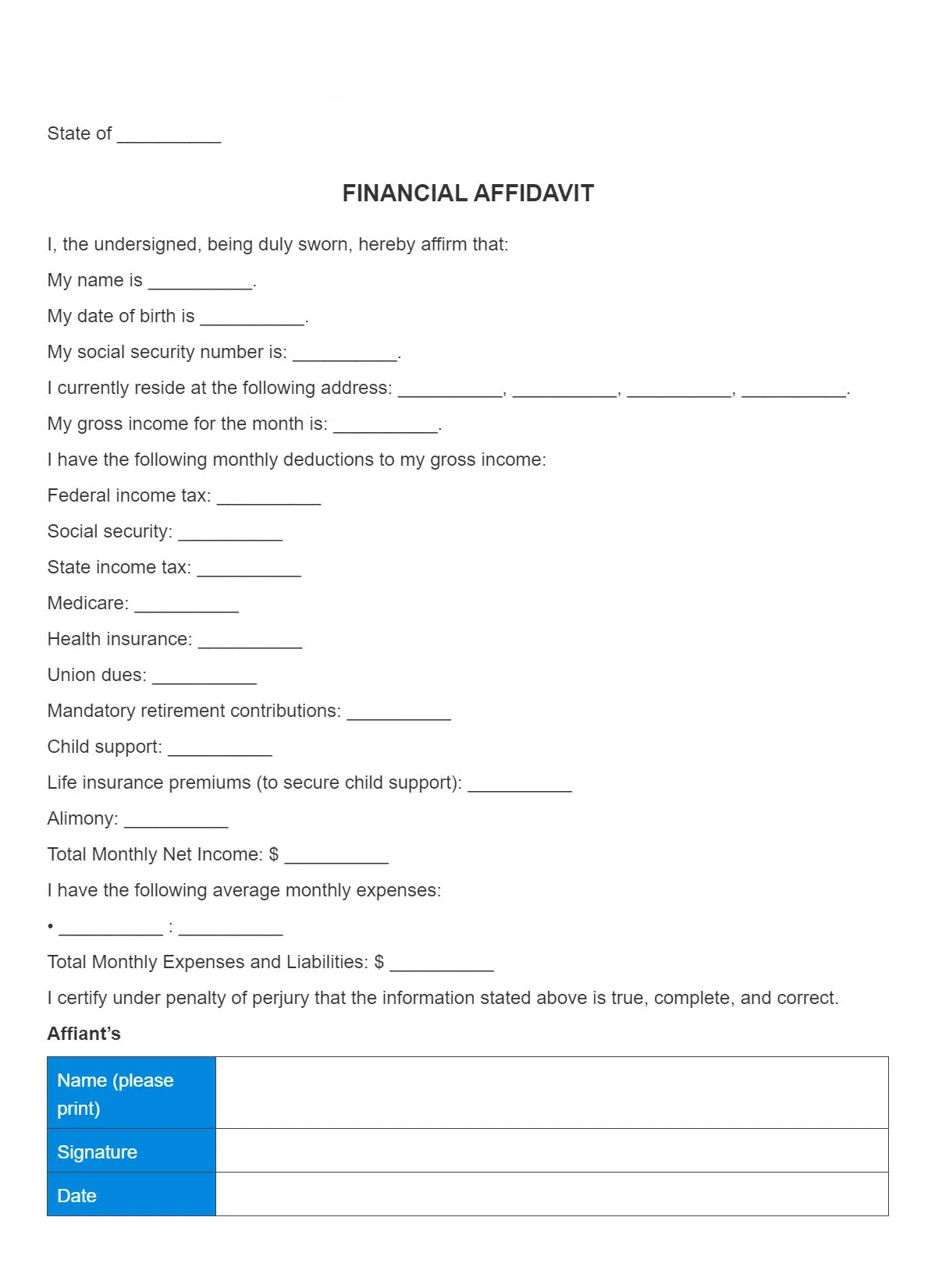

A financial affidavit is a legal document that states your current financial situation. This form is also known as an affidavit of financial disclosure. It includes details about your monthly income, expenses, assets, taxes, and debts. It also mentions information related to your job, such as whether you own a business or are employed. Like other types of affidavits, a financial affidavit has you swear that the information on the form is true, accurate, and complete under penalty of perjury.

It’s common to customize financial affidavit templates depending on the reason you need the form. If you’re involved in a divorce case, choose a financial affidavit focused on alimony or child support. These family law financial affidavits usually go into much more detail than other types, often separating normal monthly expenses and large one-time expenses. This allows you to include additional explanations, such as which assets are marital and which belonged to you prior to marriage.

On the other hand, financial affidavits for business loans and immigration applications may be simpler. They may stick to average monthly income and expenses instead of in-depth lists.

A financial affidavit is used to prove your current assets, income, expenses, and debts. The most common use of financial disclosure affidavits is in family law cases related to divorce or child support. They may also be needed if you’re planning on acting as a legal guardian, applying for a loan or promising financial support on a government application. If you apply for bankruptcy, a judge will usually request a family law financial affidavit from you as well.

When filling out an application for loans, bankruptcy, or government assistance, having a correct financial affidavit is generally required for approval. In divorce cases, detailed financial affidavits can speed things along and help you avoid going to court. If your ex is satisfied with the information provided, you can move on to the next step quickly.

On the other hand, if you don’t use a financial affidavit, or the form is missing information, there are likely to be significant financial consequences. The judge may order a long and expensive discovery process, including financial audits, depositions, and interrogatories. You may be required to go to court, leading to higher attorney fees and legal costs. If the information is false, the signer may even be found guilty of perjury and have to pay fines or spend time in prison.

A financial affidavit is a serious legal document where you swear the information you provide is complete and truthful. This means you need to be very careful that all details included in the form are 100% accurate. Do not exaggerate or guess. Here are the different items you need to include:

The most important part of filling out a financial affidavit is gathering all the needed documents. Take your time writing down your monthly income, expenses, assets and debts to make sure you don’t forget anything. Never guess. You should have at least three years of tax returns, one year of pay stubs/payment forms and one year of bank account statements.

A great PDF template can save you a lot of time creating a financial affidavit. However, you may still need to make a few changes to customize things to your needs. Look for a PDF editor with lots of tools. PDFSimpli allows you to edit PDFs, scan paper documents, add text and change sections. A big advantage of PDFSimpli is that you can merge PDFs, combining a financial affidavit form with your tax returns, W-2s and other documents. These tools are all free to use during your trial period.

With a simple financial affidavit, you can easily use the Add Text Tool to fill in each box with the right information. If you want to change what individual paragraphs say, use the Erase Tool or the Edit Text Tool. These tools appear near the top of the document. Click on the Signature button to add your own signature to your PDFSimpli account. This way you’re ready to sign digitally while a notary public watches.

Check once more that all the financial information is correct. Make sure you haven’t signed the document yet.

Click on the Save Button to save the completed financial affidavit to your PDFSimpli account. This document stays available to you in your account, so you can edit it again if you need to submit an updated form. Download the finished PDF form to your computer if you want to email it, print it out directly to take it to a notary public, or use PDFSimpli’s Send-for-Signature Tool if you want to notarize the document online.

Hiring a CPA or a divorce attorney to help you with a financial affidavit isn’t a legal requirement. However, these professionals can be a big help. They can explain your state’s laws regarding financial affidavits and make sure you don’t miss any expenses, debts, assets or income sources on the form.

There are many different income sources you have to count, including work bonuses, inheritances, gifts and government benefits. You can also mention a variety of expenses. For example, healthcare costs include expenses related to doctors’ visits, dental checkups, healthcare premiums and out-of-pocket expenses. You can count professional costs as well, such as educational expenses, insurance premiums and costs to stay certified.

When creating your financial affidavit, it’s important follow the laws of your state. In New Jersey, this form is called a “case information statement” while New York refers to it as a “statement of net worth.” Different states have individual requirements for how to report finances, such as how many years of pay stubs and tax returns you must include.