Invoice Form Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Invoice Form with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Invoice Form with PDFSimpli.

Pick from the colors and templates below

An invoice form is a document used to quickly generate invoices for business customers. Invoices are used to request payment for certain goods and/or services. It has an itemized list of the products sold and services rendered along with their prices. The invoice also typically specifies acceptable forms of payment and a due date.

In some circumstances, a very similar document is called a bill. However, this term is more often used in a business-to-consumer setting when the payment is due immediately (such as at a restaurant). Conversely, invoices are most often used in a business-to-business setting and may allow some time to complete payment. Invoices are also used in B2C settings in some cases, typically more complex sales.

Usually, an invoice is issued as part of an already agreed-to transaction. For example, the buyer may have ordered 500 widgets. The seller ships the widgets and issues an invoice to the buyer, requesting payment. By placing the order, the buyer has already agreed to the price and other terms. The invoice is simply a request to fulfill the prearranged price.

Some invoices have payment terms that allow the buyer to pay within 30 days (or some other time frame). Additionally, a seller may offer a small discount on the invoice for paying early.

Businesses use invoices to request payment for transactions in an orderly manner. The advantage of a custom invoice is that it is itemized. So, the buyer can easily see what products and services the invoice is covering and how the price is broken down.

Invoice forms are among the best and easiest ways to ensure timely and accurate payment. Additionally, they help with recordkeeping for both parties involved in the transaction. From the buyer’s perspective, invoices also help to ensure that they are only paying for what they ordered and that the price is consistent with the original order. Overall, using an invoice form is just smart business.

Proper invoicing can help to ensure timely payment for any goods and services you provide to your customers. Additionally, it can help to make the collection process proceed more quickly. In short, invoicing is important for the orderly running of your business.

However, there is no reason to create new invoices every time one is needed. Instead, it is better to fill out an invoice template each time. This can be done by hand or on a computer and printed out. Using a consistent format will increase understanding and save time for both the buyer and seller.

customize your invoice template to suit your unique needs. Once you have designed your invoice template, you can easily fill it out with the specifics of each invoice form.

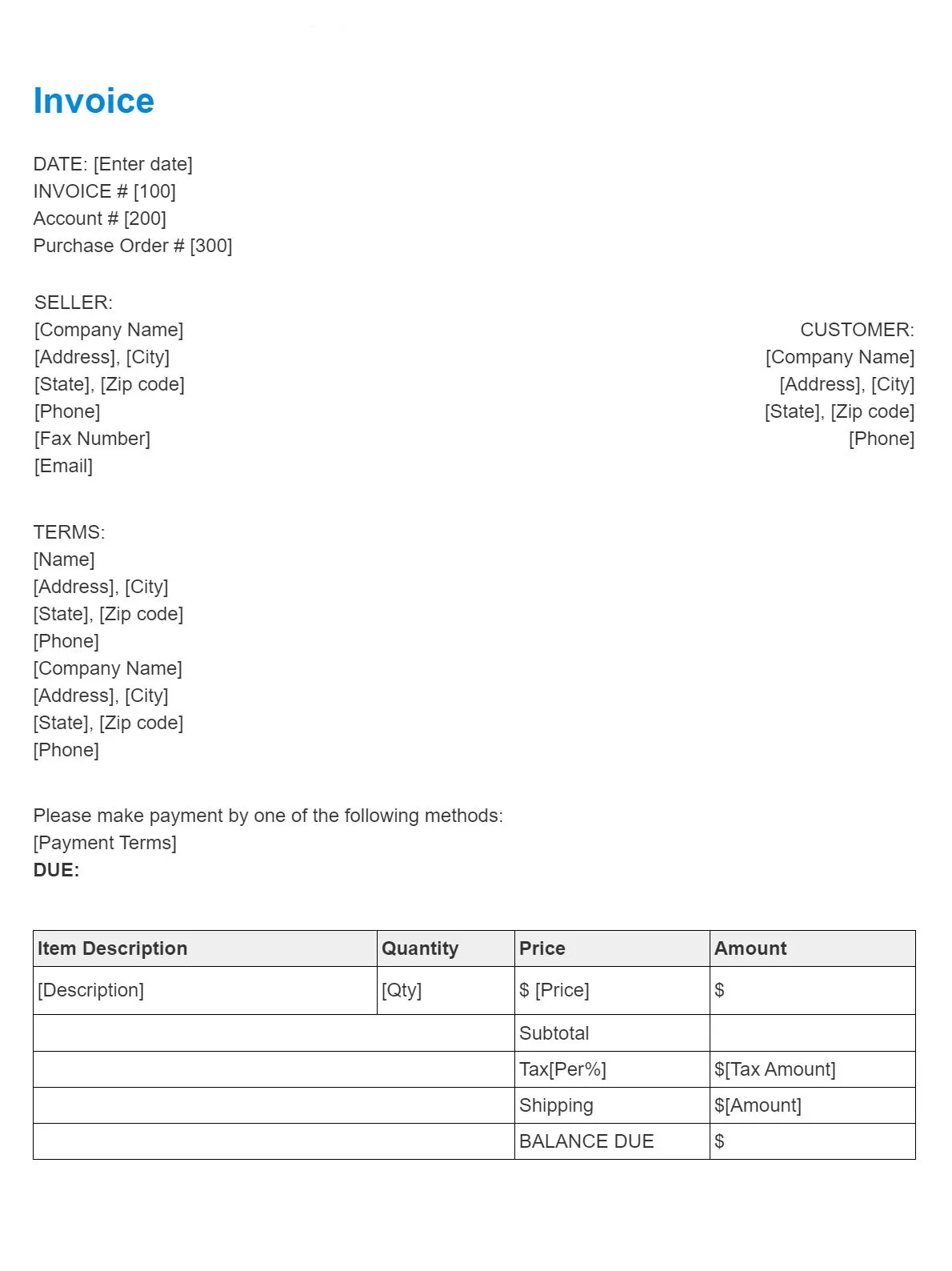

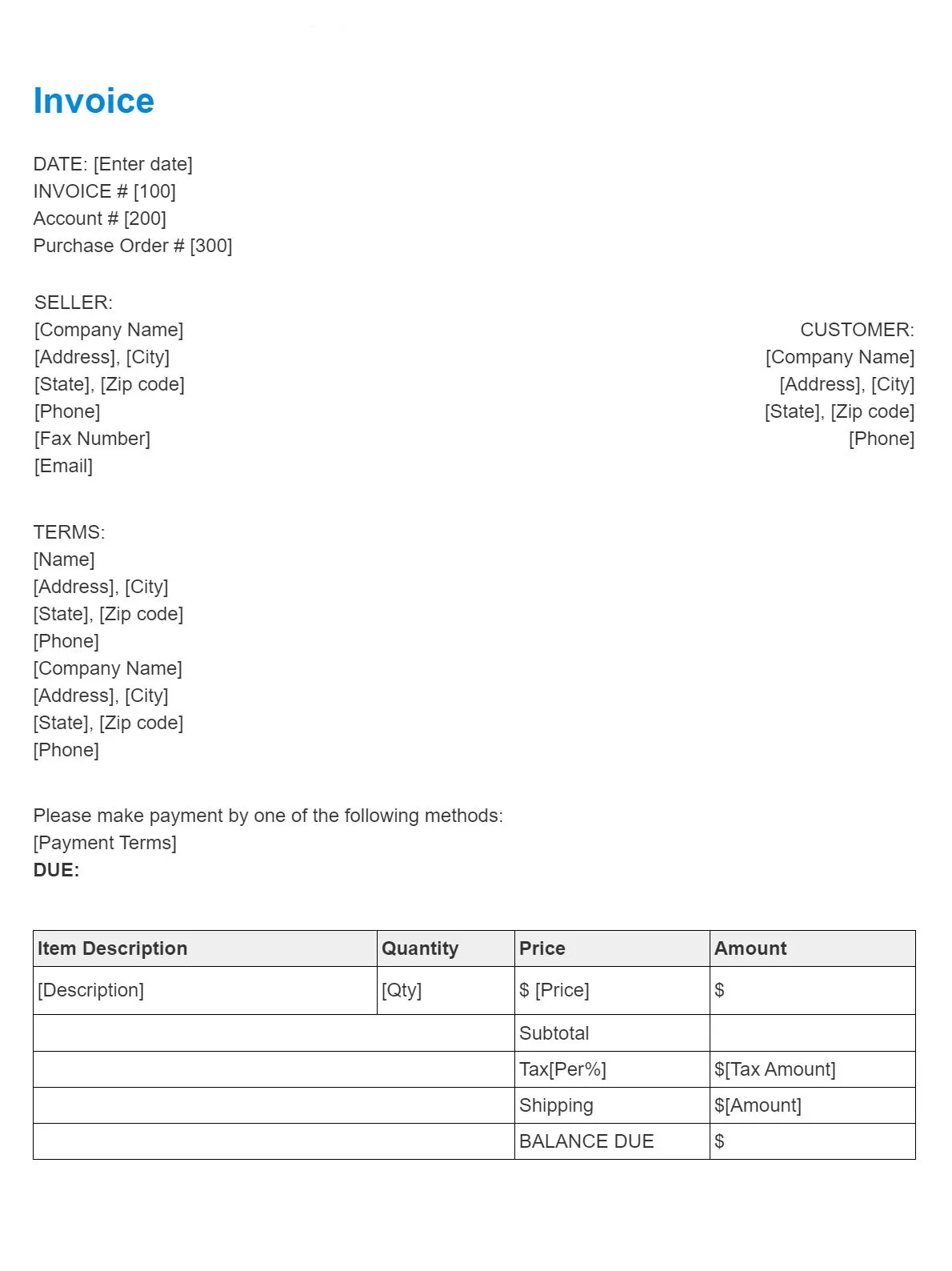

The main content of an invoice is the information about the transaction. This all needs to be included when you fill out the form. However, there are some other details as well that you should be careful not to forget. The following are some of the elements and fields you need to include in your invoice form:

Creating your invoice form is relatively simple. Most organizations use similar formats with more or less the same information. However, a little preparatory work can help you tweak the standard format to suit your needs. This may help you to save some time down the road. Consider referencing a recent transaction and look at all the details the customer needed. You should plan your form around those needs.

Next, select the software that you will fill the invoice out with. Consider using PDFSimpli. This will let you take an invoice form template and quickly customize it. Better yet, you can fill out copies of the form with the specific details of each transaction. So, you can handle all your invoice-writing needs with the same software.

Using the PDFSimpli online editor, you can complete the invoice form with the necessary details and fields. You can include images such as a logo easily. Additionally, the editor includes drawing tools for keeping your invoices organized with boxes and other lines.

It is helpful to keep your invoice form consistent between transactions. Take some time to look through the invoice form and make sure it has everything you will need. Consider making a practice invoice using PDFSimpli to see how easy it is to fill out invoices. You can save your work to the cloud as you go.

Finally, you are ready to put your invoice form to use. You could print off several copies if you intend to complete the form by hand (common for contractors and similar on-site workers). Alternatively, you may save it on PDFSimpli for later use. You can also download the form in whatever format you like to complete on your computer.

Sales tax can make calculating the final cost of the invoice slightly confusing in some cases. If the buyer and seller are in the same jurisdiction, you can simply include the sales tax for your jurisdiction. In many cases, you may be required to collect the tax as the seller.

However, if the sale is taking place between jurisdictions, the sales tax is normally assessed whether the buyer took possession. In some cases, the buyer may be required to self-assess taxes. In other cases, you may need to do it. Seek the advice of a tax expert to learn your responsibilities.

Invoices typically include several dates on them. The invoice date is the day that the invoice was issued (or will be issued if you are preparing in advance). The ship date is the day that the products were shipped or will be shipped. The purchase order date is the day that the customer created the corresponding purchase order. Payment terms are typically in relation to the invoice date.

UOM is short for unit of measure. This is how the product on the invoice is measured. For example, this may be in kilograms if the product is a food. SKU is short for stock keeping unit and is the identifier of the product.