Promissory Note Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Promissory Note with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Promissory Note with PDFSimpli.

Pick from the colors and templates below

A promissory note is a type of loan agreement in which the borrower promises to pay a sum back to the lender. Unlike other similar agreements, a promissory note does not need to include any language about the original loan. Instead, it is just a promise to pay a sum, similar to an IOU. The note acknowledges that a sum is owed and describes the plan for paying that sum.

Although it is a legally binding document that can be enforced, a promissory note is often considered less formal than some other forms of loan agreements. Therefore, it may be preferable for friends or other individuals who have an existing relationship. You may use a promissory note if you want to loan a loved one money but want to set clear expectations about the repayment schedule. In addition to being legally enforceable, a promissory note also helps to ensure all parties are on the same page.

Unlike an IOU, a promissory note specifies details about the loan repayment. In particular, it indicates the consequences of failing to pay the loan. This may include interest, the late fee, and/or collateral. Additionally, many promissory notes include specifics about how the amount will be repaid such as the repayment structure and deadlines.

There are many types of loan agreements that can be used to set the terms of a personal loan between two individuals. A promissory note is more formal than using an IOU or no agreement but is less formal than a comprehensive loan contract. Therefore, people often use this document to describe the terms for relatively small sums of money, a short term loan, or when the two parties have an existing relationship. Nonetheless, sometimes businesses also use a promissory note for more formal types of loan, such as a business loan. The borrower is legally required to follow the terms of both a loan agreement and a promissory note.

You could write a promissory note from scratch if you wanted to (even a handwritten note is enforceable). However, it can be helpful for both parties if the note includes the right language and clearly explains the terms of the loan. The lenders get the protection of having an enforceable agreement to compel payment if necessary. The borrower is protected by having clear rights and responsibilities in the note.

Using a form, such as those available on PDFSimpli, makes it easier to create your promissory note. You can be confident that the template includes all the language you need. Additionally, it may remind you of some of the details you need to discuss with the other party. Using a template will also make the writing process much faster and less stressful.

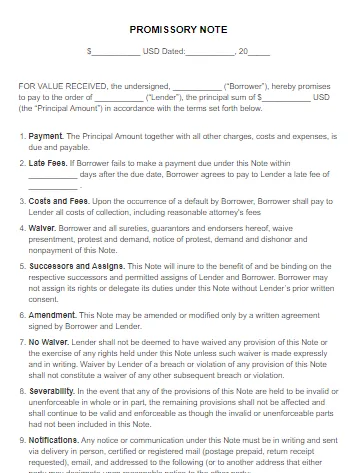

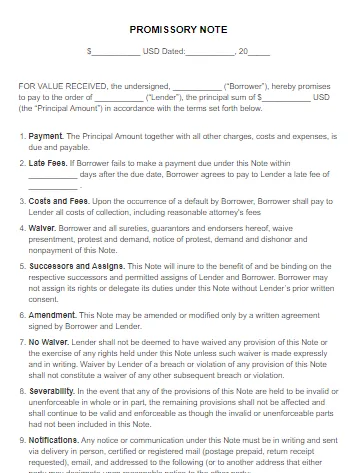

Writing a basic promissory note is easy, especially if you work from a template. There are only a few elements that need to be required. You can also add other terms and details as you see fit. These are the main pieces of information needed to create a legally binding promissory note:

The note should clearly identify the lender and the borrower. Additionally, it should have their contact details. If you have someone co-signing the loan, that person’s information should be included as well.

Unsurprisingly, the promissory note must include the amount that is being repaid. If you are charging interest, you can include that elsewhere. However, the principal amount should be stated.

Include the interest rate and any fees that the borrower will need to pay. This should include any fees for late payment.

Indicate how the loan debt will be repaid. It may be due in one lump sum or in several installment payments. Some promissory notes specify on-demand repayment.

If collateral (an asset used to secure the loan against a default) is part of the agreement, that must be specified in the note.

The promissory note should include space for each party to sign. Make sure to also clearly mark the name next to the signature. Promissory notes do not typically need to be notarized, so you can simply sign at your leisure.

Before writing your promissory note, it is a good idea to agree to the terms of the loan. For example, you should select how the loan debt will be paid and if interest will be charged. It is usually easier to work these details out beforehand. You will also need to gather information about the parties and any collateral that may be applied to the loan.

Once you have the details worked out, it is time to select and template and get started. Consider using PDFSimpli to write your promissory note. The platform has a powerful online editor and many templates for promissory notes and other agreements. You can even save to the cloud as you work, making your agreement accessible from any device.

Open the template in the PDFSimpli editor and start to fill in your terms. You can just fill in the details or edit the terms as you see fit. As necessary, you can also use the image, watermark and drawing tools in the editor. These can help you to create a document to fit your exact requirements.

Although a promissory note is somewhat informal, it is still legally binding. So, it is important to make sure you got everything right before you sign it. You don’t want to add an extra zero to the amount, for example. Use the online editor to review easily. Alternatively, add a watermark and print out a draft copy to look over.

Finally, you are ready to sign the document with the other party. The easiest way to do this is to sign in PDFSimpli by drawing, uploading or typing a signature. You can even send it to the other party to sign online as well. Alternatively, save or down the document to your computer. You can also print it from the editor.

No, there is no requirement to charge interest on the promissory note. In fact, many lenders do not because they are simply trying to help a friend or family member out. The two parties can agree to any interest rate. However, there may be tax and legal consequences if the interest is excessive (don’t expect to charge 1000% interest).

If you are using collateral, you can select any asset that both parties agree upon. The collateral can also be multiple assets or even a class of assets up to a certain value (businesses sometimes use inventory as collateral). Therefore, the value can be any amount that the two parties find agreeable. However, if the lender recovers more than the amount owed, he or she does not keep the extra. Instead, that would be returned to the borrower. Therefore, it is typical to match the value of the collateral to that of the note.

Usually, a promissory note does not require witnesses or notarization. However, some jurisdictions have special rules. Additionally, notes for very large sums should be notarized. It may be a good idea to see a notary public if either party is uncertain about the agreement being sufficiently enforceable.